Featured News Headlines

Ripple News- XRP Price Breakout Signals Potential Upside Ahead

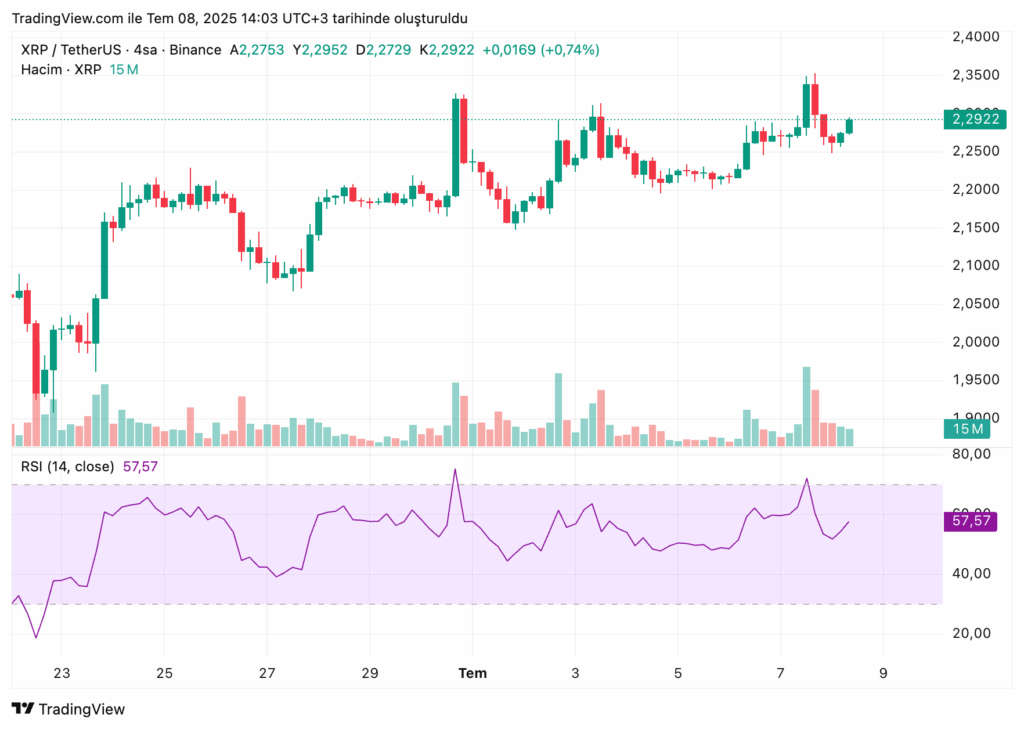

Ripple News– Between July 7 and 8, XRP witnessed a significant price rally, surging approximately 4.5% and reaching a peak of $2.35 before settling around $2.26. This upward movement was accompanied by unusually high trading volumes, with over 182 million XRP tokens exchanged during peak trading hours. The strong trading activity indicates a heightened market interest in the cryptocurrency, especially amid a broader cautious sentiment prevailing in the crypto market.

Market Context: XRP’s Resilience in a Volatile Environment

In a period marked by escalating global trade tensions and geopolitical uncertainties impacting financial markets worldwide, cryptocurrencies remain in a complex position, caught between risk-off investor sentiment and increasing institutional involvement. Ripple (XRP) has notably emerged as a resilient player, bolstered by robust on-chain activity and renewed attention from institutional investors.

One significant catalyst has been Grayscale’s recent decision to add XRP to its Digital Large Cap Fund, marking the first inclusion since prior regulatory limitations were lifted. Additionally, ten separate Ripple (XRP) spot ETF applications are currently under review by U.S. regulators, with verdicts expected potentially as early as October. This wave of regulatory clarity is adding a positive narrative around Ripple (XRP), alongside Ripple’s ongoing efforts to secure a U.S. banking charter, which could further integrate the token into mainstream financial infrastructure.

Technical Analysis: Key Price Movements and Support Levels

Data from CoinDesk Analytics highlights that XRP’s price jumped from $2.25 to $2.35 within a 24-hour window starting from July 7 at 05:00 to July 8 at 04:00, representing a solid 4.5% gain. The most active trading period occurred between 13:00 and 16:00, when volume surged to between 144 million and 182 million XRP, driving the price to its session high. Following this peak, some profit-taking led to a pullback, with XRP stabilizing near $2.26.

An initial resistance level was observed at $2.32, where selling pressure temporarily took control, pushing prices lower. However, the price found support in the $2.25 to $2.26 range, a zone that repeatedly absorbed selling pressure during periods of volatility later in the session. In the final hour, XRP displayed about 2% volatility, rallying from a session low of $2.25 at 04:22 to $2.30 at 04:33, reflecting continued active trading dynamics.

Potential Price Targets and Market Sentiment

Analysts increasingly view Ripple (XRP) as one of the most technically promising large-cap cryptocurrencies currently on the market. According to detailed technical projections and chart analysis, if Ripple (XRP) can successfully break through and sustain trading above the key resistance level at $2.38, it may trigger a significant bullish momentum. This breakout could pave the way for further price appreciation, potentially driving the token toward the $3.40 zone in the near to medium term. Such a move would signal renewed strength for Ripple (XRP), attracting additional market participants and potentially sparking broader buying interest.

Despite these positive technical signs, the broader market environment remains cautious and somewhat fragile. Ongoing geopolitical tensions, coupled with persistent economic uncertainties worldwide, continue to weigh heavily on investor sentiment across financial markets. Against this backdrop, Ripple(XRP)’s strong on-chain activity metrics — which indicate healthy transactional volume and network engagement — along with the increasing involvement of institutional investors, serve as meaningful counterweights. These factors contribute to XRP’s relative resilience, offering some insulation against the general market’s risk-off tendencies.

In addition to the technical factors, the current landscape is marked by a considerable degree of uncertainty and complexity. Adam Parker, CEO of Trivariate Research, recently spoke to this point during an interview, reflecting on the challenges faced by investors in interpreting recent market developments. He stated, “If you go through the details, I don’t even know if anybody understands the difference between what was announced today, what was there previously, and if it will actually be implemented.” Parker’s observation captures the broader confusion and unpredictability that many market participants are experiencing. This ambiguity underscores the importance of carefully considering both technical indicators and fundamental market data to navigate the turbulent environment effectively.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.