Featured News Headlines

Norway’s $2 Trillion Fund Supports Metaplanet’s Push to Scale Bitcoin Holdings

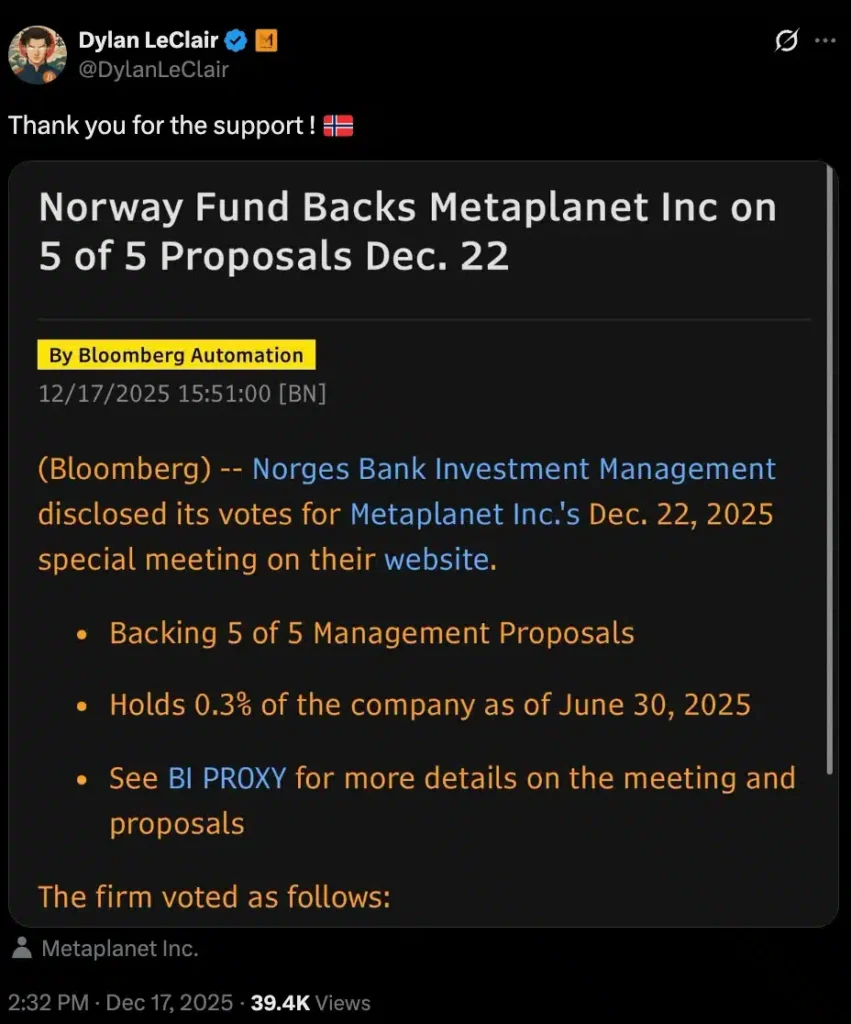

Norway’s sovereign wealth fund manager, Norges Bank Investment Management (NBIM), has taken a notable step in the crypto-linked equity space by fully backing Metaplanet, a Tokyo-listed company pursuing an aggressive Bitcoin Treasury Model.

NBIM Signals Confidence in Bitcoin-Centric Strategy

Ahead of Metaplanet’s Extraordinary General Meeting (EGM) scheduled for 22 December, NBIM — which currently holds roughly 0.3% of the company — has voted “Yes” on all five management proposals. This unanimous support places the $2 trillion fund manager firmly behind Metaplanet’s Bitcoin-focused corporate strategy, moving beyond the role of a passive shareholder.

What the Approved Proposals Include

The approved measures represent a sweeping overhaul of Metaplanet’s capital structure, designed to strengthen its balance sheet and support long-term Bitcoin accumulation.

The company plans to reduce capital stock and reserves, freeing up surplus funds for dividends, share buybacks, or additional Bitcoin purchases, without changing the number of shares outstanding. It will also expand its authorized share pool and introduce new preferred share classes to improve capital-raising flexibility.

At the center of this plan are two new instruments. Class A shares (MARS) will function as perpetual senior securities with variable monthly dividends, offering yield while limiting dilution for existing shareholders. Class B shares (MERCURY) will provide fixed quarterly dividends, along with conversion and redemption features, targeting institutions seeking predictable returns with potential Bitcoin-linked upside.

Metaplanet also intends to raise $150 million through MERCURY shares, with explicit approval to deploy the proceeds toward Bitcoin purchases.

A Global Bitcoin Treasury Play

NBIM’s support aligns with its broader exposure to Bitcoin treasury companies. The fund already holds about 1.05% of Strategy (formerly MicroStrategy), a position valued at over $1.1 billion by late 2025. Its growing stake in Metaplanet — rising from 0.3% in June to approximately 0.49% — suggests a global approach to Bitcoin-backed equities across regions.

Market Context and What Comes Next

Metaplanet’s shares recently traded at 404 JPY, while Strategy rose to $167.50, according to Google Finance. However, Metaplanet has paused Bitcoin purchases since 29 September, reportedly due to its mNAV falling below 1x.

The upcoming EGM could prove decisive, as Metaplanet weighs its ambition to scale holdings from 30,000 to 100,000 BTC by 2026, even as uncertainty lingers around timing and execution.

Comments are closed.