Bitcoin Price Outlook: Whales vs Retail Investors

Bitcoin Price Outlook – Bitcoin (BTC) has surged to a new all-time high (ATH), nearly breaking the $112,000 barrier in the last 24 hours. This marks a significant milestone, reigniting bullish momentum after a steady rise since the start of July.

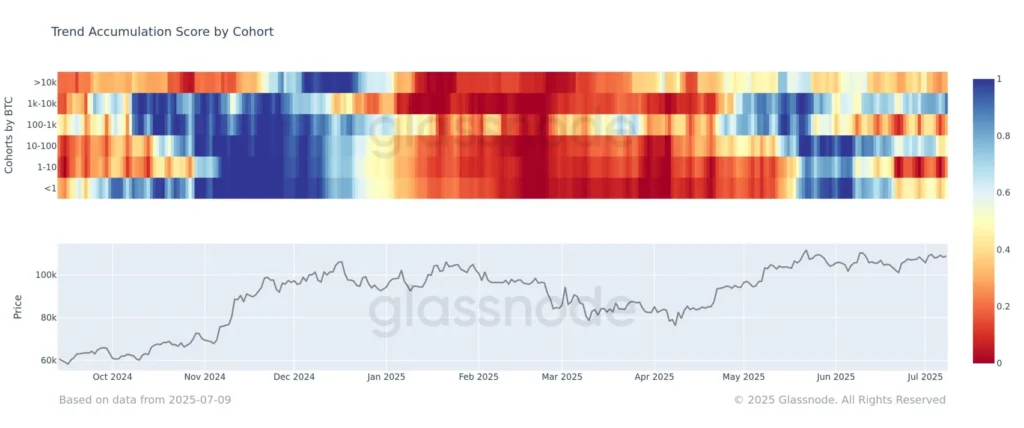

Whales Hold Strong Amid Retail Selling Pressure

While many retail investors, especially those holding between 1 and 10 BTC, have been selling and increasing market supply, Bitcoin whales—entities holding 1,000 to 10,000 BTC—continue to accumulate. This contrast in behavior is crucial. Whales are maintaining their positions with a long-term, strategic outlook, providing much-needed stability to Bitcoin’s price.

Their disciplined accumulation offsets the volatility caused by retail selling, helping prevent sharp price declines. The data supports this, showing over 52,000 BTC worth $5.7 billion sold to exchanges since July, mainly by smaller holders. Despite this selling pressure, whales’ resilience has helped keep Bitcoin’s upward trend intact.

Key Support Levels and What’s Next

Currently, Bitcoin trades around $111,183, with the $110,000 level emerging as a critical support floor. Holding this level is essential for BTC to attempt breaking through $112,000 and potentially set a new ATH. A breakthrough could spark further gains, driven by renewed investor confidence and strong demand.

However, caution remains warranted. If selling intensifies and Bitcoin drops below $110,000, it could retrace to $108,000 or lower, potentially invalidating the current bullish outlook.

Bitcoin’s recent price action highlights the powerful influence of whales in shaping market dynamics. As the battle between sellers and buyers continues, all eyes remain on whether BTC can sustain this momentum and push into new highs.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.