Featured News Headlines

Ethereum Faces Caution Despite Price Rebound

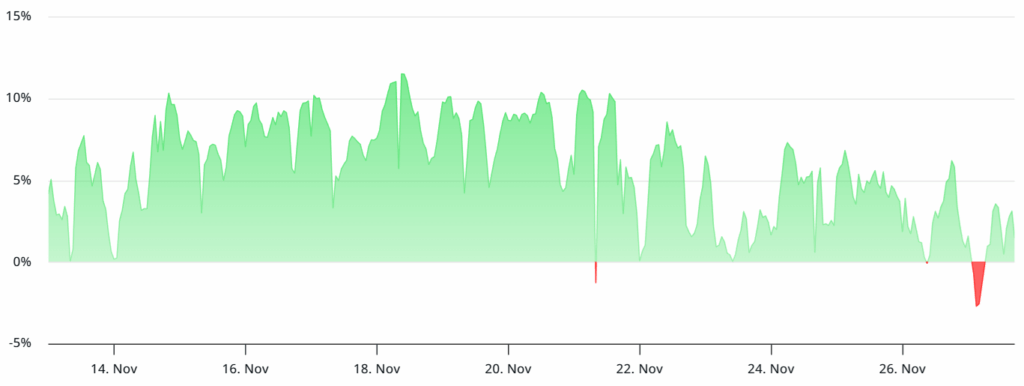

Ether (ETH) has risen 15% from last week’s $2,623 low, yet market sentiment shows little conviction behind the move. Despite the price recovery, derivatives data suggests that traders remain hesitant to take on bullish leverage. Combined with declining Ethereum network fees and shrinking on-chain deposits, the path toward reclaiming the $4,000 level remains uncertain.

Leverage Demand Weakens After October’s Sudden Crash

The sharp 20% drop on Oct. 10 left a lasting impact across both centralized and decentralized trading platforms. Liquidations surged, amplifying caution among investors and market makers. According to DefiLlama, Ethereum’s total value locked (TVL) slid to $72.3 billion on Oct. 10, down from $99.8 billion just one day earlier. This contraction, paired with softer demand for leveraged positions, continues to weigh on sentiment.

Perpetual futures funding rates—typically expected to hover between 6% and 12% under balanced market conditions—remain subdued. Analysts note that the absence of sustained bullish leverage from larger participants underscores the fragile mood.

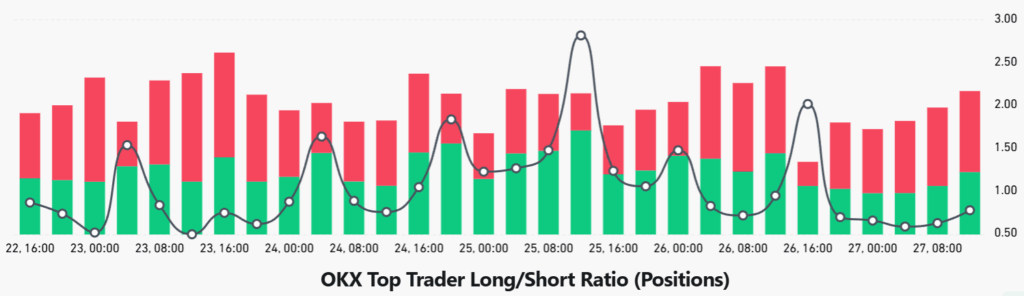

At OKX, aggregated spot, futures, and margin data shows top traders trimming their exposure. The long-to-short ratio reveals a 23% tilt toward bearish positions, reinforcing the view that conviction among whales has not returned.

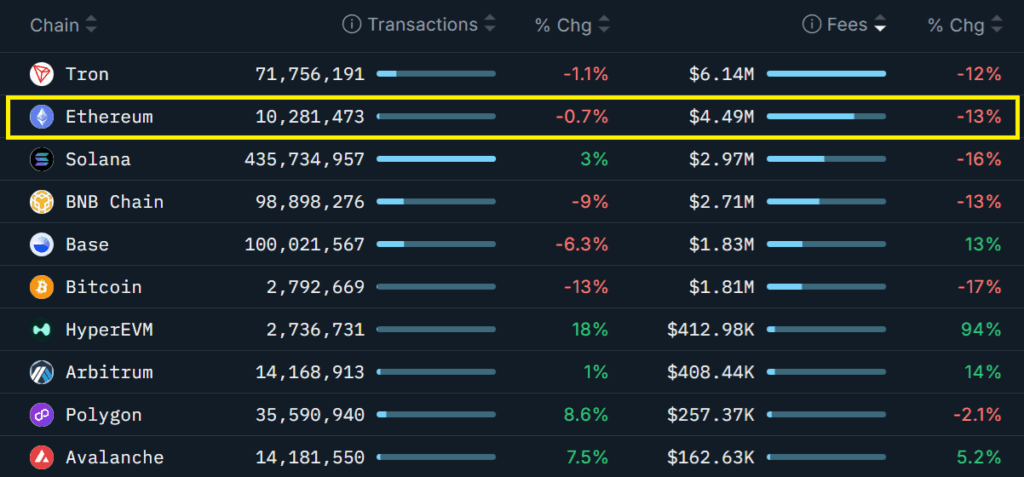

Network Fees Decline Despite Steady Activity

Over the past week, Ethereum network fees fell 13% even as transaction volumes remained largely unchanged. This divergence has raised concerns about the network’s economic health. With deposits shrinking and fee revenue under pressure, some investors fear a feedback loop that could lead to softer burn rates and a potential uptick in ETH supply.

Because Ethereum’s burn mechanism depends heavily on sustained activity, any prolonged decrease in network fees may influence the asset’s medium-term dynamics.

U.S. Labor Market Concerns Add to Market Caution

Macroeconomic uncertainty is adding another layer of hesitation. Reports of weakening U.S. labor data have contributed to a broader risk-off tone among digital asset traders. Yahoo Finance highlighted a drop in consumer spending following the government shutdown that ended on Nov. 12, while Reuters noted more than 25,000 job cuts announced by U.S. firms in November.

Adam Sarhan, CEO of 50 Park Investments, emphasized the significance of the trend, saying:

“You don’t have mass layoffs when the economy is strong.”

Should layoffs accelerate, market analysts warn that consumer sentiment could weaken further, potentially affecting appetite for risk-sensitive assets such as Ether.

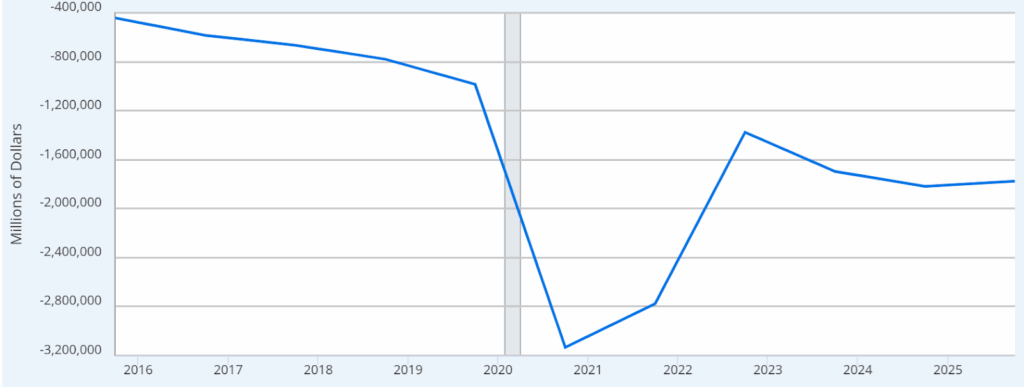

Economic Slowdown Complicates the Outlook

The U.S. government’s expanding debt requirements, rising operational costs for companies, and delayed returns from large-scale AI infrastructure spending all contribute to the uncertain backdrop. While large deficits can increase interest in alternative assets, traders remain cautious in the absence of clear policy direction from the Federal Reserve.

Although a softer economy could prompt the Fed to adopt a more accommodative stance, uncertainty surrounding the labor market continues to overshadow potential upside catalysts. The easing of risk-off sentiment following the end of the U.S. government shutdown provides some relief, but not enough to establish a clear bullish trend.

Focus Shifts to Tech Stocks and Bonds

For now, many investors appear to be directing their attention toward technology equities and bond markets. As a result, short-term enthusiasm for ETH remains muted. Until traders see firmer economic signals or renewed liquidity support from major central banks, Ether’s ability to reclaim the $4,000 mark remains in question.

Comments are closed.