Bitcoin Bounces Back: Short-Term Recovery Sparks Hope Amid Bearish Trend

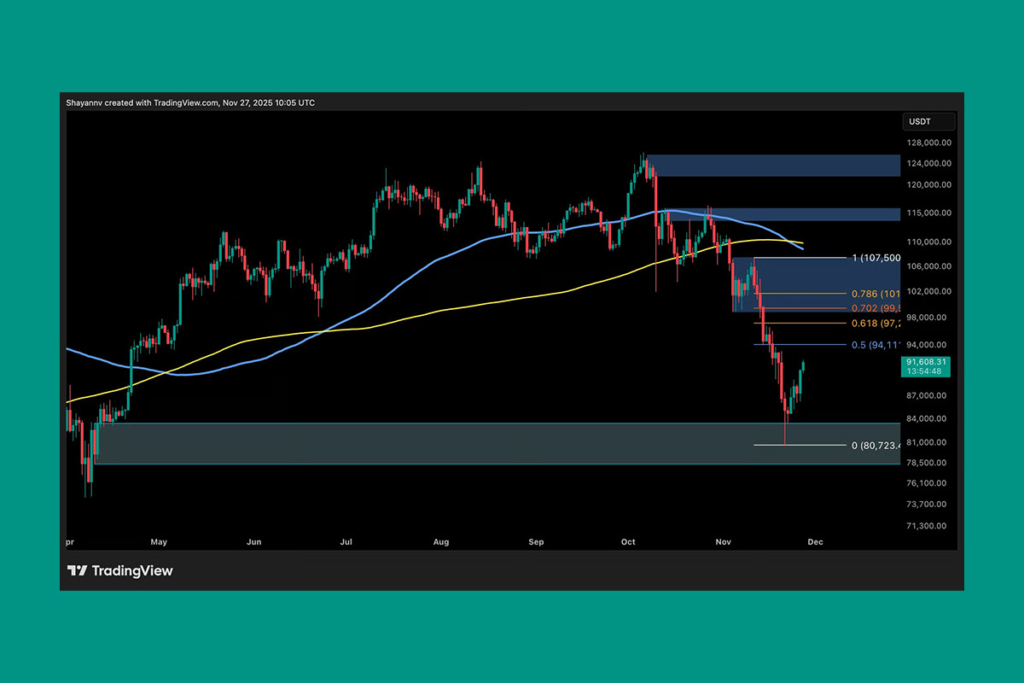

Recently, a surge of buyers has drawn Bitcoin to a crucial support area, causing a dramatic recovery into a short-term supply range. The overall trend is still negative, notwithstanding this rebound. Until the price can recover and consolidate above the $100K mark, the most recent move should still be seen as a brief retreat.

$80K Accumulation Sparks Bounce: Is $100K Next for Bitcoin?

Around the $80K support zone, there was significant buy-side demand in Bitcoin, which led to a robust bounce. While fear and capitulation dominated larger sentiment, this reaction indicated continued accumulation at depressed prices. But there are still several layers of resistance above. The $96K pivot is close to the first critical threshold. A mid-range retest of $100K–$104K is likely if buyers demonstrate approval above this area. If this structure is not recovered, Bitcoin would be vulnerable. The $80K–$83K accumulation region, where long-term purchasers previously intervened, may see another deeper sweep.

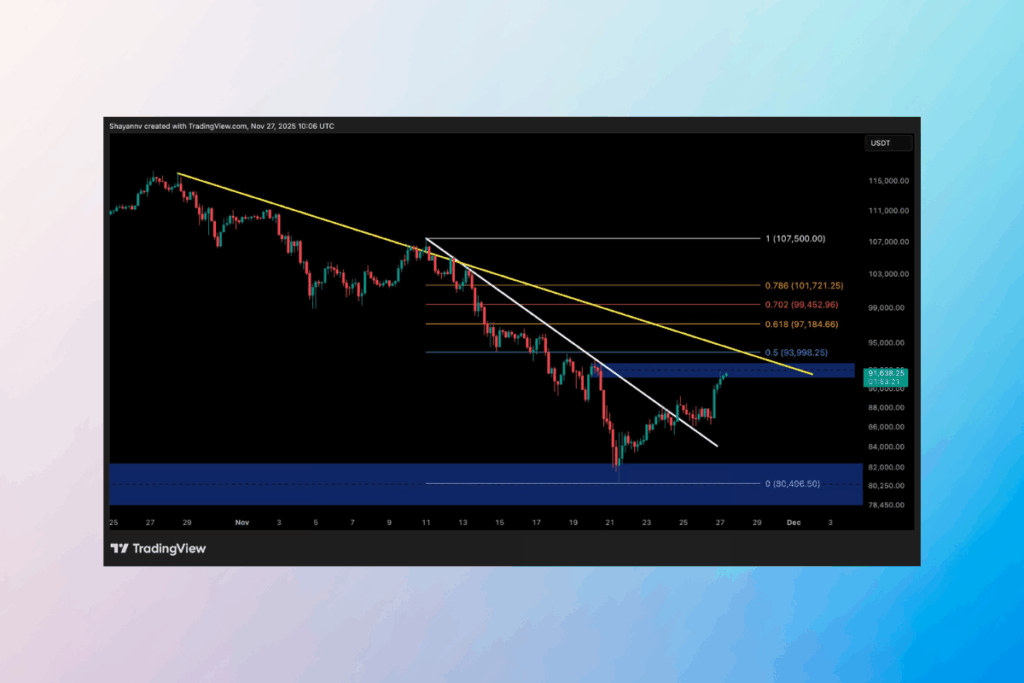

Can Bitcoin Surpass $91K and Rally Toward $100K?

Bitcoin has been declining over the past few weeks, which has increased market anxiety. Despite earlier strong selling, the most recent rally confidently broke over the short-term declining trendline. This indicates that demand is returning to the market. However, the $91K supply zone and the declining yellow trendline, which has restricted the price during the drop, present a significant obstacle to the recovery. This area is crucial. Bitcoin might return to the $80K support if this is rejected. On the other side, a good breakout would probably push the price closer to $100,000. This gives buyers more short-term momentum.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.