Featured News Headlines

SOL Price Recovers From Mid-November Lows

Solana (SOL) is closing the week with relative stability, although short-term momentum has turned more bearish. SOL is trading around $139.58, down 2.9% in the past 24 hours but roughly 6.5% higher over the past week, according to CoinGecko data.

Price Recovers From Mid-November Lows

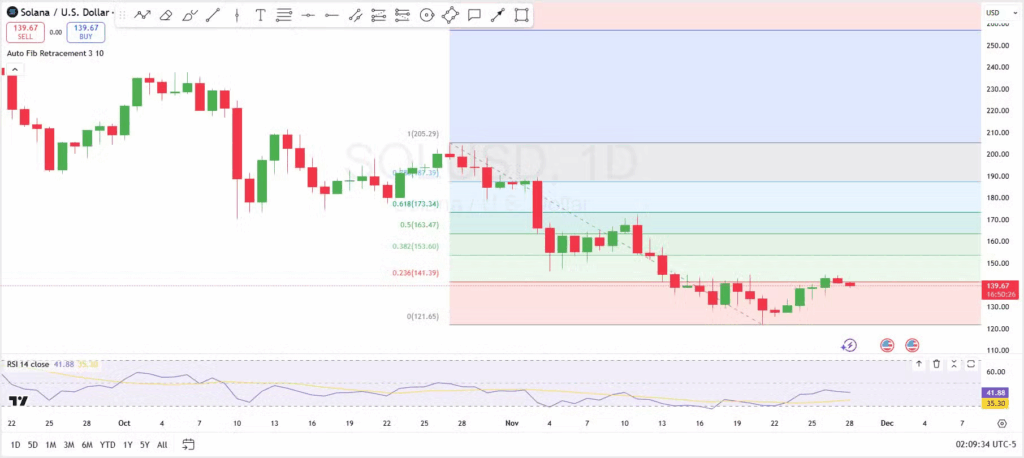

The token rebounded from the $121 support area, forming a series of green candles before a late-week surge briefly pushed SOL above $144. Despite a modest pullback, Solana remains in the upper half of its recent range. However, the asset has struggled to surpass a key resistance zone. Weekly patterns indicate steady demand, with buyers stepping in on dips to push prices to higher peaks. At the same time, the $144 level is acting as a short-term ceiling, raising questions about whether SOL can sustain a breakout or face renewed downward pressure.

Technical Overview Highlights Corrective Phase

From a technical standpoint, Solana is still navigating a corrective period following the drop from late-October highs above $205 to the mid-November low near $121. Fibonacci retracement analysis shows the current rebound has struggled to break the 23.6% retracement around $141, with SOL now hovering below this level.

The next resistance clusters are observed at 38.2% near $154, 50% at $163, and 61.8% around $173. Until SOL convincingly reclaims the 23.6%–38.2% range, the current bounce appears more like a relief rally inside a broader downtrend rather than a confirmed trend reversal. Should resistance hold at 23.6%, the token may retest liquidity around $121.65.

Momentum Indicators Suggest Caution

Technical indicators support this cautious outlook. The daily RSI has recovered from near-oversold levels around 30 to roughly 42, signaling that intense selling pressure has eased but buyers have not yet gained full control. The oscillator remains below the neutral 50 line, maintaining a slightly bearish bias. A sustained RSI move above 50–60, combined with a break of the $153–$163 Fibonacci zone, would indicate that November’s low could mark a medium-term bottom.

Signs of a Short-Term Bottom?

Analyst Ted highlighted on X that Solana may have found a short-term bottom, pointing to rebounds in Solana-treasury assets. His post notes $527.9 million in inflows to the Bitwise Solana ETF since November 10, suggesting increased investor interest in the token amid its recent corrective phase.

Comments are closed.