Featured News Headlines

Ethereum Price- Is Ethereum Stuck in a Range Between $2,220 and $2,550?

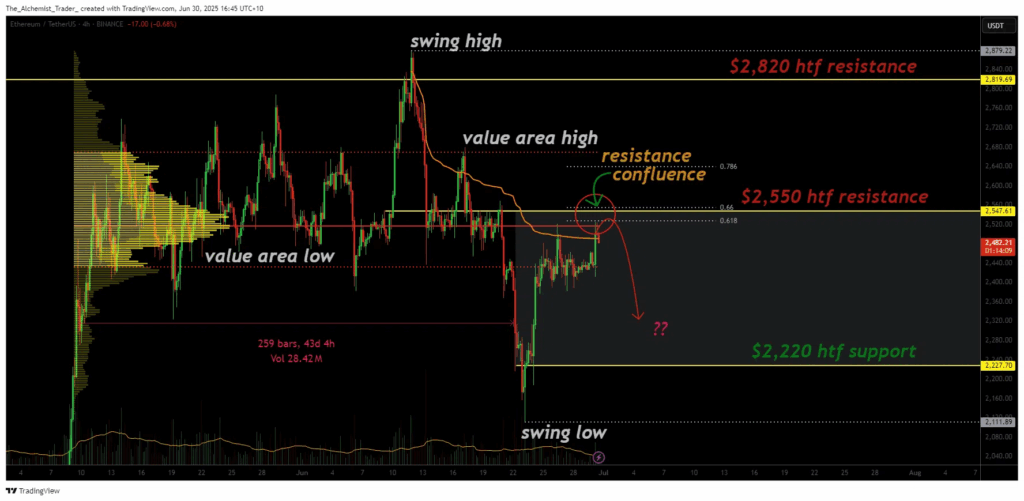

Ethereum Price– Ethereum (ETH) recently bounced from an oversold condition, but its recovery has brought it back into a key resistance zone—one that has historically capped price action for over 40 days. This level, centered around $2,550, is now crowded with overlapping technical resistance, making it a critical inflection point for Ethereum’s next move.

Oversold Bounce Faces Multi-Layered Technical Barrier

After sweeping the lows of a well-defined trading range, Ethereum (ETH) staged a swift rebound, signaling a potential relief rally. However, this bounce has landed ETH squarely into a resistance-packed region. This area isn’t just psychologically significant—it’s also technically dense.

At the heart of this zone lies the Point of Control (POC) from the previous range, marking the highest volume concentration during the last consolidation phase. This level often acts as a magnet for price but can also act as a ceiling without strong momentum.

To make matters more challenging for the bulls, the Volume Weighted Average Price (VWAP) anchored from the last swing high intersects at this same level. VWAP is a favored tool among institutional traders and often acts as dynamic resistance. Add to this the 0.618 Fibonacci retracement—commonly known as the golden pocket—and you have three powerful technical tools converging at roughly the same price: $2,550.

Why Volume Matters More Than Ever

This confluence of resistance signals a potential rejection zone unless Ethereum (ETH) sees a convincing breakout, supported by high volume. As of now, that surge in volume hasn’t materialized. In fact, trading activity remains muted, which does not inspire confidence in the sustainability of the recent bounce.

A low-volume push into multi-layered resistance usually results in rejection.

This quote holds especially true in ETH’s current setup. Without strong participation, price is more likely to stall or reverse from such significant resistance. If the rejection plays out, Ethereum is expected to retrace back toward the $2,220 support level, effectively defining a new range between $2,550 and $2,220.

Range Behavior Likely to Continue Without Breakout

Ethereum (ETH) recently emerged from a prolonged period of sideways movement, having rotated inside a clearly defined range for over 40 days. During this time, the price oscillated between the Value Area High (VAH) and the Value Area Low (VAL)—technical boundaries that represent the upper and lower limits of the value area, where most trading activity occurred. This kind of price action typically signals indecision in the market, as neither bulls nor bears gain enough momentum to break out of the structure.

Following a sweep of the range’s lower boundary—the VAL—Ethereum triggered a sharp bounce to the upside. This kind of move often reflects a liquidity grab, where the price dips below key support levels to shake out weak hands before reversing sharply. The reaction was swift, suggesting a short-term relief rally off oversold conditions. However, as price recovers, it’s now running into increasingly tough resistance near the midpoint of the old range.

What Comes Next for Ethereum Price Action?

Ethereum (ETH) is now at a critical decision point. Here are two possible short-term outcomes, depending on how price behaves near $2,550:

- Rejection from Resistance: If ETH fails to break and hold above the $2,550 zone, a move back toward $2,220 is likely. This would confirm a lower high and potentially reintroduce a period of sideways chop, mirroring past behavior within the same structure.

- High-Volume Breakout: On the flip side, if Ethereum manages to surge above $2,550 on strong volume, this would be a significant bullish signal. Such a move would invalidate the current resistance and possibly lead to a trend continuation, opening the door to higher levels and shifting market sentiment.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.