Featured News Headlines

BNB Price- Burn Impact and Options Market Insight

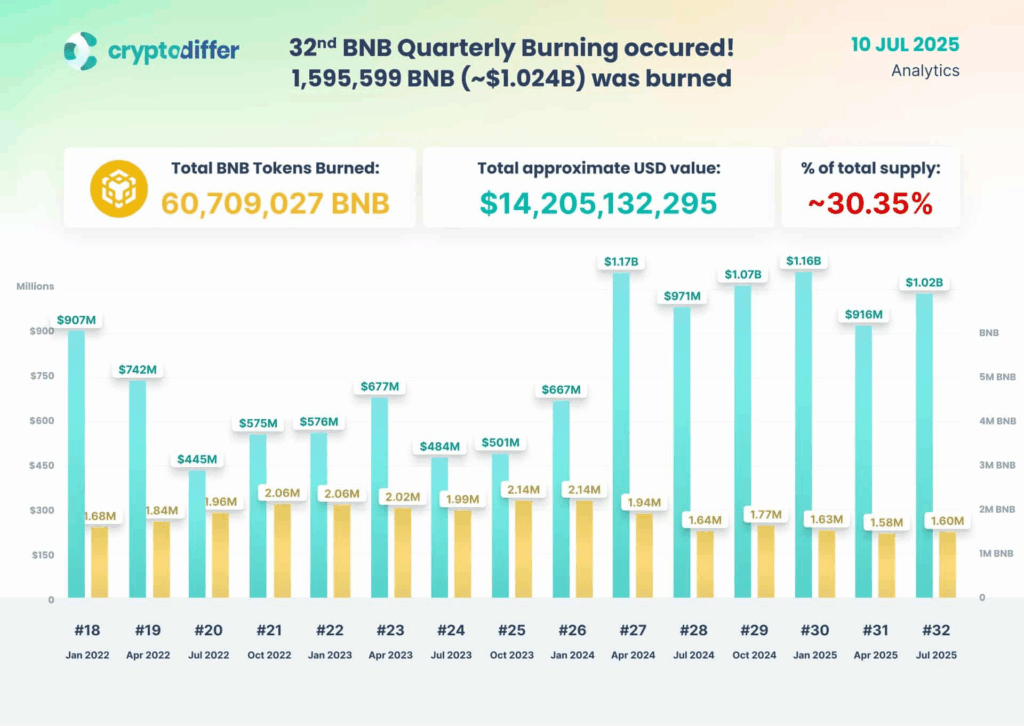

BNB Price– The BNB Chain just completed its 32nd token burn, permanently removing 1.59 million BNB (worth over $1 billion) from circulation. This brings the total burn tally to 60.7 million tokens, or nearly $14.2 billion, since the deflationary plan launched in 2022.

Now, only 139 million BNB remain in circulation—over 30% of the total supply has been burned. But here’s the twist: BNB’s recent price rally may have little to do with the burns.

Burn Rate Hits $1B+ Again, But Price Impact Slows

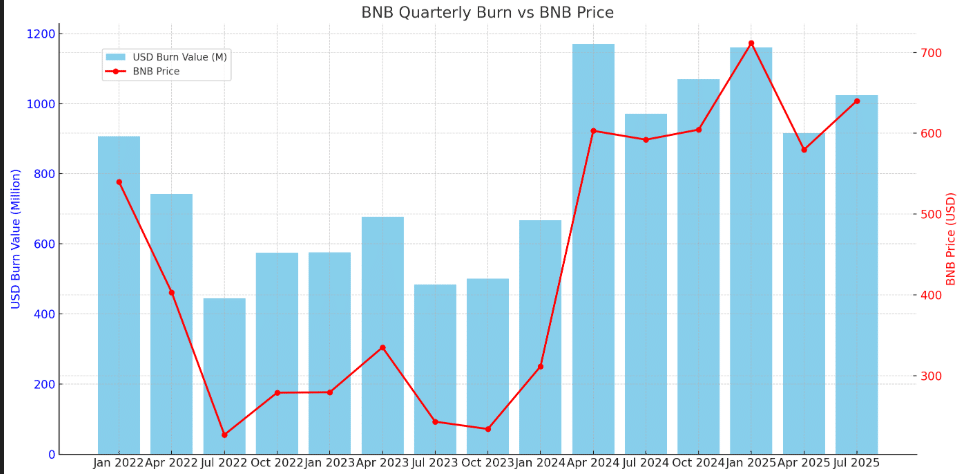

Back in early 2024, when BNB’s quarterly burn crossed $1 billion for the first time, the price surged from $300 to $600. Naturally, investors assumed a supply shock was driving the rally.

However, that narrative didn’t hold up over time. In July 2025, another $1.02B burn occurred—but price gains were far more muted, even with a similar burn size.

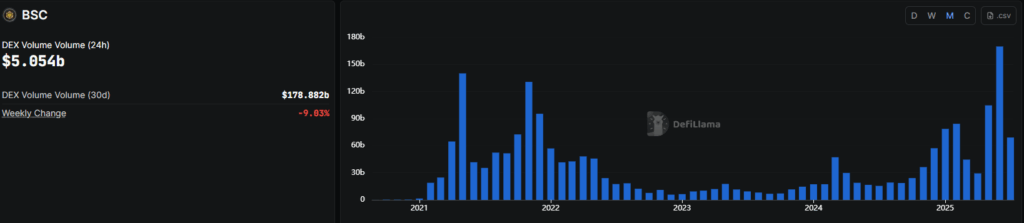

Real Demand May Be On-Chain

According to DeFiLlama, BNB Chain’s DEX volume soared, hitting $170 billion in June 2025. This on-chain growth may be the real driver behind BNB’s strength—not just supply cuts. At the time of writing, BNB trades at $692, up 15% from June.

Options Market Cautions at $700

Still, the derivatives market shows caution. Options data reveals heavy put activity at $700, suggesting a key resistance zone. Short-term downside risk lies at $660, while a clean break above $700 could open the door to $800.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.