Featured News Headlines

PENGU Leads Market Losses With Double-Digit Decline

Pudgy Penguins (PENGU) has underperformed over the past 24 hours, posting an 11% drop—the steepest decline among the top 100 cryptocurrencies, according to CoinMarketCap. Such conditions often signal a high probability of extended downside, yet several market indicators now point to the potential for a short-term recovery.

Liquidity Flight Triggers Bearish Pressure

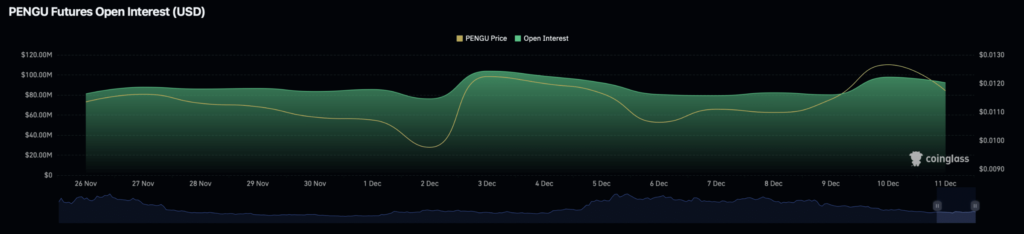

The derivatives market reveals the most substantial capital outflow tied to PENGU.

Open Interest (OI)—a key metric reflecting the amount of active capital—fell 19%, removing approximately $15.4 million from market exposure.

This combination of falling OI and declining price suggests a strengthening bearish tone. Recent liquidation data reinforces that trend: nearly $1 million in long positions have been wiped out, indicating that bullish traders are being pushed out as sentiment turns against them.

The Long/Short Ratio over recent days stood at 9.9 to 1.1, meaning the market force-liquidated $9.9 in longs for every $1.1 in short positions—another sign of bullish exhaustion.

Bullish Signals Emerge Despite Market Stress

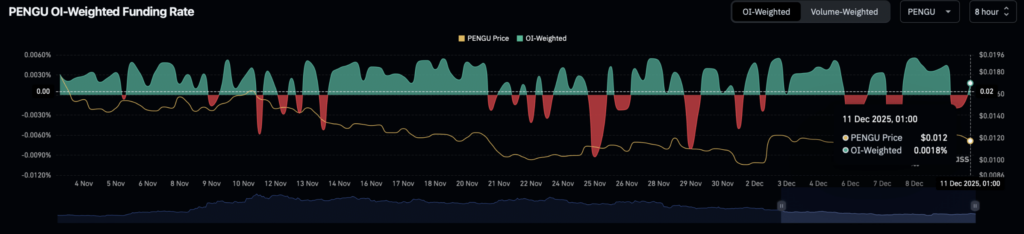

Despite the broader outflows, conditions vary across exchanges. On Binance—PENGU’s largest derivatives venue with $22.7 million in Open Interest—data paints a different picture.

The Long/Short Ratio on the exchange has hovered around 1.6, well above the neutral threshold, indicating that buying activity currently dominates. Additionally, the Open Interest-Weighted Funding Rate has flipped positive to 0.0082%, suggesting long traders are paying a premium, a dynamic typically associated with bullish sentiment.

Spot Market Activity Supports Recovery Narrative

Bullish positioning is also visible in spot markets. Exchange netflow data shows a consistent accumulation trend over the past 48 hours, totaling $2.26 million in net inflows.

Most of that buying occurred on 10 December, when investors added $1.76 million in PENGU to their holdings.

Today’s accumulation—so far $509,000—indicates continued interest. Should this pace sustain, total daily inflows could surpass previous levels.

Although PENGU has experienced a sharp short-term correction, the combined derivatives and spot indicators suggest the decline may resemble a temporary retracement rather than a trend reversal.

If bullish inflows persist and sentiment stabilizes, analysts expect momentum to remain supportive of PENGU’s broader upward trajectory—though volatility is likely to remain elevated.

Comments are closed.