Crypto Bears Annihilated: Massive Liquidations Rock Crypto Markets After Record Bitcoin Rally

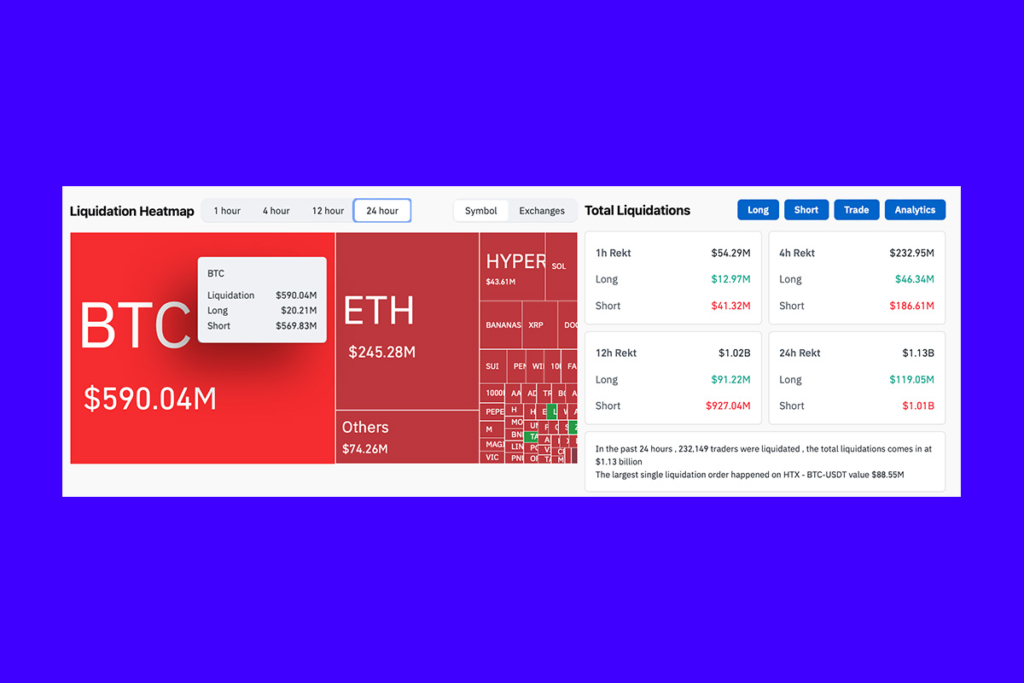

Thursday’s record high for the cryptocurrency dealt a severe blow to short sellers. Within 24 hours, short positions worth over $1 billion were liquidated. 232,149 traders were impacted by the liquidation of $1.01 billion in cryptocurrency short positions, according to CoinGlass statistics. Approximately $206.93 million in Ether shorts and $570 million in Bitcoin shorts were included in this.

As Bitcoin broke its previous record for the second day in a row, the liquidations took place. On Thursday, Ether hit $2,990, while Bitcoin surged to $112,000 on Wednesday and $116,500 on Thursday. It is currently trading at $117.770.

Traders Divided as Bitcoin Teeters Near Record Levels

There was disagreement among traders on whether Bitcoin would reach new heights. Some observers were doubtful that Bitcoin would hit fresh highs earlier this week. Analysts at Bitfinex reported on Tuesday that as Bitcoin struggles to break its current all-time high level, traders are displaying a lack of follow-through strength.

Bulls are hesitant or unable to push prices significantly higher without fresh catalysts or clearer macro signals,

Bitfinex analysts

Some were more optimistic, though.

The inevitable breakout to an ATH on Bitcoin might even happen during the upcoming week.

MN Trading Capital founder Michaël van de Poppe

$2 Billion in Long Positions at Risk if Bitcoin Slips to $112K

Traders are currently placing bets on the price staying steady or increasing even more. Long positions worth over $2.11 billion might be liquidated if Bitcoin drops back to its price of $112,000 on Wednesday.

On February 3, however, one of the biggest crypto liquidation occurrences took place. Concerns of a worldwide trade war intensified when US President Donald Trump signed import duties, leading to liquidations totaling more than $2.24 billion.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.