Featured News Headlines

- 1 BYD Stock- Boyd Group Services Dividend Increase Signals Confidence to Investors

- 2 Mixed Analyst Ratings Reflect Cautious Optimism

- 3 Stock Performance: A Recent Uptick Amid Volatility

- 4 Financial Health: Strong Yet Watchful

- 5 Dividend Boost Adds Appeal for Income Investors

- 6 Insider Buying Signals Confidence

- 7 About Boyd Group Services

- 8 A Stock to Watch Closely

BYD Stock- Boyd Group Services Dividend Increase Signals Confidence to Investors

BYD Stock– Boyd Group Services Inc. (TSX: BYD) has recently been in the spotlight as analysts adjust their price targets and ratings amid evolving market conditions. With a market cap of approximately C$3.19 billion, Boyd Group continues to attract attention from institutional investors, insiders, and market watchers alike. Here’s the latest on analyst views, stock performance, dividend updates, and insider activity — all essential insights for anyone tracking this auto repair giant.

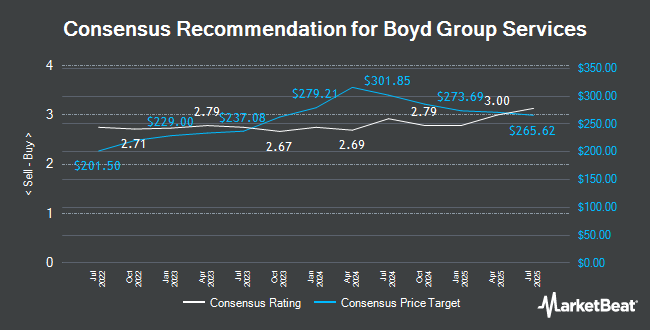

Mixed Analyst Ratings Reflect Cautious Optimism

Recent analyst reports paint a nuanced picture for Boyd Group Services. Several leading financial firms have slightly lowered their price targets but maintain a positive outlook overall:

- ATB Capital trimmed its target price from C$295 to C$290 while keeping an “outperform” rating as of May 22nd.

- Cormark was more conservative, reducing its price objective significantly from C$240 to C$200 on March 20th.

- Stifel Nicolaus dropped its target from C$265 to C$255 but retained a “buy” rating on May 22nd.

- Desjardins also lowered its price target from C$270 to C$255, maintaining their “buy” stance since March 20th.

- Royal Bank of Canada (RBC) recently decreased its target price from C$277 to C$270, continuing to rate Boyd as “outperform” on May 22nd.

In total, Boyd Group Services has received two “hold” ratings, seven “buy” ratings, and three “strong buy” ratings. According to MarketBeat, the stock holds an average rating of “Buy” with a consensus price target of C$262.

Stock Performance: A Recent Uptick Amid Volatility

On Thursday, shares of Boyd Group Services traded up by C$1.72, closing at C$210.54. This 0.8% increase comes despite relatively low trading volume (20,107 shares) compared to its average daily volume of 48,755. Over the past year, Boyd’s stock has fluctuated between a low of C$191.27 and a high of C$262.55.

The company’s technical indicators show a fifty-day simple moving average (SMA) at C$208.70 and a two-hundred-day SMA at C$216.29. These suggest the stock is trading slightly above its short-term average but below the longer-term trend, indicating a potential area of consolidation or support.

Financial Health: Strong Yet Watchful

Boyd Group Services maintains a high price-to-earnings (P/E) ratio of 77.55, which suggests investors expect significant future growth, albeit with some risk. The PEG ratio stands at -56.72, reflecting volatile earnings expectations, while the company’s beta of 0.99 implies that its stock price moves roughly in line with the broader market.

The company’s balance sheet reveals a debt-to-equity ratio of 150.94, signaling a relatively leveraged position. Liquidity measures such as the current ratio of 0.70 and quick ratio of 0.30 indicate the firm might face some short-term financial pressures, as these values are below the standard benchmark of 1.0.

Dividend Boost Adds Appeal for Income Investors

Boyd Group Services recently announced a quarterly dividend increase to $0.153 per share, payable on July 29th to shareholders recorded by June 30th. This marks a modest rise from the previous dividend of $0.15 per share and translates to an annualized dividend of $0.61, yielding approximately 0.29%. The company’s dividend payout ratio stands at a conservative 22.10%, suggesting sustainable dividend payments without straining cash flow.

For investors seeking income, this dividend increase may reinforce Boyd’s attractiveness as a steady, income-generating stock amid market uncertainties.

Insider Buying Signals Confidence

Adding to the positive sentiment, Boyd Group’s Director Robert Berthold Espey purchased 150 shares on June 10th at an average price of C$201.74, totaling over C$30,000 in insider buying. Insider ownership remains low at 0.37%, but such transactions often indicate management’s confidence in the company’s future prospects.

About Boyd Group Services

Boyd Group Services Inc. operates a leading portfolio of auto body repair and auto glass facilities across the United States and Canada. In Canada, it primarily trades under the Boyd Autobody and Glass brand, while in the U.S., Gerber Collision and Glass is its most recognized name. The company’s expansive footprint and diversified service offerings position it well in the growing automotive repair market.

A Stock to Watch Closely

Boyd Group Services is navigating a complex landscape with mixed analyst opinions, moderate stock gains, and solid corporate actions. While price targets have been revised downward recently, the overall market sentiment remains cautiously optimistic. Institutional interest, dividend growth, and insider purchases all point to underlying confidence in Boyd’s business model.

Investors should monitor upcoming earnings reports, debt management strategies, and industry trends to gauge whether Boyd Group can maintain its growth trajectory. With a current average price target of C$262, there appears to be upside potential from the current trading levels near C$210.

Whether you’re a growth-oriented investor or dividend seeker, Boyd Group Services offers a compelling case for inclusion in a diversified portfolio — just be mindful of the risks posed by leverage and market volatility.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.