IP Token Price Soars—But Bearish Signals Are Emerging

IP Token– The digital asset “IP” has posted a modest rally, climbing just over 10% in recent days. This uptick was supported by a significant spike in trading volume—rising 286.56% to $50.3 million—indicating renewed interest from market participants.

According to DeFiLlama, the protocol’s Total Value Locked (TVL) reached a record high of $25.33 million. This marks a strong rebound from the $10.66 million range seen between May 22 and June 14. Analysts suggest the surge reflects growing investor confidence in IP’s long-term utility, despite short-term volatility.

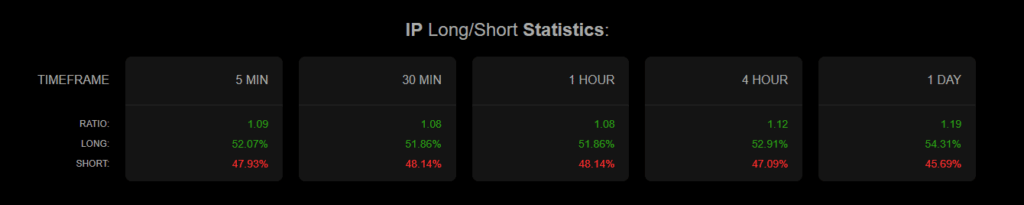

Data from Coinalyze reveals that the Long-to-Short ratio across exchanges stood at 1.19, with 54.31% of open interest leaning long. This coincided with $189,000 in short liquidations—substantially higher than the $29,300 lost by longs.

“This means that for every $1 lost by long positions, $6.49 was lost by shorts,” analysts noted, highlighting the momentum swing toward buyers.

However, this bullish dominance appears to be softening. In the past hour, long volumes dipped to 51.86%, while shorts climbed to 48.14%, signaling a potential shift in sentiment.

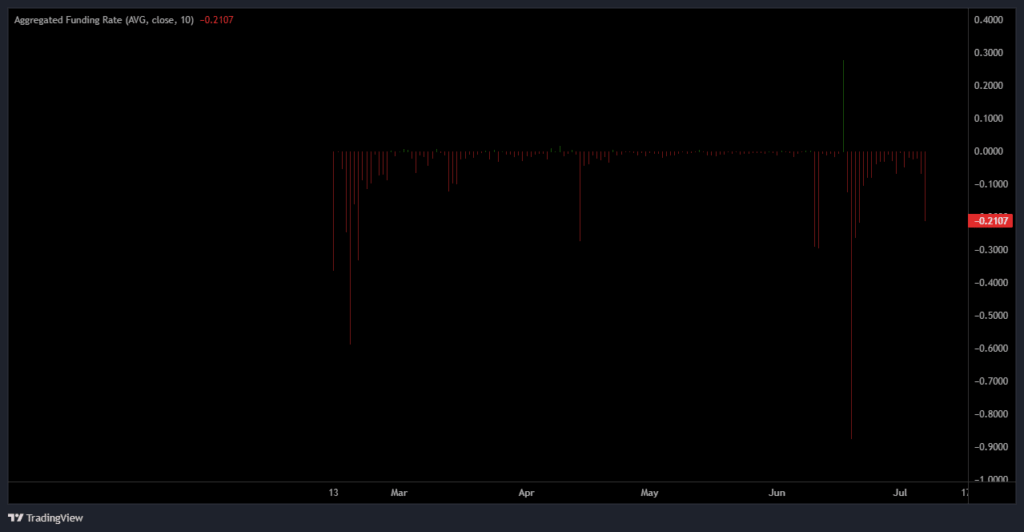

Funding Rates Turn Negative as Sellers Step In

Bearish pressure is mounting. Coinalyze reports that the Aggregated Funding Rate has dropped to -0.2107, its lowest since June 22. Negative rates often imply that short positions are becoming more aggressive, even paying fees to maintain them.

Additionally, CoinGlass data shows net exchange inflows of $1.98 million—indicating that investors may be preparing to take profits. Cumulative sell-offs over the past 48 hours now exceed $3.4 million.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.