The Price Under Pressure, but Chainlink Reserves Hit New Highs

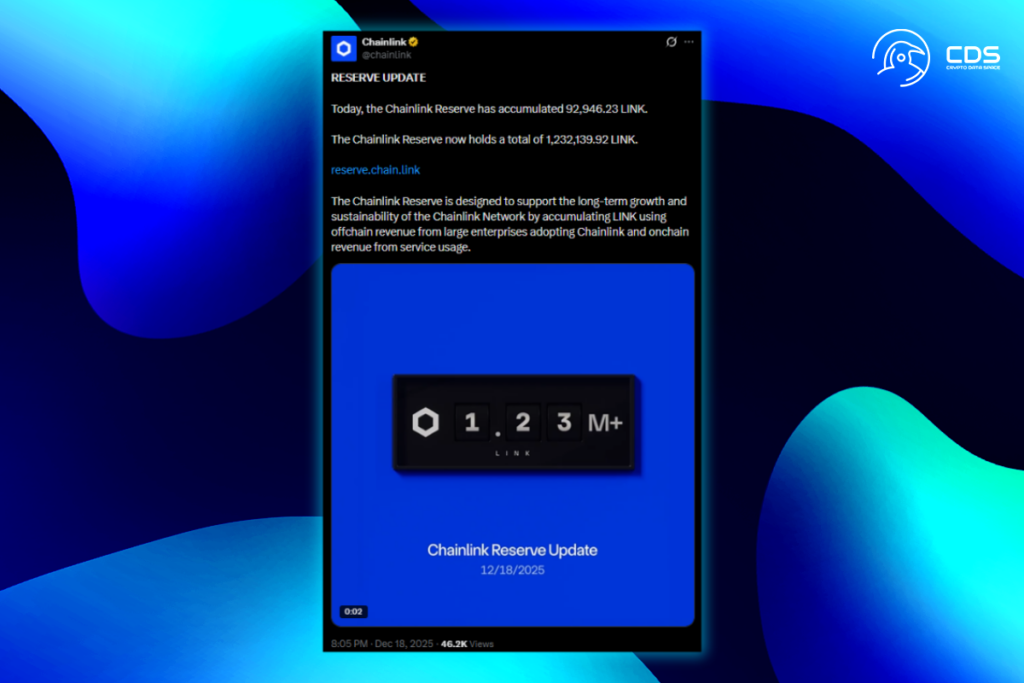

Under the cover of a persistent market downturn, Chainlink’s reserve activity keeps piling up. Total reserves have been increased to 1,232,139.92 LINK, with an additional 92,946.23 LINK added in the most recent update. This buildup happened when LINK was trading close to a demand zone that lasted for multiple weeks, about $12.45, at the time of press. During a drawdown, reserves grew. However, they did not do so when the momentum was going up. Rather than reactive positioning, this conduct demonstrates long-term conviction.

A stronger protective layer and less circulating liquidity stress are the long-term effects of increasing reserves. Instant rallies are not often sparked by reserves. Rather, they impact the price’s reaction to the return. Consequently, the underlying network structure is getting better even while price movement is still under pressure. In the latter stages of a correction, this variation is common.

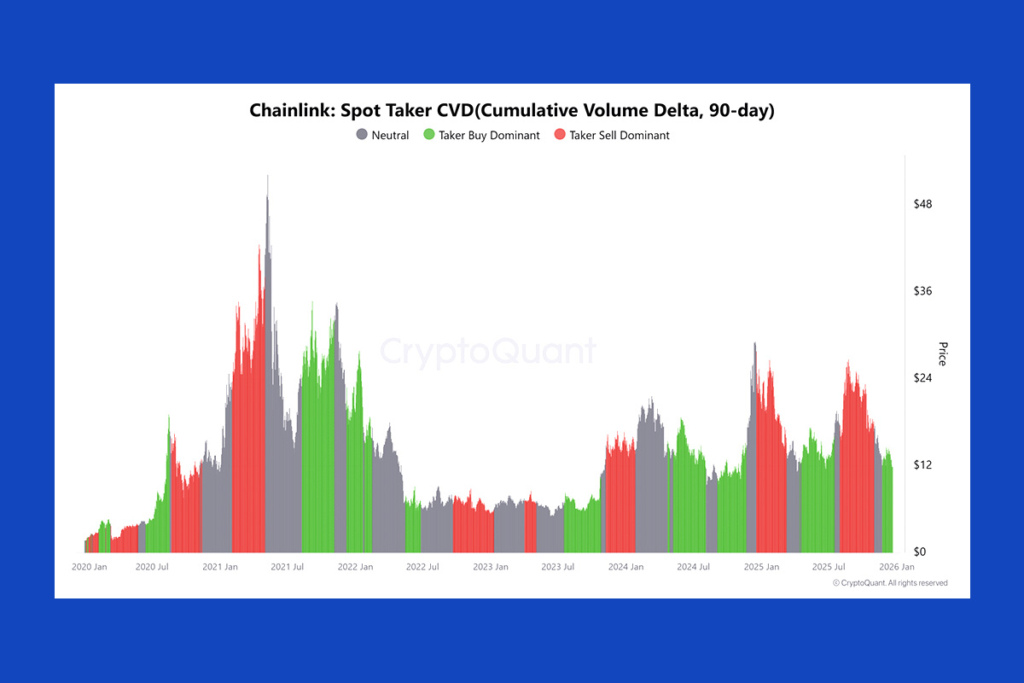

LINK Price Falls, but Buy-Side Pressure Still Leads

Spot market activity suggests selling pressure lacks organic conviction. The 90-day Spot Taker CVD is buy-dominant. Even if LINK fell from $16–$17 to $12, market buys outweighed market sales. Buyers lift offers without waiting for deeper pullbacks. While derivative activity distorts price signals, this strength is hidden. Even with spot absorption, leveraged selling reduces the price. Still, buy-side dominance favors accumulation over distribution. As the price reaches demand zones, negative moves usually slow down.

Forced positioning was a major factor in LINK’s recent decline, according to liquidation data. Short liquidations were close to $167.24K and long liquidations were close to $46.03K at the time of publication, for a total of about $213K in liquidations. Downside fuel is gradually reduced by repeated lengthy flushes. Cascading sell-offs are more difficult to maintain as longs leave. Expanding short exposure, meanwhile, makes one more susceptible to shrewd countermoves. In this context, liquidation behavior is more often indicative of fatigue than of new trend growth.

LINK Shows Signs of Strength Near Key Support Area

Buyers have defended the price several times. LINK still maintains a well-defined demand zone between $11.8 and $12.2. There has never been a sustained breakdown below $11.8 since this region has consistently absorbed sell pressure. Crucially, at the time of writing, the signal line was close to 33.16, and the RSI was still at 40.81. This indicates that the bearish momentum is not increasing but rather decreasing. During the base-building stages, this RSI behavior frequently manifests. Downside risk is limited as long as the price stays above demand. However, in order to verify short-term strength, LINK needs to recover $13.02.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.