Bitcoin Breaks Records Again: What’s Different This Time?

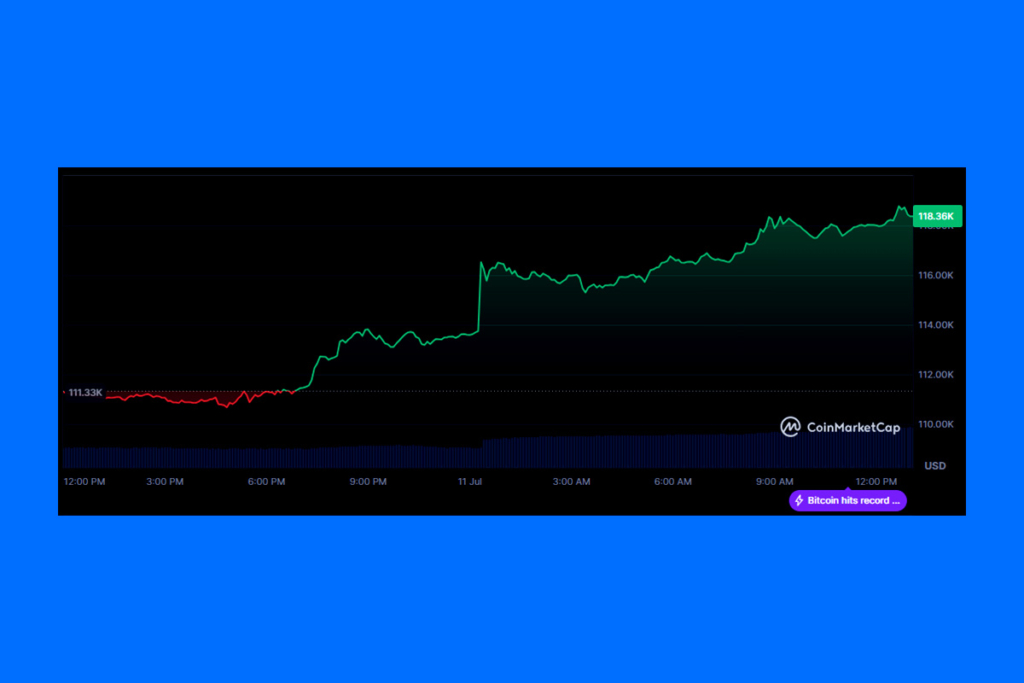

After hitting a new all-time high yesterday, Bitcoin has continued to rise. According to CoinMarketCap data, Bitcoin has increased by 5.54% over the last day and is currently trading at over $117,612.

In the last 24 hours, Bitcoin has exchanged hands for over $81 billion. This type of volume hasn’t been seen in Bitcoin since late February, when it fell under $84,000, and in January, just before President Donald Trump’s second inauguration. The fact that this rise isn’t just being pushed by retail traders is noteworthy, according to Kushal Manupati, Binance’s regional growth and operations head in South Asia.

Bitcoin inching towards the $120,000 mark, hitting an all-time high at $118,000, marks a pivotal moment for the virtual digital assets industry. Institutions are showing confidence to enter the space at scale, bringing not just liquidity but long-term credibility to the space.

Manupati

Bitget Analyst: Bitcoin Could Reach $120K by End of July

Traders are attempting to determine how long the excitement will stay now that Bitcoin has reached new price levels. Exchange flows, or the quantity of Bitcoin sent to exchanges, most likely for trade, have been steadily declining since October. According to CryptoQuant, they have already fallen to $2.39 million, the lowest amount in the previous three years. Strong stock market performance, a stable money supply, and the enactment of the One Big Beautiful Bill Act are all indicators that the Bitcoin market is doing well, according to Ryan Lee, principal analyst of Bitget Research.

Given these conditions, Bitcoin is well-positioned to break its previous high in July, with upside potential toward $120,000 by month-end,

Lee

Whale Confidence Grows: Bitcoin Poised for a New Digital Asset Era

Increased whale accumulation is another important reason bolstering Bitcoin’s upward trajectory, according to market observers. During times of consolidation, large holders have been consistently purchasing, indicating confidence in rising long-term valuations. The conditions are conducive for sustained bullish optimism, especially when combined with positive macroeconomic tailwinds like a robust stock market and legislative certainty brought about by the One Big Beautiful Bill Act. In the upcoming weeks, Bitcoin might not only test but also solidly establish itself above the $120,000 barrier, ushering in a new era for digital assets, if institutional inflows and a diminished exchange supply continue.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.