BTC Price- Bitcoin Metrics Say Rally Isn’t Over Yet

BTC Price– Bitcoin may be trading close to its all-time high near $108,000, but according to new on-chain analysis, it remains far from overvalued. A key metric known as the Mayer Multiple suggests BTC has more room to grow.

Mayer Multiple Signals No Overheating

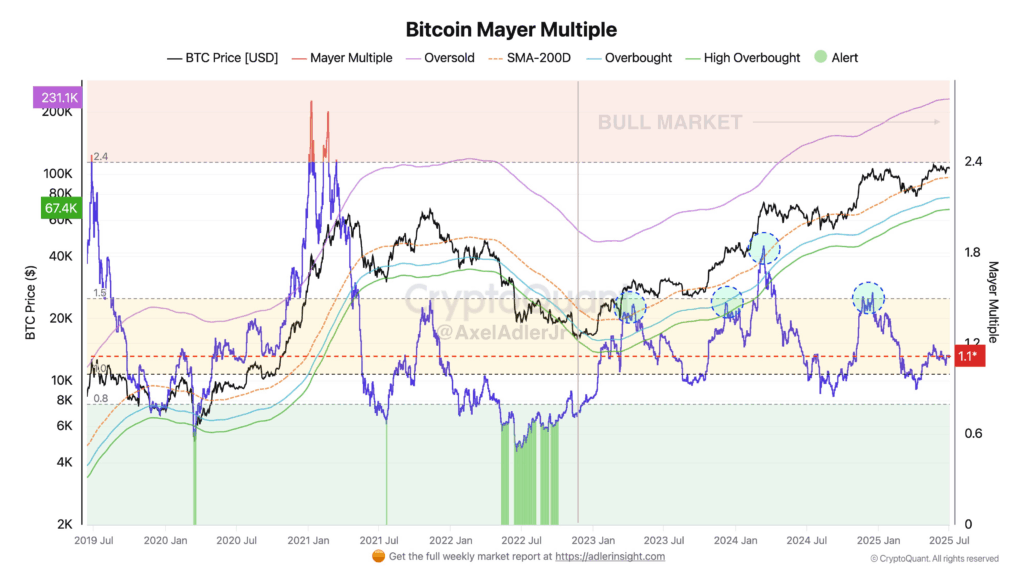

In a post on X, CryptoQuant contributor Axel Adler Jr. pointed to the Mayer Multiple as evidence that Bitcoin is not yet in overheated territory. The metric, which compares BTC’s current price to its 200-day simple moving average (SMA), currently stands at 1.1x.

“Currently, the metric stands at 1.1x (price to 200-day moving average), which falls within the neutral zone (0.8–1.5x) and is significantly below overbought thresholds (1.5x),” Adler wrote. This suggests that, despite Bitcoin gaining over 90% in the past year, the market remains structurally sound.

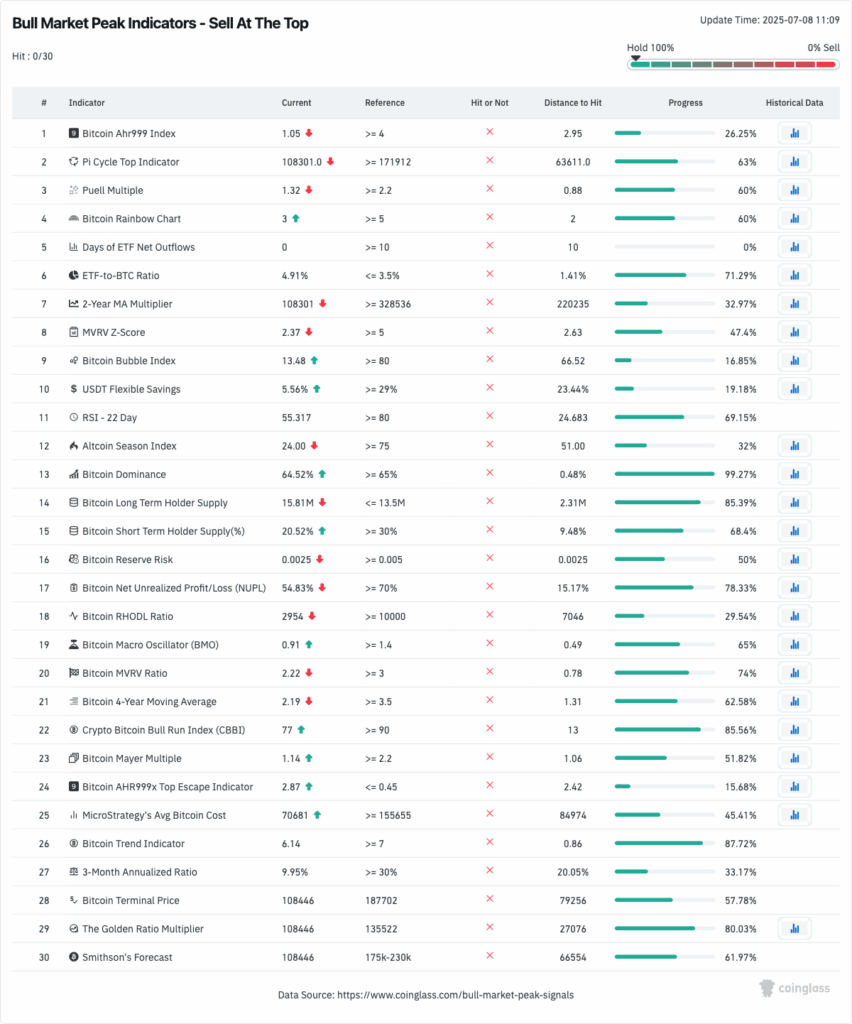

Cointelegraph also reported that CoinGlass’s list of 30 indicators for identifying bull market peaks is still firmly in “hold” mode—offering no major warning signs yet.

Analysts Eye October 2025 as Potential Peak

Several analysts are pointing to September or October 2025 as the next likely Bitcoin market top, based on historical halving cycles. Crypto trader Rekt Capital emphasized this timeline over the weekend, noting, “If Bitcoin is going to peak in its Bull Market in September/October 2025 as per historical Halving cycles… That’s only 2-3 months away.”

Echoing this sentiment, trader Jelle also confirmed that early profit-taking behavior has already begun, suggesting some market participants are positioning ahead of a potential peak.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.