June CPI Report Looms: How Will Tuesday’s Inflation Numbers Move Markets?

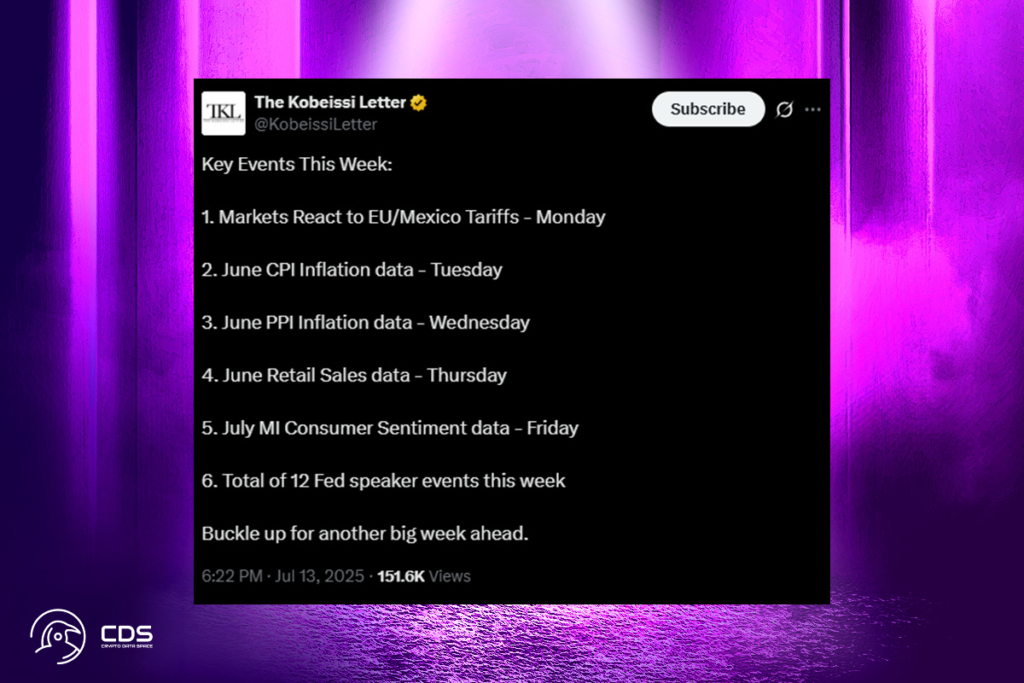

The June Consumer Price Index (CPI) report, one of two important indicators of inflation for consumers, businesses, and policymakers, will be released on Tuesday. This data directly affects the Fed’s rate choices, reflects price patterns, and determines consumer attitudes and spending. With inflationary pressures continuing, particularly in energy and certain products because of tariffs, the CPI for June is predicted to increase by 0.23% to 0.25%.

Over the weekend, crypto markets held onto their gains from the previous week, and on Monday morning in Asia, they started to rise once more. If this week’s US inflation data is encouraging, the momentum might continue. President Trump proposed 30% tariffs on Mexico and the European Union late last week, but the cryptocurrency markets did not respond.

Investors have gotten calmer about the overall inflation outlook in the last few months. I wouldn’t say that the market has shifted toward disinflationary mode, but it’s certainly less inclined to be worried about inflation,

Thierry Wizman, global foreign-exchange and rates strategist at Macquarie Group

Key Inflation Data Week: PPI, Retail Sales, and Consumer Sentiment in Focus

The Producer Price Index (PPI) for June is scheduled to provide additional inflation statistics on Wednesday. Retail prices are a leading predictor of inflation, and this report evaluates the cost of producing consumer items and represents costs for manufacturers and producers.

The June Retail Sales report, which provides a leading indicator of the state of the economy and details consumer spending on durable and non-durable products, is due on Thursday. The results of a monthly survey evaluating consumer confidence and long-term inflation predictions will be summarized in the July Michigan Consumer Sentiment Index and Inflation Predictions reports, which will be released on Friday.

Bitcoin Hits $123K as Crypto Market Cap Tops $3.8 Trillion

Monday morning saw a little increase in total capitalization to $3.8 trillion, the most since the middle of January. The main driver of it was Bitcoin, which during the morning Asian trading session gained an additional 4.16% to set a new all-time high of $123,091. While the majority of the cryptocurrencies were green, Ethereum had recovered $3,000.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.