Featured News Headlines

Why Bitcoin Fell: Leverage Liquidations Hit as Institutions Hold Firm

Bitcoin’s recent price weakness may appear puzzling at first glance, especially as institutional interest in Bitcoin continues to deepen. Behind the scenes, large holders are quietly strengthening their grip on supply, while traditional finance builds infrastructure for future demand.

Institutional Bitcoin Holdings Continue to Grow

Large institutional entities now control roughly 5.94 million Bitcoin, representing close to 30% of the circulating supply. These holdings are spread across exchanges, ETFs, public companies, and government treasuries.

At the same time, long-term Bitcoin balances are increasing, while exchange-held BTC has largely stagnated. This combination points to reduced sell-side pressure over the long run, as fewer coins remain readily available for trading.

U.S. Banks Expand Bitcoin Offerings

Wall Street’s interest has not faded. According to River, 14 of the top 25 U.S. banks are currently building or exploring Bitcoin-linked products, including trading desks and custody services. These offerings are primarily aimed at high-net-worth clients, signaling that major financial institutions are positioning themselves ahead of the next phase of demand rather than reacting after the fact.

Leverage, Not Fundamentals, Drove the Sell-Off

Despite this accumulation, Bitcoin prices have slipped due to one key factor: leverage breaking in the futures market. Recent price drops closely aligned with sharp spikes in long liquidations across exchanges.

Traders had built up heavily leveraged long positions, expecting further upside. When Bitcoin fell below key levels, these positions were automatically closed, triggering forced market sell orders. This cascade effect amplified downside pressure, with each liquidation pushing prices lower.

A Critical Technical Level Comes Into Focus

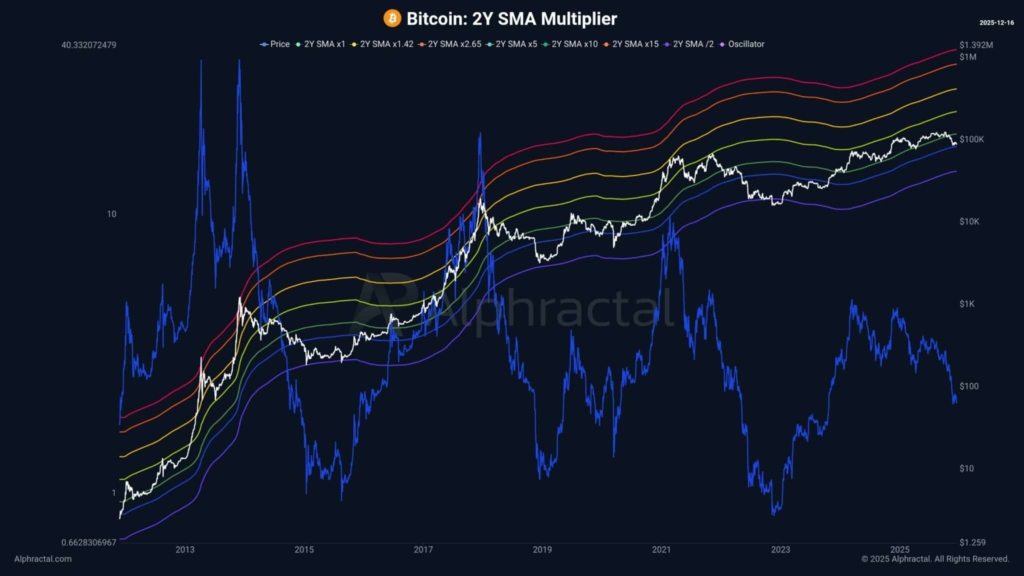

Attention is now turning to Bitcoin’s long-term structure. On the 2Y SMA Multiplier chart from Alphractal, Bitcoin is approaching its two-year simple moving average near $82,800. Historically, this level has acted as a major regime marker.

Monthly closes below the 2Y SMA have coincided with extended bear phases, while holding or reclaiming it has helped reset the market after periods of excess. As the year draws to a close, this level remains a key line the market is watching closely.

Comments are closed.