ETH Price Analysis: Bearish Pattern or Bullish Breakout Coming?

ETH Price – The Ethereum Foundation is once again under the spotlight as it moves significant amounts of ETH from its wallets. According to CryptoQuant data, almost 1,000 ETH valued at about $2.51 million was recently transferred — marking the 21st such outflow since April. The total amount moved during this period now adds up to approximately $52.82 million.

Despite these transfers, the Foundation still holds a hefty balance of 196,770 ETH, worth nearly $495 million at current prices. These ongoing moves raise intriguing questions about the Foundation’s strategy and what impact they might have on Ethereum’s market sentiment.

Technical Watch: Is ETH Facing a Bearish “Rising Wedge”?

As Ethereum’s price hovers around $2,580, technical analysts have their eyes on a potential bearish signal. Notably, Carl Moon points out a rising wedge pattern on the ETH chart—a formation often linked to trend reversals.

This wedge has brought ETH close to a key resistance level near $2,700. If ETH fails to break this level with strong trading volume, the bearish pattern could confirm, possibly leading to a sharp drop with a downside target near $2,200.

However, a decisive breakout above $2,700 would invalidate the wedge, potentially reigniting bullish momentum and pushing prices higher. Market watchers now seek clear volume surges to confirm the next big move.

Bullish Signals: Strong Volume and Growing Open Interest

Ethereum’s market activity remains healthy. In the past 24 hours, ETH’s price increased by 2.60%, sitting comfortably at $2,580.22, with a solid 7-day gain of 4.45%. Trading volume remains robust, exceeding $10.2 billion in the last day.

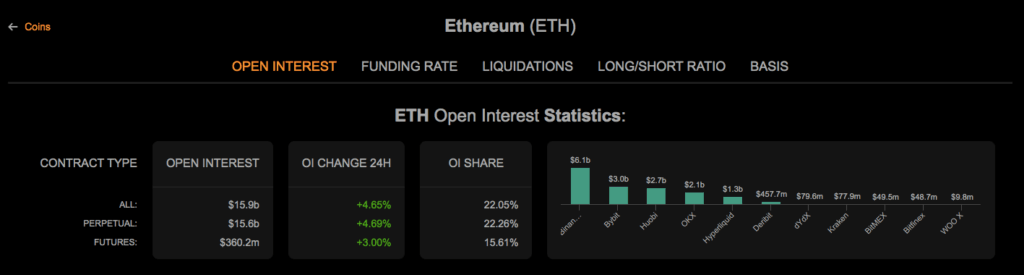

The derivatives market further supports growing interest. Total open interest in Ethereum has climbed to $15.9 billion, dominated by perpetual contracts at $15.6 billion. Binance leads exchanges with $6.1 billion in ETH open interest, followed by Bybit, Huobi, and OKX. This more than 4.65% jump in open interest in just 24 hours signals heightened trader activity and anticipation.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.