Featured News Headlines

Bitcoin Price Under Pressure: $60K–$70K Range in Focus

Bitcoin’s latest correction has reignited debate over whether the market is approaching a true bear market or simply experiencing another pause within a broader bull cycle. After dropping nearly 30% in Q4 2025 and slipping below the $90,000 level, BTC cracked a key support zone that caused several well-known analysts to turn cautious on the mid-term outlook.

Is Bitcoin Entering a Bear Market?

According to pseudonymous analyst Jackis, even a deeper pullback toward $70,000 would not necessarily signal a “typical bear market.” Instead, he described the current move as part of a macro range for 2025, framing the weakness as a temporary pause in the macro trend rather than a fundamental breakdown. Jackis emphasized that, unlike the downturns seen in 2022 or early 2025, the current decline is not driven by broader risk-off sentiment, but by an exchange of hands between long-term holders (OGs) and institutions.

Bitcoin Slips Below a Critical Technical Level

From a technical perspective, Bitcoin’s price action is raising concerns. Historically, the 50-week Exponential Moving Average (50W EMA) has acted as a crucial support during bull markets. Sustained trading below this level has, in past cycles, coincided with bear market conditions.

The extended correction below $100,000 in mid-November pushed BTC beneath this key support. If the 50W EMA is not reclaimed, the broader bullish structure could be at risk. Based on historical behavior, a decline into the $60,000–$70,000 range could represent a potential bottom or reversal zone, as this area previously marked breakout levels that limited deeper corrections. Former Ark Invest executive Chris Burniske has echoed a similar outlook.

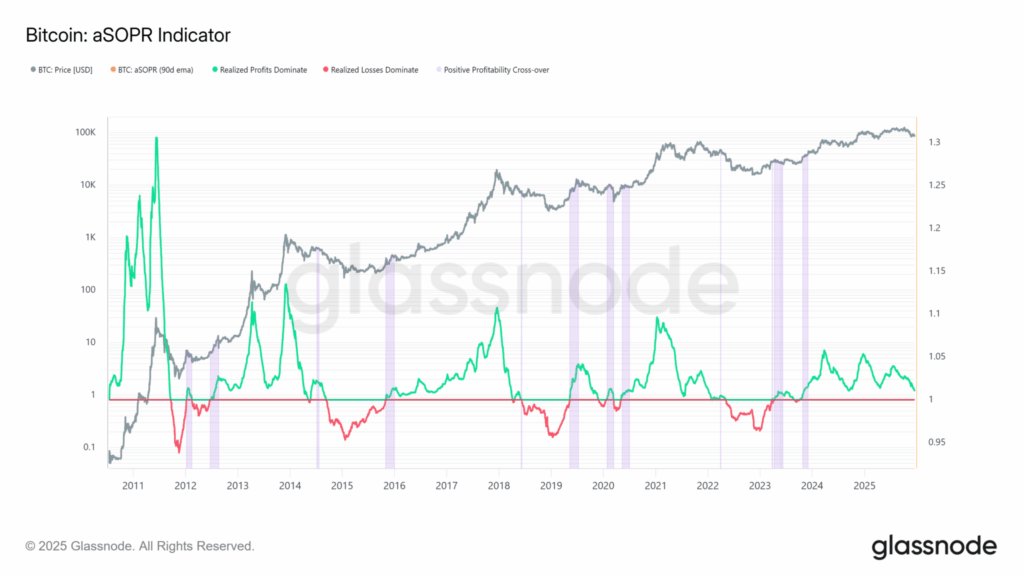

On-Chain Data Signals Rising Stress

On-chain metrics also suggest mounting pressure. The adjusted Spent Output Profit Ratio (aSOPR) is hovering near 1, a level that has historically preceded bear market capitulation and subsequent reversals. Additionally, around 7 million BTC are currently held at a loss—the highest level seen in this cycle and approaching the 8–10 million BTC range that defined prior bearish regimes, according to Glassnode.

Overall, Bitcoin’s drop to around $88,000 has placed the market under significant stress. A further move toward $60,000–$70,000 could mirror conditions seen during past bear markets, intensifying capitulation across the network.

Comments are closed.