Featured News Headlines

MEI Pharma’s Bold $100M Litecoin Acquisition Shakes Market

MEI Pharma is making waves in both the crypto and stock markets after announcing a strategic pivot to hold Litecoin (LTC) as a reserve asset. Since the announcement, MEIP shares have skyrocketed—gaining over 100% in just five days—signaling strong investor confidence in this groundbreaking decision.

$100 Million PIPE Deal Fuels Litecoin Acquisition

On July 18, MEI Pharma closed a private investment in public equity (PIPE) deal, raising $100 million by selling roughly 29.2 million shares at $3.42 each. This capital injection bypassed traditional public offerings, providing rapid funding to secure LTC holdings. Leading the investment were Litecoin founder Charlie Lee and crypto trading powerhouse GSR, alongside major players like the Litecoin Foundation, MOZAYYX, ParaFi, HiveMind, and Primitive.

First Public Company to Hold LTC as Treasury Asset

MEI Pharma proudly becomes the first publicly traded company on a national exchange to designate Litecoin as a treasury reserve asset. The company plans to use all proceeds exclusively for LTC purchases, marking a new era of crypto adoption among public firms. GSR was also appointed as the digital asset and treasury management advisor, and Charlie Lee joined MEI Pharma’s Board of Directors—strengthening ties with the Litecoin ecosystem.

Stock Momentum Reflects Market Excitement

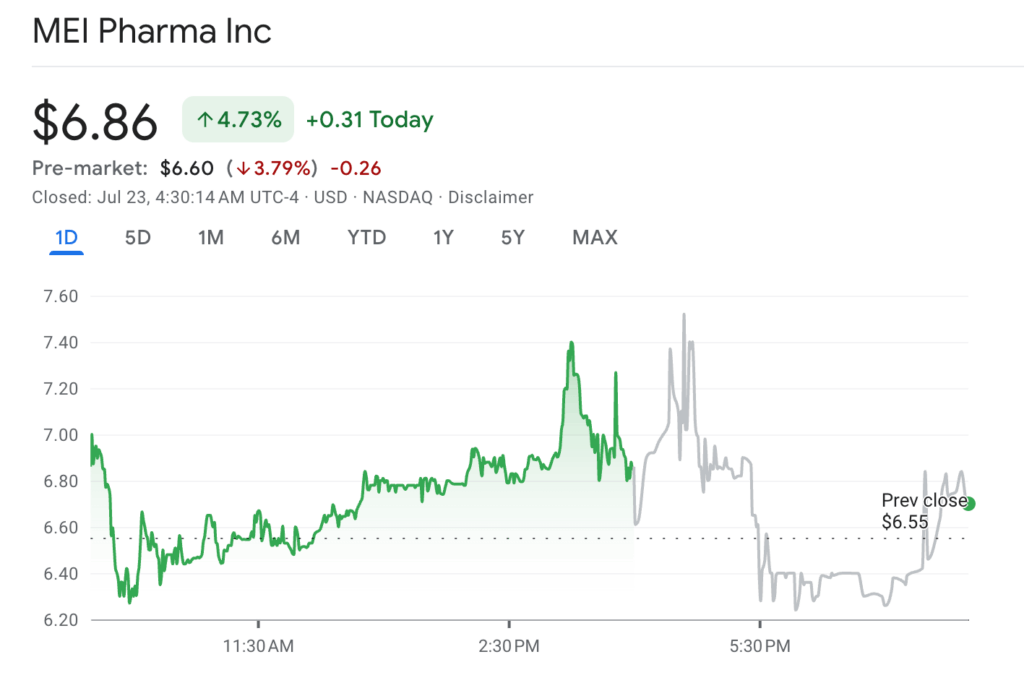

Following the announcement, MEIP’s stock price surged to $9, a level unseen since September 2022. Despite minor fluctuations, the stock closed at $6.86 recently—up 4.73%—and overall has soared 111% in less than a week, showcasing robust market enthusiasm. Additionally, MEI Pharma is reportedly eyeing another $100 million to expand its LTC holdings, underscoring its long-term commitment to cryptocurrency.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.