Featured News Headlines

Avalanche Selected for Europe’s First Tokenized Asset Trading System

Securitize, a prominent platform specializing in tokenized real-world assets (RWAs), has received full regulatory approval from Spain’s CNMV to operate what is described as the European Union’s first blockchain-based trading and settlement system. The decision marks a significant milestone for the firm and highlights Avalanche as a preferred network for institutional-grade blockchain infrastructure.

Why Avalanche Was Selected

Avalanche’s fast settlement times and highly configurable architecture have made it an attractive choice for institutions seeking reliable blockchain performance. Securitize’s decision to build on Avalanche has strengthened confidence in both the network and its native token, AVAX, across the short and long term.

Network Metrics Present a Strong Performance Profile

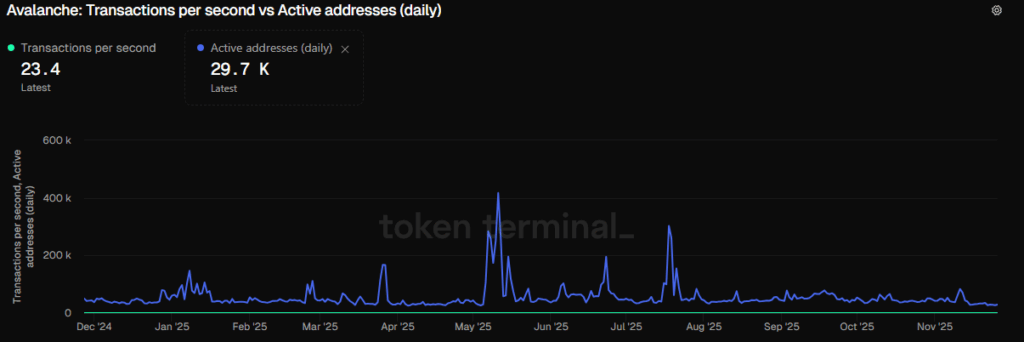

Data from Token Terminal shows that Avalanche has averaged 23 transactions per second (tps) and roughly 30,000 daily active addresses over the past ten days. Although its current tps mirrors Ethereum’s activity, Avalanche’s capacity is significantly higher.

According to Nansen, the network is capable of handling 4,500 tps with 2-second finality.

Securitize’s platform launch therefore showcases a blockchain still operating far below its theoretical limits — a reflection of adoption levels rather than technical constraints.

Market Reaction: AVAX Sees a Sharp Initial Rally

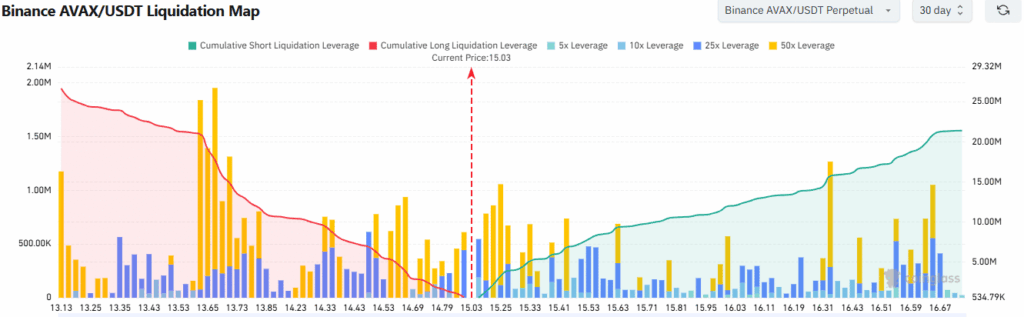

Following the announcement, the AVAX token jumped 7.4% within eight hours, before stabilizing around the $14.9–$15range. The initial surge began at $13.9, leaving behind notable high-leverage long liquidation levels near $13.65.

Liquidation maps also indicated that long liquidations outweighed short liquidations around current price levels.

This imbalance suggests potential volatility if price gravitates toward these liquidation zones over the weekend.

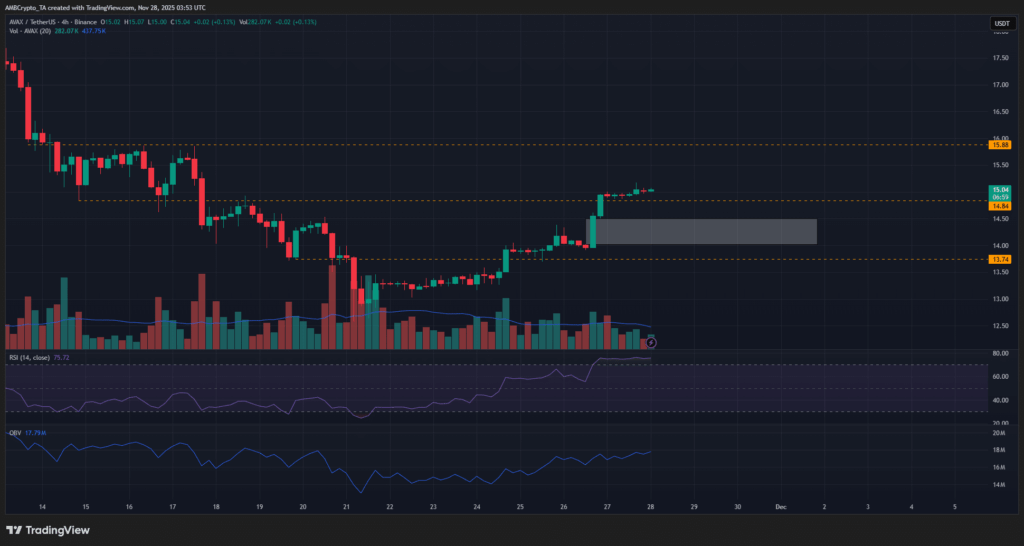

Price Structure Gradually Improves

A four-hour chart review shows the earlier downtrend slowly reversing. Former resistance levels have begun flipping into support zones, with $14.84 serving as the latest example.

However, the recent rally created a visible imbalance around the $14 area, and long liquidation clusters near $13.65remain relevant in the short term.

Comments are closed.