Featured News Headlines

Corporate Crypto Crisis: Digital Asset Treasury Inflows Plunge 90% in 2025

Digital Asset Treasury (DAT) inflows have experienced a sharp contraction, dropping to just $1.32 billion in recent months—the lowest level recorded in 2025. This represents a staggering 90% decline from July’s peak, sparking renewed concerns over the stability and sustainability of corporate crypto treasury strategies.

Institutional Appetite for Crypto Weakens

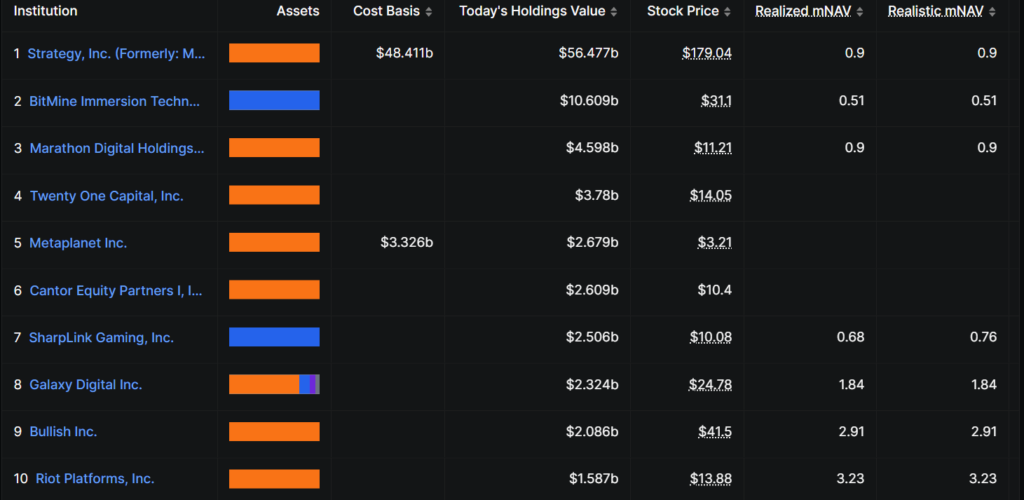

Data from DefiLlama highlights the dramatic downturn in institutional digital asset allocations. Leading companies such as Strategy, Inc. (formerly MicroStrategy), BitMine Immersion Technologies, and Marathon Digital collectively control tens of billions in digital assets, yet both realized and unrealized market net asset values (mNAVs) have contracted significantly.

- Strategy, Inc. leads with $48.411 billion

- BitMine Immersion holds $10.6 billion

- Marathon Digital reports $4.5 billion

Although these institutions maintain diversified holdings across Bitcoin, Ethereum, Solana, and other altcoins, the strategy has failed to insulate corporate treasuries from market depreciation, reflecting declining investor confidence.

Altcoins and Liquidity Concerns

The ongoing contraction underscores the challenges facing altcoins, particularly those without strong liquidity channels. CryptoQuant CEO Ki Young Ju warns that projects lacking access to DATs or ETFs face heightened long-term risk. According to Ju, only tokens supported by institutional treasuries or approved ETFs have a reasonable chance of survival in the current market environment.

Currently, Ethereum, Solana, XRP, and Chainlink are the only altcoins with approved ETF status, while most others remain in “filed” or “possibility” categories, exposing them to higher volatility and reduced institutional support.

ETF Market Efforts and Structural Challenges

In October 2025, CoinShares launched an ETF providing exposure to 10 leading Layer 1 altcoins, aiming to diversify investor holdings beyond Bitcoin and Ethereum. The equal-weighted fund also waived management fees through September 2026 to encourage participation. Despite these efforts, DAT- and ETF-backed altcoins continue to face structural pressures, highlighting the difficulties of institutionalizing highly volatile digital assets.

Calls for Strategic Treasury Shifts

Analysts are advocating for re-evaluation of corporate treasury strategies, emphasizing stability over speculation.

- Nwachukwu, a crypto analyst, suggests reducing exposure to volatile tokens like Ethereum and Solana in favor of tokenized real-world assets (RWAs), which offer steadier yields and preserve capital.

- Taiki Maeda criticizes the DAT model, arguing that bundling decentralized assets into DATs adds overhang and undermines intrinsic value.

Despite challenges, Strategy, Inc. continues to champion the DAT model, maintaining transparency through its official Bitcoin purchase updates and hosting events like the Bitcoin for Corporations 2025 conference.

Consolidation and Capital Preservation

As crypto market volatility persists, the decline in DAT inflows signals an imminent phase of consolidation and strategic reassessment. Corporate treasuries may need to pivot, balancing crypto exposure with liquidity management and stability-focused asset allocation. Success will depend on selecting robust assets, securing institutional support, and prioritizing capital preservation over high-risk speculation.

Comments are closed.