Featured News Headlines

BTC Price – Bitcoin Under Pressure? Key On-Chain Metrics Say Yes

BTC Price – Despite Bitcoin’s relatively stable price near $117,500, on-chain data suggests a potential correction may be brewing beneath the surface. Both long-term holder activity and whale movements are signaling early warning signs.

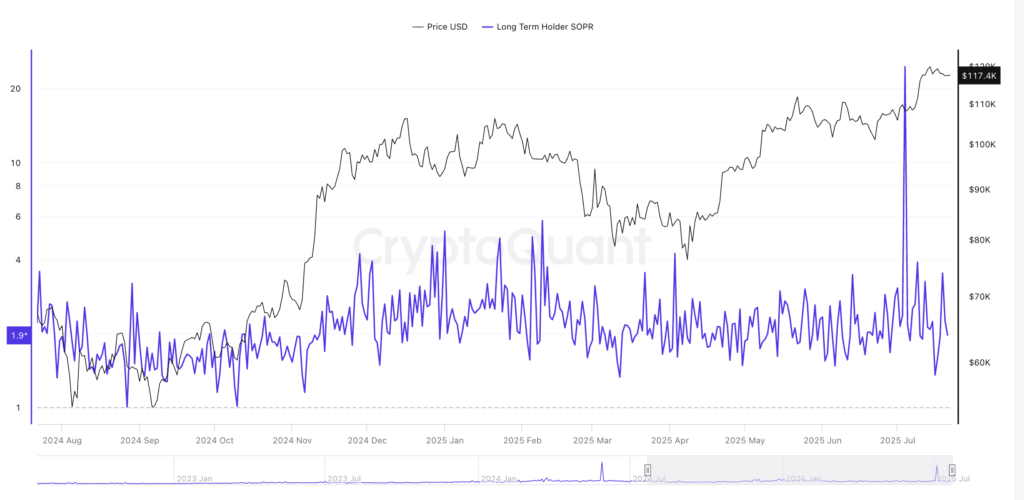

Long-Term SOPR Hints at Profit-Taking Exit

The Spent Output Profit Ratio for long-term BTC holders—those holding for 155+ days—stood at 1.96 as of July 21. This means holders are selling BTC at nearly double their acquisition cost, suggesting quiet profit-taking.

Historically, similar SOPR spikes have foreshadowed sharp pullbacks:

- Feb 9: SOPR = 5.77 → BTC dropped 12.55%

- Jun 13: SOPR = 3.47 → BTC fell 4.81%

Recent peaks of 3.90, 3.25, and 3.50—especially the July 4 SOPR spike above 24—have not yet triggered major corrections, creating a delayed reaction scenario that often leads to catch-up selloffs.

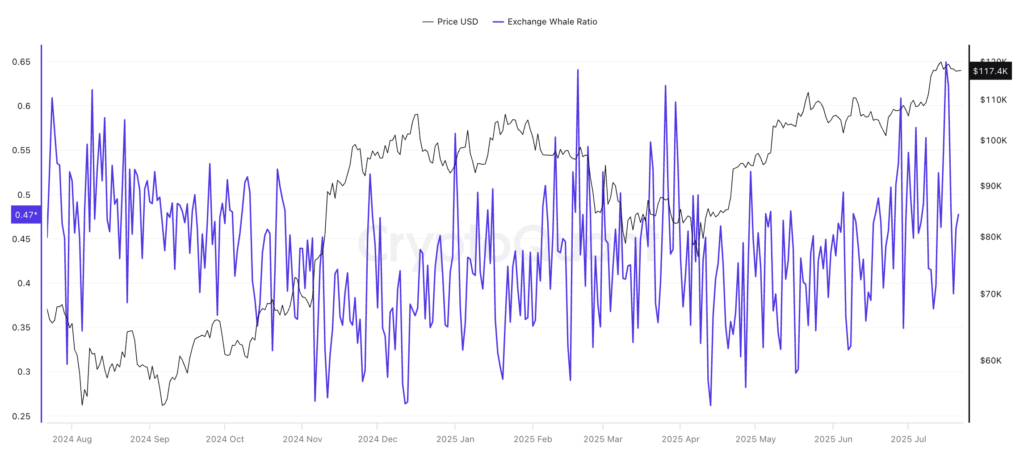

Whale-to-Exchange Ratio Quietly Rising

The Whale-to-Exchange (W2E) Ratio is climbing again. This metric monitors how much BTC whales are sending to exchanges—a classic sign of distribution and potential selling pressure.

Key historical points:

- June 28: W2E = 0.608 → BTC dropped shortly after

- July 16: W2E = 0.649 → BTC stalled, signs of weakening followed

As the W2E ratio nears the price trendline once again, smart money may be prepping for another round of distribution.

$116K Remains Critical Support

From a technical perspective, BTC has been respecting the $116,456 level—the 0.236 Fibonacci retracement from the $98,230 to $122,086 rally—since July 12. If that level breaks, it could validate bearish on-chain signals.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.