Does Record-Breaking XRP Futures Activity Signal More Upside Ahead?

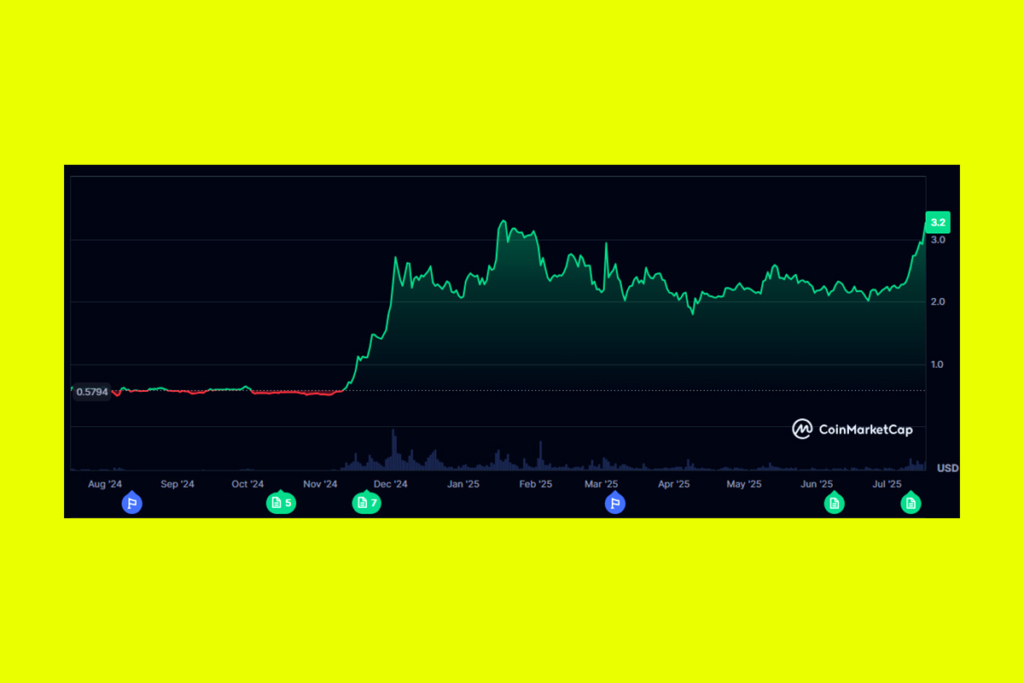

As notional open interest for the third-largest cryptocurrency by market capitalization climbed to record levels on Wednesday, the price of XRP reached a six-month high. According to CoinMarketCap, the Ripple-related coin was last trading at about $3.23, up 8.48% from the previous day. The price of the asset has increased by 420% in the last year, reaching a peak of $3.31.

According to cryptocurrency data source CoinGlass, the amount of money controlled by leveraged positions, or the notional open interest for XRP perpetual futures, exceeded $8.8 billion on Wednesday. That amounted to around 2.89 billion XRP in cumulative open interest. The two centralized exchanges with the most notional open interest were Bitget and Binance, which held leveraged positions valued at $1.94 billion and $1.48 billion, respectively.

Positive Funding Rates Highlight Investor Optimism for XRP’s Price Surge

In the majority of trading venues, XRP‘s funding rate was positive and on the rise, indicating that traders with long positions were prepared to occasionally compensate dealers with short positions for leveraged exposure. That often means that the market is bullish.

When people are trying to FOMO, and they think the price is going to go up, they’re willing to pay a higher interest rate to leverage long,

Greg Magadini, director of derivatives at Amberdata

Investors’ increasing optimism that XRP’s price momentum would last in the foreseeable future is reflected in this pattern.

Analysts Warn: High XRP Funding Rates Could Trigger Sharp Price Corrections

Strong demand for long exposure is indicated by rising funding rates, which supports the idea that the market is bullish. Even if it means paying more to keep leveraged positions, many traders are setting themselves up to profit on XRP’s rising trajectory.

Analysts warn, nevertheless, that overly high funding rates may also indicate market overheating, leaving XRP susceptible to abrupt declines. Leveraged longs may rapidly unwind if sentiment changes or profit-taking takes over, which would put more downward pressure on prices. It is recommended that traders keep a careful eye on funding rate hikes as a crucial sign of possible reversals in the current rally.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.