Featured News Headlines

BTC Price Update- Whales Hold Strong as Bitcoin Cools Below $123K

BTC Price Update– Bitcoin [BTC] is currently consolidating just below its all-time high of $123,000—a pattern often seen before a breakout. While some long-term holders are cashing out, major market signals still hint at potential upside ahead.

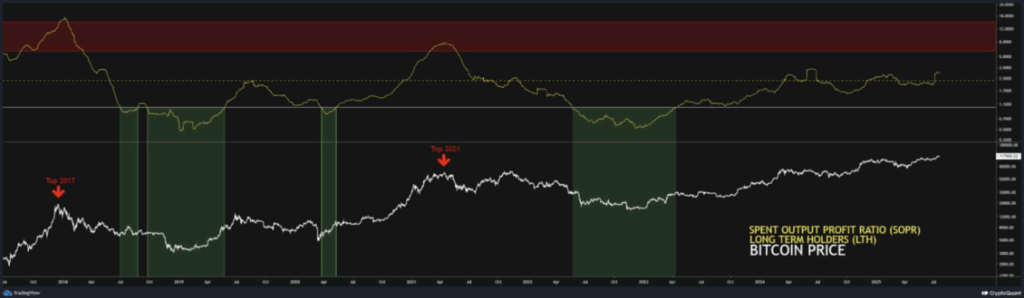

Profit-Taking Spikes—But the Bull Run Might Not Be Over

Data from CryptoQuant shows that long-term holders (LTHs) are realizing profits at the highest rate seen this year. The Spent Output Profit Ratio (SOPR) has surged above 2.5, confirming that many early investors are selling.

However, SOPR still remains well below the danger zone of 4.0—a level that has historically marked Bitcoin’s local tops. This suggests there may still be room for further growth, especially if LTHs don’t fully exit.

Yet, the Binary Coin Days Destroyed (Binary CDD) is reading 1, signaling sustained sell pressure from long-term holders. If this persists, BTC could dip further.

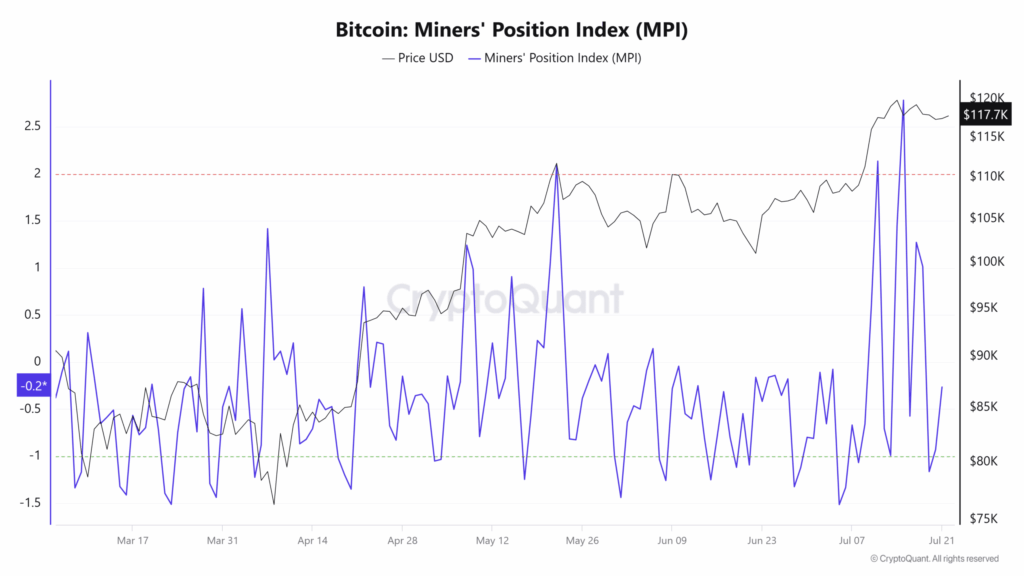

Whales and Miners Are Still Holding Strong

Despite the sell-off, whales and miners remain bullish. The Whale Exchange Ratio is at 0.42, showing whales are still active on exchanges—often a sign of smart money positioning.

Meanwhile, the Miner Position Index (MPI) sits at -0.2. A negative MPI means miners are holding onto their coins, potentially reducing supply and setting the stage for a supply squeeze.

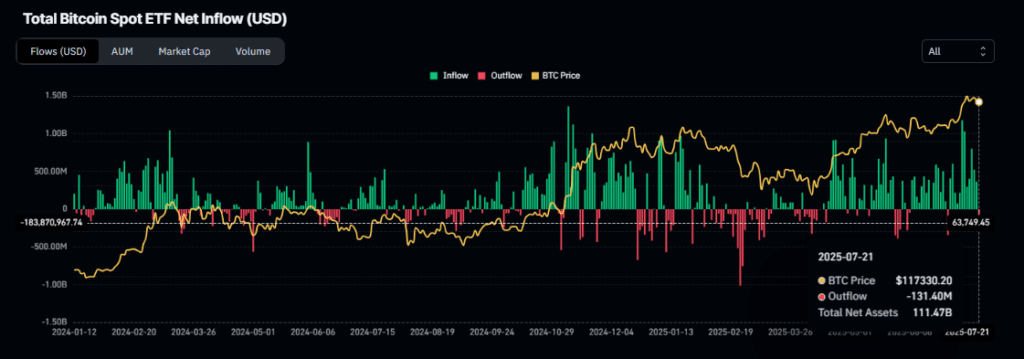

Institutions Take a Breather—But Not Out

Institutional investors sold $131.4 million worth of BTC in the past 24 hours, ending a 12-day buying streak. However, they still hold over $111 billion in BTC, suggesting this could be a strategic pullback, not a sentiment shift.

If institutional buying resumes, it could be the spark that pushes Bitcoin beyond its consolidation range—and into price discovery once again.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.