HBAR Nears Resistance- Price Momentum vs Development Activity

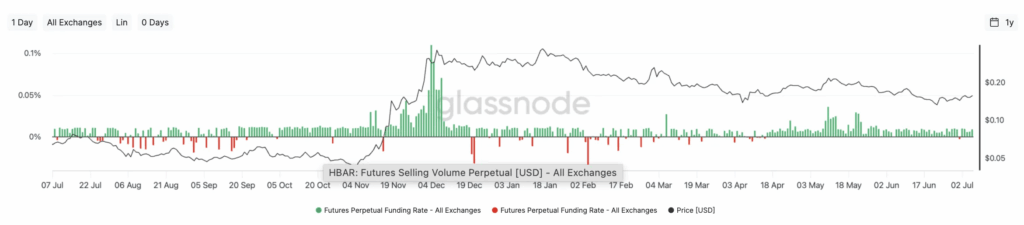

HBAR Nears Resistance– HBAR futures traders have steadily shifted to a bullish stance, reflected in rising funding rates on perpetual contracts. Since early June, most candles have remained green, meaning long positions are paying shorts—a classic indicator of bullish momentum returning. “The last sustained period with similar patterns was September–October 2024,” a phase that preceded a brief price rally, mirroring the current slow upward trend.

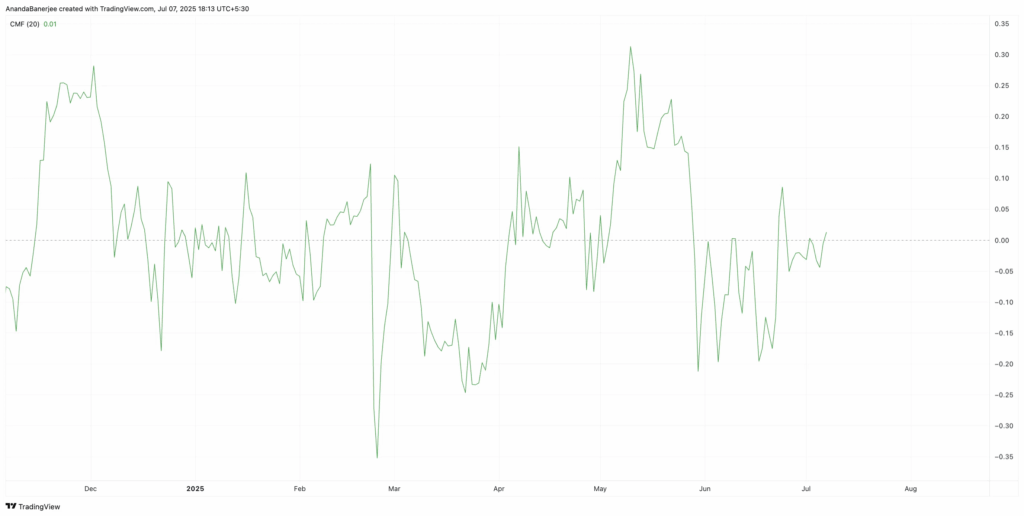

Chaikin Money Flow Turns Positive After Months

For the first time in nearly two months, the Chaikin Money Flow (CMF) indicator has crossed above zero. CMF measures buying and selling pressure adjusted by volume, helping to validate whether accumulation is genuine. Although the current CMF reading hovers marginally above zero at +0.01, this marks a break in a prolonged negative streak. Coupled with RSI divergence and strengthening price action, this adds cautious technical support to HBAR’s outlook.

Development Activity Remains a Drag

Despite improving price signals and bullish derivatives sentiment, HBAR’s on-chain development activity continues a slow decline. According to Santiment data, development contributions have steadily decreased since March, raising questions about the rally’s underlying strength.

HBAR trades just below the $0.162 resistance, a level tested three times over the past week but yet to break. Notably, the Relative Strength Index (RSI) shows higher lows, diverging from mostly flat or slightly lower price action since mid-June. Such divergence often precedes a breakout.

Should HBAR clear $0.162 convincingly, next resistance targets lie at $0.178 and $0.217. However, failure to break through might push the price back to support near $0.143—particularly if development activity does not improve.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.