SUI Price- Whales Fuel SUI Rally as Spot Volume Cools

SUI Price– Sui (SUI) has finally broken out of the multi-month triangle pattern that constrained its price since early 2024. The move above $3.60 triggered a 12.8% surge, pushing the price toward the 0.786 Fibonacci retracement level. This breakout indicates growing bullish momentum. At the time of writing, SUI is trading near $4, close to a significant historical resistance zone.

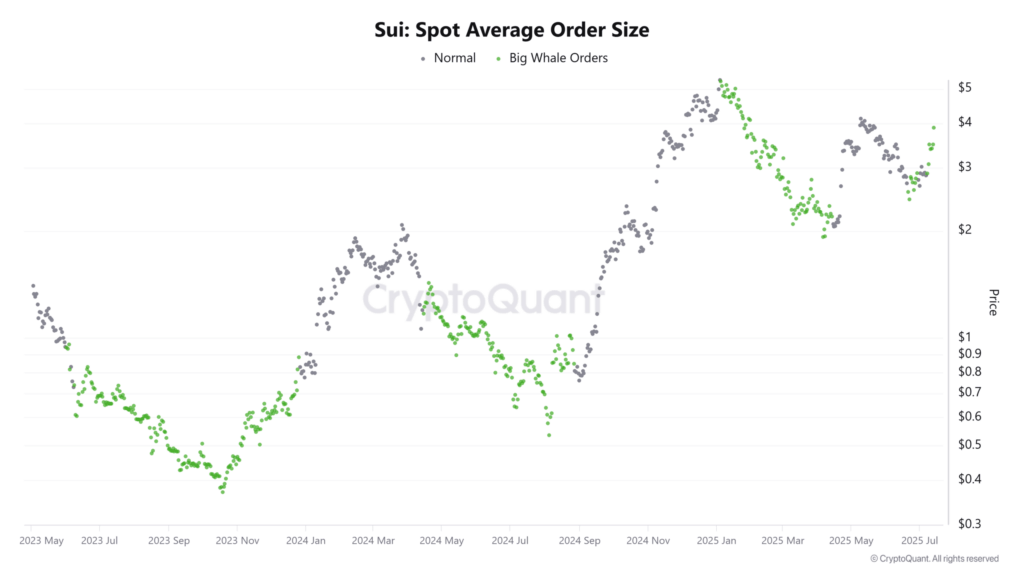

On-chain data shows a rise in large average spot order sizes, labeled as “Big Whale Orders,” suggesting that the recent price move is driven by large investors rather than retail traders. Institutional accumulation at breakout levels typically leads to more sustained rallies with less risk of immediate reversal. These large orders have been consistent over several sessions, implying strategic buying instead of short-term speculation. Whale involvement at this stage could provide a strong foundation for continued upward momentum if other market factors align.

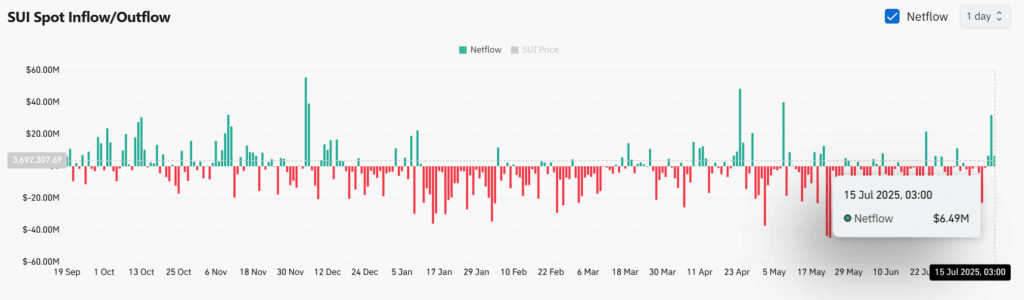

However, on-chain metrics reveal a net positive inflow of $6.49 million, meaning tokens have moved onto exchanges at their highest level in weeks. This shift from prior consistent outflows might indicate holders preparing to take profits following the breakout. While net inflows don’t always lead to immediate selling, if this trend continues, it may weaken short-term price strength and cause brief consolidation.

Strong Demand in the Futures Market

Although spot volume shows signs of cooling, the futures market continues to exhibit robust buy-side pressure. The 90-day cumulative volume delta (CVD) confirms aggressive buying activity, and the funding rate remains positive at 0.0089%, signaling bullish sentiment. If spot activity picks up and aligns with futures demand, the rally could accelerate.

Technical Indicators Suggest Caution

Sui (SUI) has entered a key resistance zone between $3.83 and $4.05, where past rallies stalled. The daily RSI at 72.70 signals overbought conditions, and the price is near the upper Bollinger Band, often a dynamic resistance level. These technical factors suggest the rally could pause or consolidate in the short term. However, if bulls can turn this resistance into support, the next target according to Fibonacci levels may be $4.80.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.