Satoshi-Era Miner Wallet Breaks Silence with a Huge Bitcoin Transfer

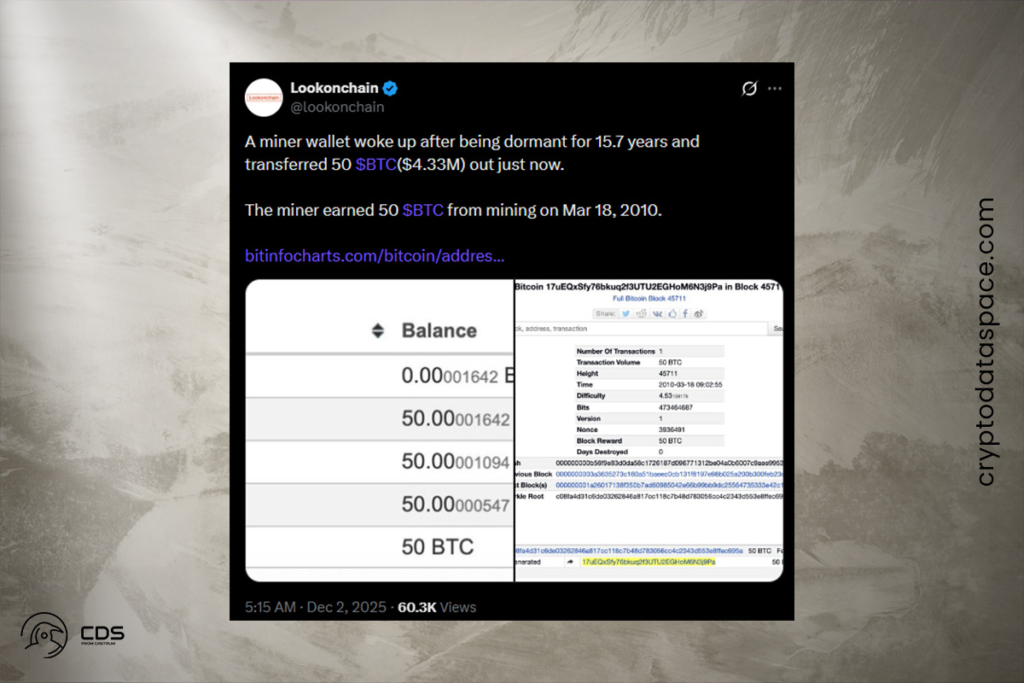

Lookonchain, an on-chain tracker, claimed that a miner wallet that had been dormant for over 15 years has come to life. An external address received 50 BTC, or roughly $4.33 million, from an early wallet. The transfer was verified by OnchainLens, which also characterized the wallet as being from the Satoshi era. In 2025, these coins might be some of the oldest Bitcoins to travel. Investors began to speculate about secret developments behind the scenes as a result of the transfer.

Miners regularly took money out of their wallets, most likely to sell, according to data from their reserves. In this regard, the Bitcoin Miner Reserve has been steadily declining over time, according to CryptoQuant. Persistent selling pressure is reflected in the pattern. Miners possessed over 1.83 million Bitcoin at the beginning of 2024. Over the previous two years, they might have sold about 300,000 Bitcoin.

Bitcoin Mining Faces Record Difficulty and Falling Revenue

The mining difficulty has stayed at 149.30T, a record high. Put otherwise, miners must execute an average of 149.30 trillion SHA-256 hashes in order to find a legitimate block. Because of this circumstance, mining machines are forced to compete more fiercely. Additionally, it raises operating expenses. Hashrate revenue decreased from roughly $55 per PH/s in Q3 2025, according to the Miner Weekly report (The Miner Mag). It dropped even more to $35 per PH/s by November.

“Bitcoin mining has entered what is effectively the harshest margin environment of all time,” Miner Weekly

The average cost of large mining companies is $44 per PH/s, which is lower than current revenue levels, according to the report. Payback durations are now longer than 1,000 days, even with modern mining equipment. The approximately 850-day countdown to the next halving has long since passed.

Bitcoin Price Near Mining Cost: Will Miners Hold or Fold?

According to analyst Ted, the Bitcoin price is currently only 19% more than the price of power. Miners might be compelled to give up if the price falls below the projected $71,087 average electricity cost of mining 1 Bitcoin. Nevertheless, Ted’s observation also pointed to a possible area of support for Bitcoin. According to historical data, the Bitcoin price often either stays above or rises over this electricity-cost level. Since 2016, this tendency has persisted.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.