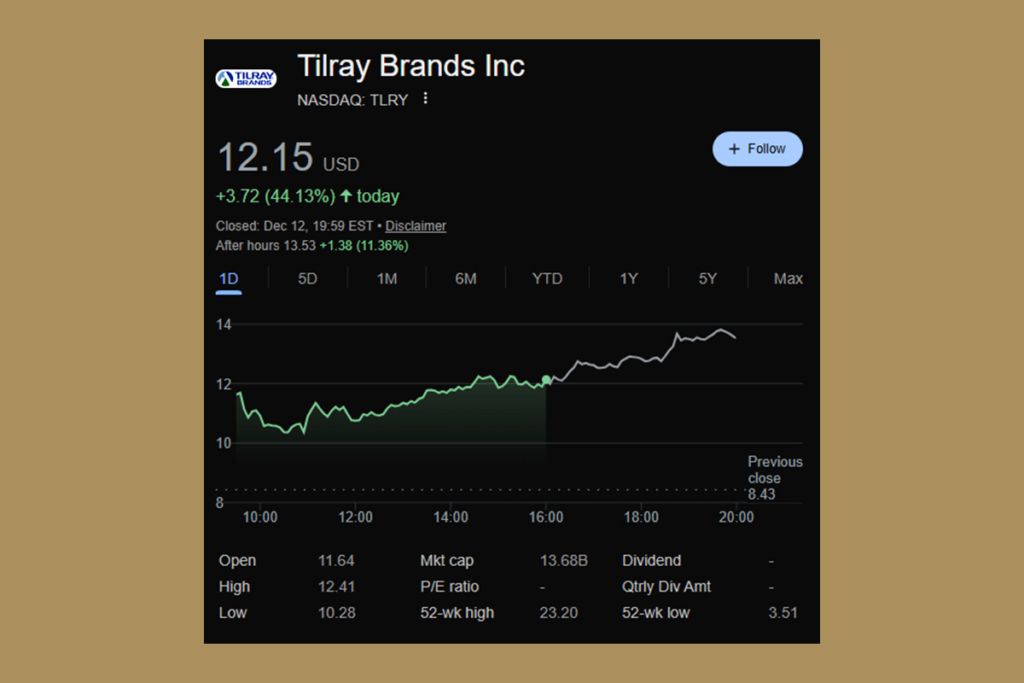

Tilray Stock Surges: What’s Driving the Move?

As interest in the cannabis industry grew again, Tilray’s stock shot up. Following a protracted run of poor performance, traders took notice of the move. The volume increased significantly over recent averages. Instead of a quiet bounce, this indicates aggressive short-term positioning. As momentum grows, investors are increasingly reevaluating Tilray’s risk-reward profile.

Short Squeeze Sparks Tilray’s Momentum-Driven Rally

Sector rotation combined with speculative buying seems to be driving the rise. As traders look for high-beta names, cannabis stocks have experienced fresh inflows. The pressure from short-covering helped Tilray as well. After prices breached important resistance levels, a comparatively high short interest rate intensified the upward trend. Technically speaking, TLRY surpassed its short-term moving averages. This led to buying based on momentum. The stock is still below significant long-term resistance, though. This implies that rather than being firmly established, the rally is still brittle and sentiment-driven.

Tilray Investors Brace for Volatility After Sharp Rally

TLRY’s ability to hold above its breakout zone is currently the main concern of traders. Maintaining a steady volume will be essential. Gains might swiftly erode without it. Overhead resistance from earlier distribution regions still exists. If those levels are not regained, there may be significant declines. The fundamentals are still unclear for investors with longer time horizons. There is still a lack of regulatory certainty and profitability issues. Risk management is still crucial even though the spike increases short-term momentum. Although Tilray is growing, volatility is probably going to remain high.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.