Featured News Headlines

Grayscale GDOG Launch Misses Analyst Targets Amid Growing Crypto ETF Boom

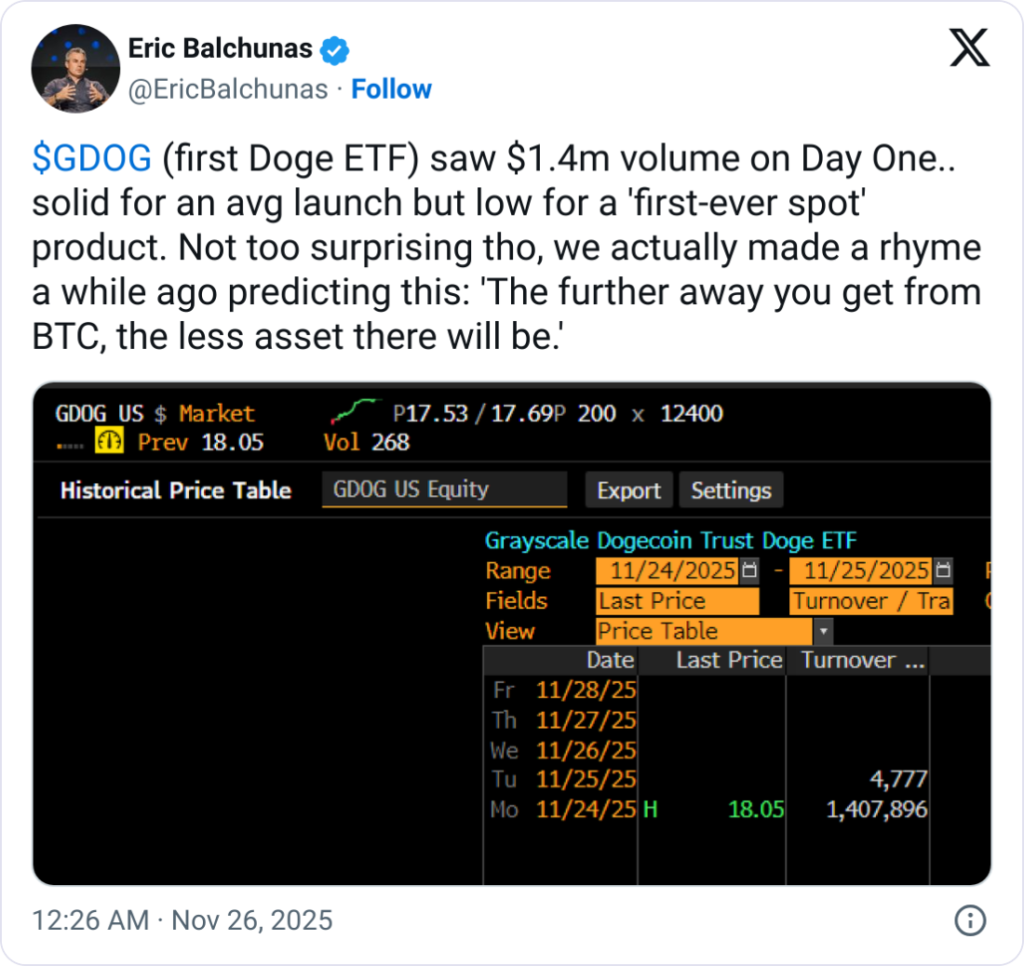

Grayscale’s Dogecoin ETF – The long-awaited arrival of the first U.S. spot Dogecoin ETF didn’t ignite the explosive trading activity some analysts anticipated. Grayscale’s Dogecoin Trust ETF (GDOG) recorded $1.4 million in debut trading volume on Monday—well below Bloomberg ETF analyst Eric Balchunas’ forecast of $12 million. Still, Balchunas noted the figure was “solid for an average launch,” though modest for a first-of-its-kind crypto product.

Bitwise Set to Enter the Dogecoin ETF Arena

Grayscale won’t stand alone for long. On Tuesday, NYSE Arca, a subsidiary of the New York Stock Exchange, filed to certify the approval and listing of the Bitwise Dogecoin ETF (BWOW). Bitwise confirmed that BWOW is scheduled to begin trading on Wednesday.

The emergence of multiple Dogecoin ETFs underscores the wave of crypto investment products hitting U.S. markets since the SEC eased listing standards in September, prompting asset managers to experiment with funds tied to more speculative digital assets.

Direct Exposure vs. Indirect Strategies

Unlike earlier Dogecoin products, both GDOG and BWOW are filed under the Securities Act of 1933, allowing them to directly hold Dogecoin (DOGE). However, this regulatory path requires a longer 240-day approval window.

That’s a stark contrast to the REX Osprey DOGE ETF (DOJE), which launched in September under the Investment Company Act of 1940—a faster route with a 75-day window but with an important catch: DOJE cannot directly hold Dogecoin. Instead, it invests in an offshore subsidiary exposed to DOGE and holds shares in European and Canadian Dogecoin ETFs.

Despite that limitation, DOJE saw a far stronger debut with $17 million in day-one trading volume, handily beating expectations of $2.5 million.

XRP ETFs Surge With Nearly $130 Million in Inflows

Dogecoin isn’t the only asset seeing ETF momentum. On Monday, Grayscale and Franklin Templeton launched their own spot XRP ETFs, pulling in a combined $129.95 million, according to SoSoValue. The Franklin XRP ETF (XRPZ) attracted $62.6 million, while the Grayscale XRP Trust ETF (GXRP) took in $67.4 million.

Still, both fell short of rivals like the Canary XRP ETF (XRPC), which generated $243 million on Nov. 14, and Bitwise’s XRP ETF, which surpassed $105 million on its opening day.

Balchunas noted Monday that the newly launched DOGE and XRP ETFs represent just the beginning, projecting—with fellow analyst James Seyffart—that more than 100 new crypto ETFs could be on the way within the next six months.

Comments are closed.