Featured News Headlines

Bittensor Rally Continues Following ETP Listing on Swiss Exchange

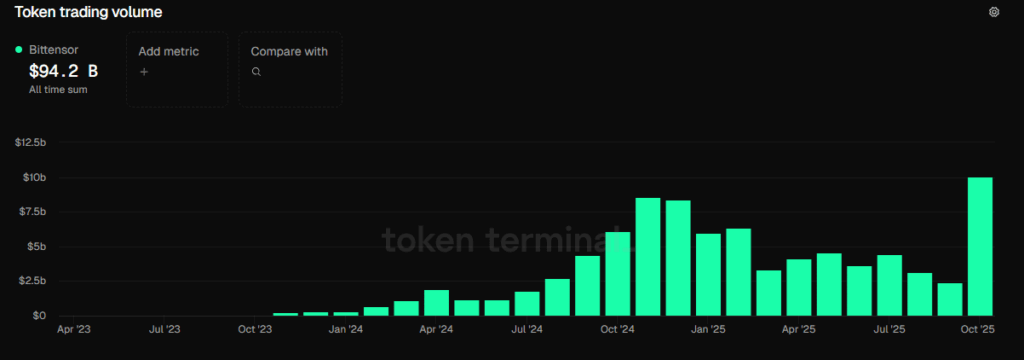

Bittensor has recorded a steady rally in recent days, and momentum remains strong. After Safello listed the TAO ETP on the SIX Swiss Exchange five days ago, the token quickly gained traction. Following the listing, TAO’s monthly trading volume jumped 31% to reach $10 billion. This figure signals growing confidence among both retail and institutional participants.

$305 at Critical Resistance Level

Bullish pressure continued to build over the past 24 hours. On the daily chart, TAO pressed against a key supply zone around $305 following a 7% daily surge. This level previously triggered several reversals.

However, renewed momentum suggests bulls are now attempting another push for a potential breakout. The price reaction at this level will determine TAO’s next major move. Strong trading activity across markets hints that buyers aren’t backing down yet.

TAO’s short-term structure will remain bullish-inclined as long as the price holds above nearby support levels. Momentum indicators also support this scenario.

Stochastic RSI Signals Buying Opportunity

TAO’s stochastic RSI bounced off from the oversold region. This mirrors renewed buying pressure as bulls anticipate rally continuation. The indicator suggests the token is in the early stages of a recovery phase.

If bulls maintain their current pace, TAO can surge past $305. Eventually, a continuation rally to test the next resistance level at $400 could come into play. However, for this scenario to materialize, the price needs to cleanly break through the key supply zone.

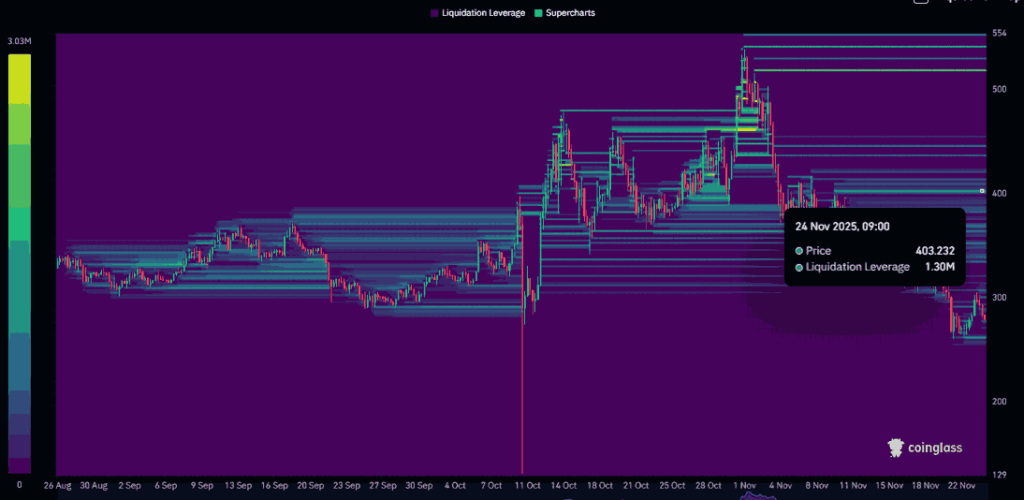

Liquidity Cluster Awaits at $400

While most metrics lean bullish, Bittensor still needs a convincing breakout from the current supply zone for a guaranteed bullish run. Failure to breach $305 could open the door for short-term consolidation.

Rising volume suggests buyers remain active. A significant liquidity cluster worth $1.3 million sits around $400. This level stands out as the next key liquidity zone.

The anticipated push to hunt this liquidity cluster could provide the required spark for further rallies. Growing institutional interest via the new ETP and positive momentum indicators represent a preparation stage among TAO investors before making strategic moves.

Eyes on the $305 Breakout

Whether the token clears the $305 supply zone or pauses for a retest will shape its path toward the $400 resistance level. Technical indicators and rising volume support bullish potential.

However, given market volatility and the strength of the critical resistance level, a cautious approach seems reasonable in the short term. Sustained institutional interest following the ETP listing continues to serve as a positive catalyst for TAO. The coming days will clarify the token’s direction.

Comments are closed.