TIA Price- Celestia Eyes $1.89 Amid Mixed Market Signals

TIA Price– Celestia (TIA) saw a notable 16% price jump over the past 24 hours, defying the broader bearish sentiment that had previously pushed it down by 26%. However, the rally revealed a divergence between spot and derivatives market behavior.

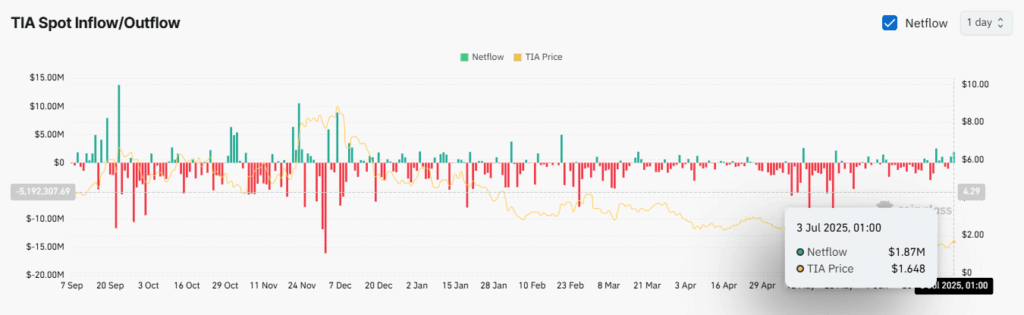

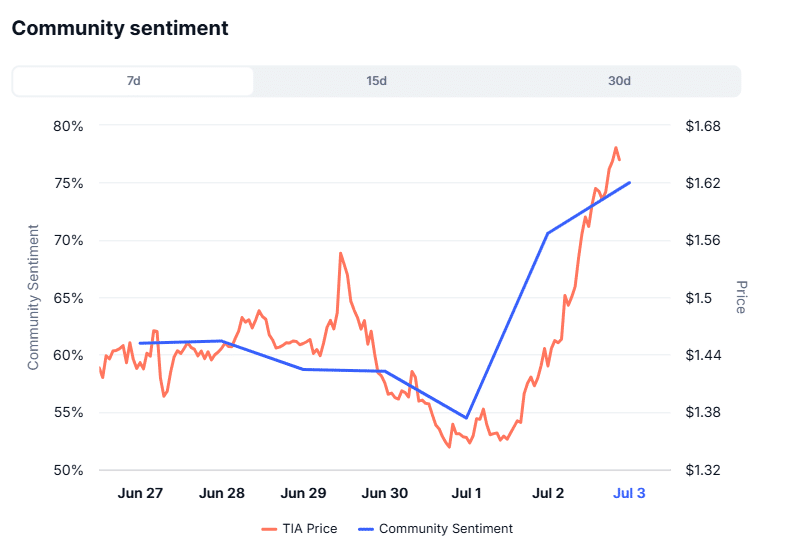

According to AMBCrypto, spot investors sold approximately $2.97 million worth of Celestia (TIA) over the last 48 hours. While this suggests bearish pressure, further analysis indicates the likely motivation is profit-taking rather than panic selling. Despite the sell-off, community sentiment remains strong—78% of participants on CoinMarketCap still expect the uptrend to continue.

If this optimism holds, fresh liquidity could flow back into Celestia (TIA), fueling further upward momentum.

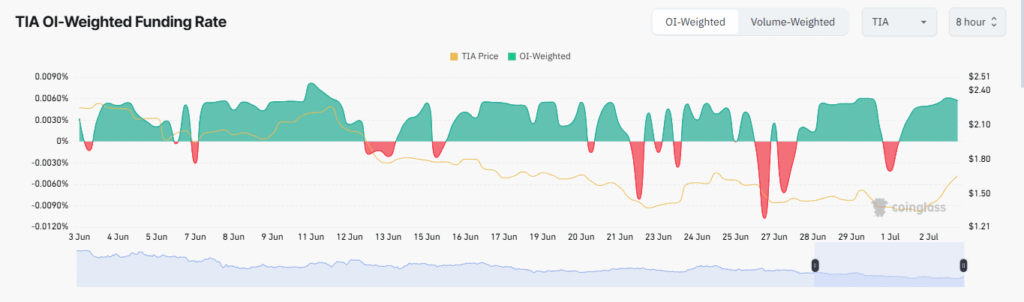

The derivatives market presents a bullish case. CoinGlass data shows a positive Open Interest Weighted Funding Rate of 0.0057%, indicating that long contracts outnumber shorts. In addition, the Taker Buy/Sell Ratio remains above 1, confirming dominant buyer activity.

Top-ranked Binance traders by position and account size are also long on TIA, with metrics reading 1.6794 and 1.7624, respectively—adding further weight to the bullish scenario.

Technical Indicators Support Move to $1.89

Technical analysis suggests that Celestia (TIA) may be targeting the $1.89 resistance level based on Bollinger Bands. The asset has bounced from the lower band, moved past the middle band, and is now approaching the upper band.

Meanwhile, the Relative Strength Index (RSI) is rising, signaling growing momentum. Though still below the neutral 50 level, a move into the 50–70 range would confirm the strength behind TIA’s rally.

With both sentiment and technicals aligning, the market may continue to favor the bulls—at least in the near term.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.