Featured News Headlines

SOL Price Rally- SOL Technical Indicators Show Growing Profit-Taking at Peak Levels

SOL Price Rally– Solana (SOL) has surged back to price levels not seen since February, sparking renewed enthusiasm among traders and investors alike. Currently trading around $198, SOL is edging toward the crucial $206 resistance mark, a psychological barrier that could dictate its near-term trajectory.

Market Sentiment Divided: Optimism Meets Anxiety

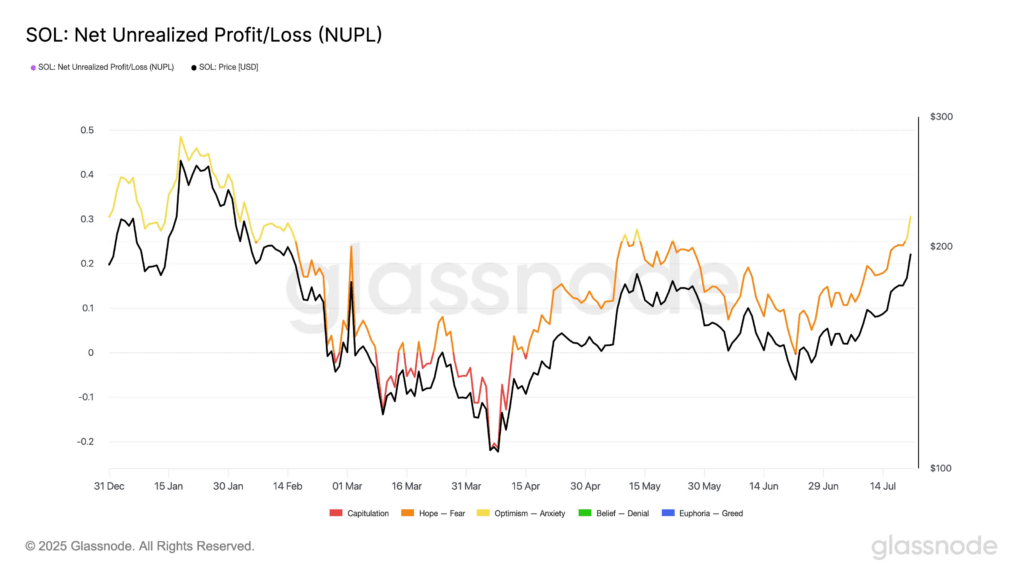

On-chain data from Glassnode reveals that SOL’s Net Unrealized Profit/Loss (NUPL) metric places the market in an “Optimism–Anxiety” zone. This signals that while many holders enjoy modest profits, uncertainty lingers about whether the rally will sustain. The NUPL measures the balance between unrealized gains and losses across all holders, providing a clear snapshot of overall market confidence.

Growing Selling Pressure Despite Bullish Momentum

Despite SOL’s recent double-digit gains and increased on-chain activity, technical indicators suggest some traders are quietly taking profits. The BBTrend indicator, which tracks trend strength via Bollinger Bands, has shown rising selling pressure over the past three days. Red histogram bars have grown in size, signaling consistent closes near the lower band — a classic sign of cautious selling amid a rally.

What’s Next for Solana?

This mix of optimism and caution suggests that while the bulls remain hopeful for a breakout above $206, profit-taking could trigger short-term pullbacks. Traders should watch closely for confirmation of a sustained move or signs that selling pressure intensifies. With Solana at a pivotal juncture, the next few days could define its path — either breaking out to new highs or retreating to consolidate gains.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.