ASTER Faces Selling Pressure: Whale Exit Sparks Bearish Shift

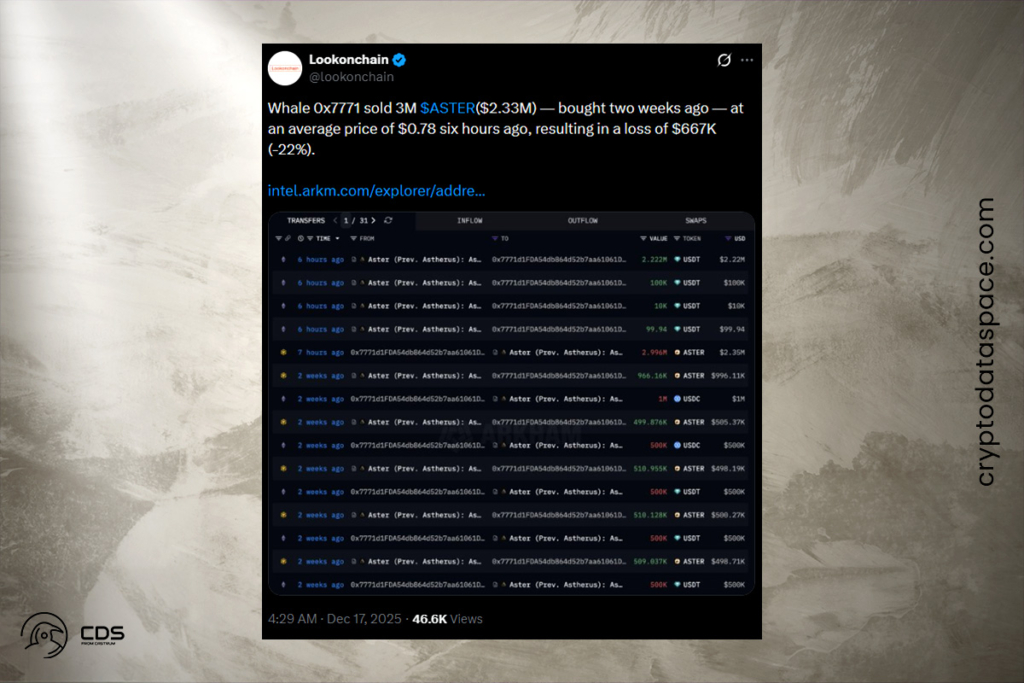

Strong wave effects were produced in the short-term direction of ASTER by whale exits. A $667K loss was locked in when an address offloaded 3M ASTER, valued at $2.33M, on December 17. Large holders’ deeper concerns are indicated by this. The shift happened just two weeks after accumulation at about $0.78, demonstrating how swiftly sentiment changed. The price’s continued slide below earlier support levels coincided with this breakdown and waning demand. The market’s reaction to the acceleration of sell-side flows was one of increased caution. This whale escape ultimately raises doubts about a short-term reversal attempt while solidifying bearish expectations.

ASTER Bears Defend Resistance as Downtrend Persists

Aster kept moving down a distinct descending pathway. At the time of writing, the price was trading close to $0.6904, below the 1.618 Fib at $0.836. The deeper objectives of $0.741, $0.646, and $0.588 are now the focus for sellers. The signal line remained above the MACD line, and the MACD continued to be negative. Every attempt to rise was thwarted by the resistance of the descending channel, prolonging the wider decline. Until buyers regain higher trend levels, the current technical situation suggests that pressure will remain.

At the time of publication, open interest had fallen 3.92% to $420.8M, indicating that traders were less inclined to keep their exposure during periods of high downside risk. The decrease coincides with declining demand in all leverage markets and comes after the whale exodus. A declining OI frequently indicates that traders are closing out their positions rather than building up weakness. But it also limits forced volatility by lowering the likelihood of abrupt liquidation increases. Therefore, before making a forceful reentry, traders require more precise directional cues.

ASTER Under Pressure as Market Absorbs Sell-Side Flow

Long positions are declining more sharply, according to liquidation indicators. Only $3,650 in liquidations happened in short holdings, compared to $48,570 in long ones. As the market declines, this imbalance indicates a lack of trust among leveraged purchasers. Regular long-side flushes are an indication of hesitant attempts to purchase dips. Smaller short liquidations, on the other hand, point to a controlled downward trend devoid of sharp volatility spikes.

When leverage resets farther into bearish territory, the market smoothly absorbs selling pressure. The technical signal that points toward sub-$0.7 goals is supported by liquidity movements, which also support downward extensions. In conclusion, whale departures, dropping OI, growing short domination, and liquidation patterns all indicate that ASTER‘s near-term outlook is still negative.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.