Bitcoin Price Breakout Supported by New Buyers and Strong Market Conviction

Bitcoin Price Rally – Bitcoin (BTC) is showing signs of renewed investor enthusiasm as new buyers increased their holdings by approximately 140,000 BTC recently. According to onchain analytics firm Glassnode, fresh capital has flowed into the market, fueling the latest price surge.

New Buyers and Aggressive Dip Buying Drive Momentum

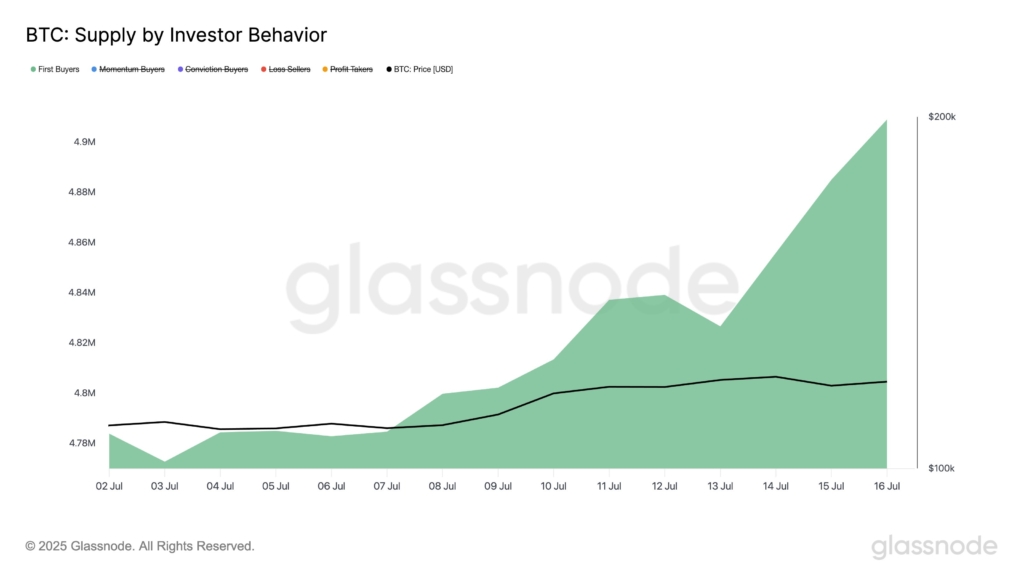

Glassnode’s latest data reveals that the supply held by first-time Bitcoin buyers rose by 2.86% over the past two weeks — climbing from 4.77 million to 4.91 million BTC. This indicates a growing wave of “fresh capital” supporting Bitcoin’s recent breakout.

Bitcoin’s price hit new all-time highs above $123,000, sparking frenzied activity among investors both new and old. The firm’s cost basis heatmap shows that buyers stepped in aggressively during this week’s dip below $116,000, scooping up nearly 196,600 BTC between $116,000 and $118,000. Glassnode noted this adds over $23 billion in value near the local peak, signaling strong conviction and potential positioning for further gains.

Retail Interest Grows, But Mainstream FOMO Is Still Muted

Despite this, retail interest in Bitcoin remains relatively muted. Google Trends data shows a slight increase in searches for “Bitcoin” over the past two weeks, but compared to historical highs, mainstream FOMO (fear of missing out) is still lacking.

Meanwhile, altcoins—especially Ethereum (ETH)—are capturing much of the spotlight. Research firm Santiment reports a surge in social media mentions and bullish price targets for many altcoins. After Bitcoin’s record highs earlier this week, retail FOMO has shifted to Ethereum, with growing chatter around $4,000+ price calls across platforms like X, Reddit, and Telegram.

As Bitcoin continues to climb, new buyers’ aggressive moves and shifting retail interest toward altcoins signal a dynamic and evolving crypto market — but the full-scale return of mainstream FOMO might still be on the horizon.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.