Featured News Headlines

Chaikin Money Flow Signals Reduced Selling Pressure on HBAR

Despite recent stagnation, HBAR holders appear increasingly active, signaling a potential easing of bearish pressure. Analysts note that early signs suggest the altcoin could be preparing for a change in market sentiment.

Chaikin Money Flow Indicates Reduced Selling Pressure

The Chaikin Money Flow (CMF) indicator is showing a sharp uptick, pointing to a slowdown in token outflows. “As investors pull back from offloading tokens, sentiment gradually shifts toward a more constructive outlook,” experts say. If CMF continues improving and crosses above zero, HBAR will officially register net inflows, which often coincide with strengthened momentum.

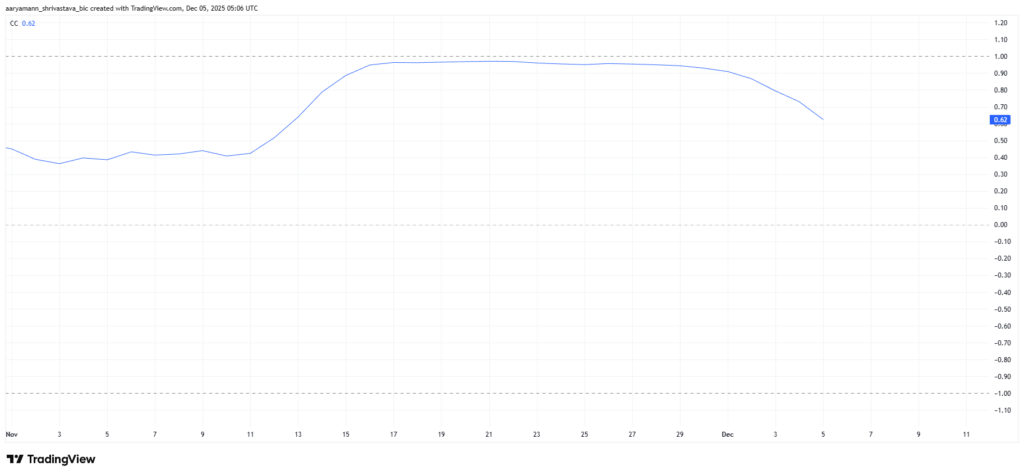

HBAR Decouples from Bitcoin

HBAR’s correlation with Bitcoin has declined from a tight alignment over the past three weeks to 0.62. This decoupling suggests HBAR is becoming less dependent on Bitcoin’s trend and may be preparing to chart its own path. Analysts highlight that this divergence could be advantageous, as Bitcoin remains directionless and has yet to establish a clear recovery trend.

Sideways Price Movement Persists

HBAR’s price has fallen 5% in the past 24 hours, continuing to trade in a range between $0.130 and $0.150 for nearly three weeks. The altcoin’s sideways action is likely to persist unless a significant catalyst emerges.

Improving CMF readings suggest potential underlying support. Analysts note, “If HBAR capitalizes on strengthening investor support, it could bounce from the $0.141 local support level and retest $0.150.” A breakout above this barrier could open the path toward $0.162, supported by rising inflows and reduced selling pressure.

Conversely, if investor sentiment weakens again, HBAR may test the key $0.130 support level. Falling below this point could challenge the bullish-neutral outlook and leave the price vulnerable to a decline toward $0.125.

Comments are closed.