Cathie Wood Buys Into Ethereum Boom With Massive Bitmine Acquisition

Cathie Wood – In a surprising strategic move, Cathie Wood, founder and CEO of ARK Invest, has pivoted several of her flagship ETFs away from Bitcoin and fintech staples like Coinbase and Roblox — in favor of an emerging Ethereum-focused treasury firm, Bitmine Immersion Technologies (BMNR).

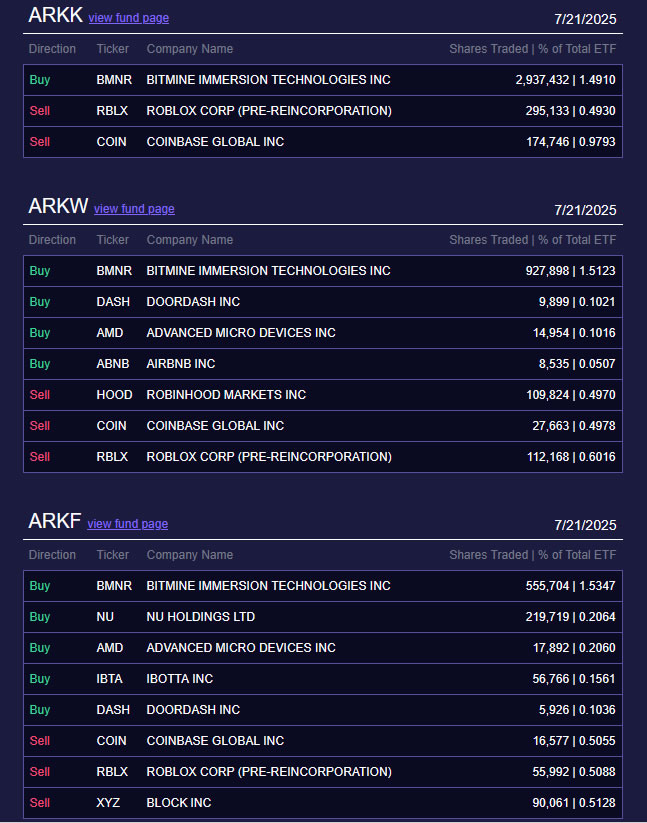

According to ARK’s latest daily trading update, Wood’s ARK Innovation ETF (ARKK), Next Generation Internet ETF (ARKW), and Fintech Innovation ETF (ARKF) sold a combined 218,986 Coinbase (COIN) shares valued at approximately $90.5 million. The funds also unloaded 463,293 shares of gaming company Roblox (RBLX), worth around $57.7 million.

At the same time, the three funds purchased 4.4 million shares of Bitmine, chaired by Fundstrat’s Tom Lee, totaling an investment of $174 million. This marks ARK’s first allocation into Bitmine since the company’s dramatic shift from Bitcoin to Ethereum in late June.

Bitmine Surges on Ethereum Pivot

Bitmine’s stock soared over 3,000% following its pivot to Ethereum, reaching an all-time high of $135 on July 3, before cooling off to around $39.57 — still up more than 400% year-to-date. Last week, billionaire investor Peter Thiel acquired a 9.1% stake in the company, adding more spotlight to the Ethereum-centric firm.

Fintech and Innovation Funds Reshuffled

Besides Bitmine, ARK’s funds also made new bets on AMD, Doordash, and Airbnb, while reducing positions in Robinhood, Block Inc., and the ARK 21Shares Bitcoin ETF (ARKB) — selling over 225,000 shares on July 16.

Among the three, ARKF stands out with a small but notable 1.15% exposure to Ethereum, via the 3IQ Ether Staking ETF, marking a growing interest in ETH over BTC within ARK’s fintech strategy.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.