Featured News Headlines

Uniswap Traders Eye $5.6 Liquidity Zone as Vitalik Buterin Moves UNI

Uniswap (UNI) recently drew attention as Ethereum co-founder Vitalik Buterin executed a small token sale, yet the market remained surprisingly stable under persistent liquidity pressure. Despite high-profile on-chain activity, UNI traded in a tight range, signaling caution rather than panic among traders.

UNI Price Action Shows Restraint

UNI’s price stayed compressed beneath resistance levels, with both downside attempts and upside bounces losing momentum. Each dip slowed quickly, and rebounds stalled just as fast, reflecting market hesitation rather than a clear directional trend. Volatility contracted even as sell-side pressure persisted, maintaining a delicate balance between buyers and sellers.

Vitalik’s Wallet Moves Contextualized

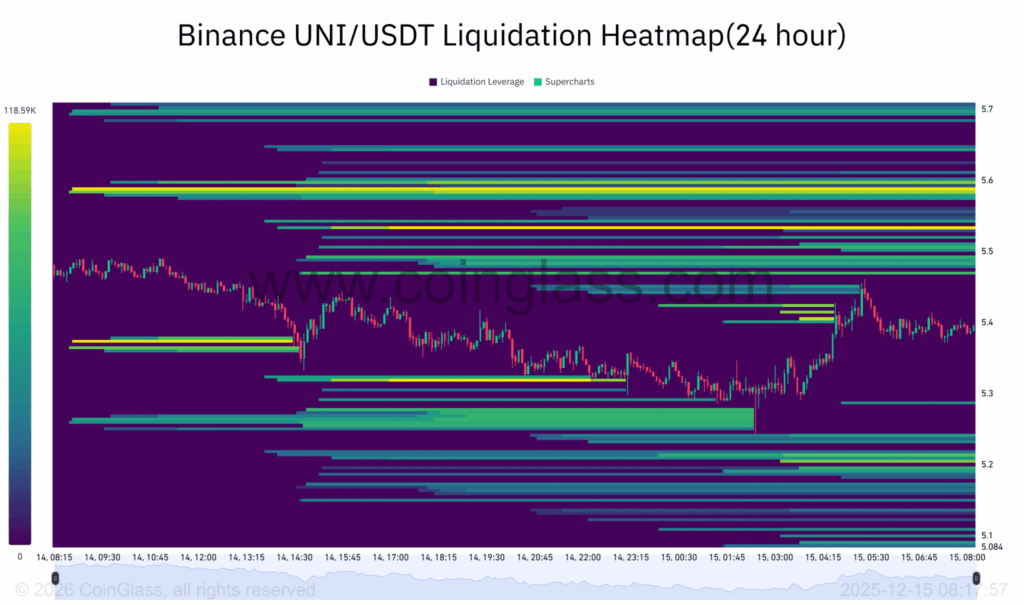

According to Lookonchain, Vitalik sold 1,400 UNI (~$7.48K), 10,000 KNC (~$2.47K), and 40 trillion DINU just hours earlier, generating 16,796 USDC in total. These transfers, aligned with previously observed patterns of unsolicited tokens sent to Buterin’s public wallet, were interpreted as routine wallet housekeeping rather than market-driven selling. The UNI volume remained small relative to overall market depth, even as it coincided with a liquidity-heavy zone near $5.6, which acted as both a magnet and resistance.

Compression Signals Potential Exhaustion

UNI moved deeper into the final phase of a falling wedge, with downside momentum weakening. A bullish RSI divergence indicated that lower prices were losing conviction. Meanwhile, the token continued leaving exchanges, pointing to reduced immediate sell pressure, although the price remained capped below resistance.

Traders are closely eyeing the $5.6 liquidity band, which could shift short-term market control. A break above this zone may open the way toward $6, while failure to reclaim it keeps downside risks active, with support near $4.81 providing a potential floor. Ultimately, a move above $10 would invalidate UNI’s multi-year downtrend, signaling a potential reset in the higher-timeframe bias.

Comments are closed.