Featured News Headlines

PENGU Price- Can Pudgy Penguins Hit Fibonacci Target?

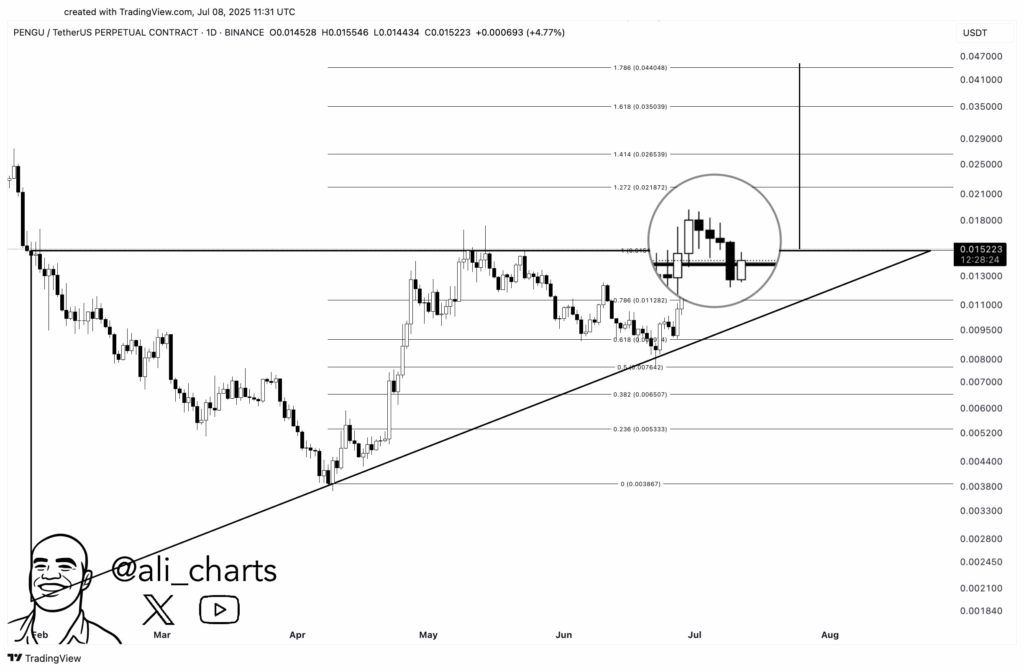

PENGU Price– Pudgy Penguins (PENGU) has held firm above its recent ascending triangle breakout level, signaling continued strength in its technical structure. The sustained move follows multiple successful retests of the trendline, suggesting bullish momentum as investors defend higher lows.

If current price patterns hold, a move toward the $0.044 Fibonacci target appears increasingly possible. Technical indicators continue to favor this bullish outlook, particularly as price consolidates above prior resistance.

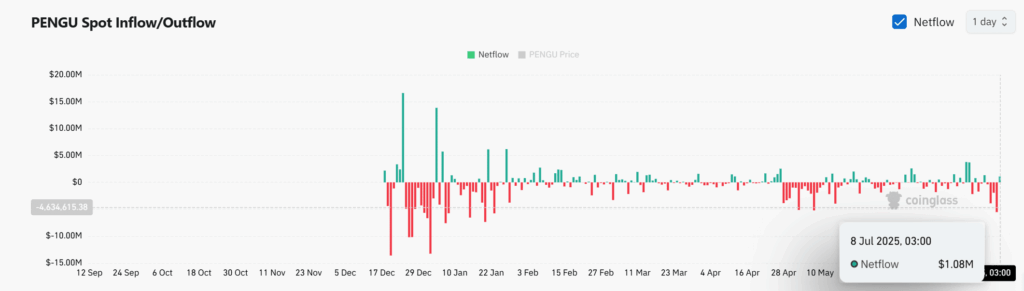

Capital Inflows Suggest Renewed Conviction

At the time of writing, net inflows into spot markets totaled $1.08 million—a notable increase following weeks of low activity. Analysts often interpret such inflows as part of accumulation phases, potentially pointing toward a bullish continuation if they persist above the $1 million threshold and are backed by volume.

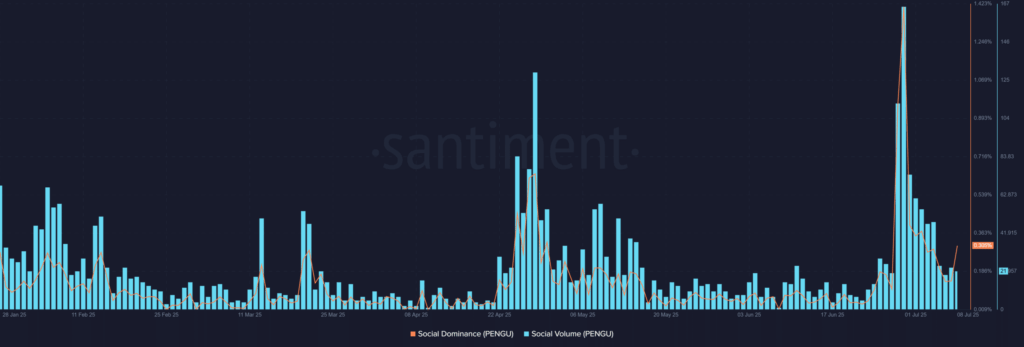

Social Metrics Reignite Community Focus

Pudgy Penguins (PENGU)’s social dominance has jumped from 0.18% to 0.30%, signaling a rebound in online chatter. While community interest had declined since late June, recent upticks in social volume reflect growing engagement. Historically, these shifts tend to precede upward price moves, especially when aligned with strong technical setups.

Trading Volume Heats Up

Data from volume bubble maps indicates that Pudgy Penguins (PENGU)’s spot volume has entered a “heating” phase, typically linked to increased visibility and momentum. If volume continues to rise while the price stays above support, a breakout trendcould take shape. Traders may look to volume spikes and bullish candles as confirmation signals.

Funding Pressure vs. Bullish Bias

Despite a negative funding rate of -0.0189%, the long/short ratio sits at 1.033, suggesting a bullish tilt. This divergence implies that buyers remain confident, even at a funding cost. Should the funding rate normalize and the long bias persist, it could accelerate upward movement in the short term.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.