Ethereum Near Support Zone as Holders Face Heavy Losses

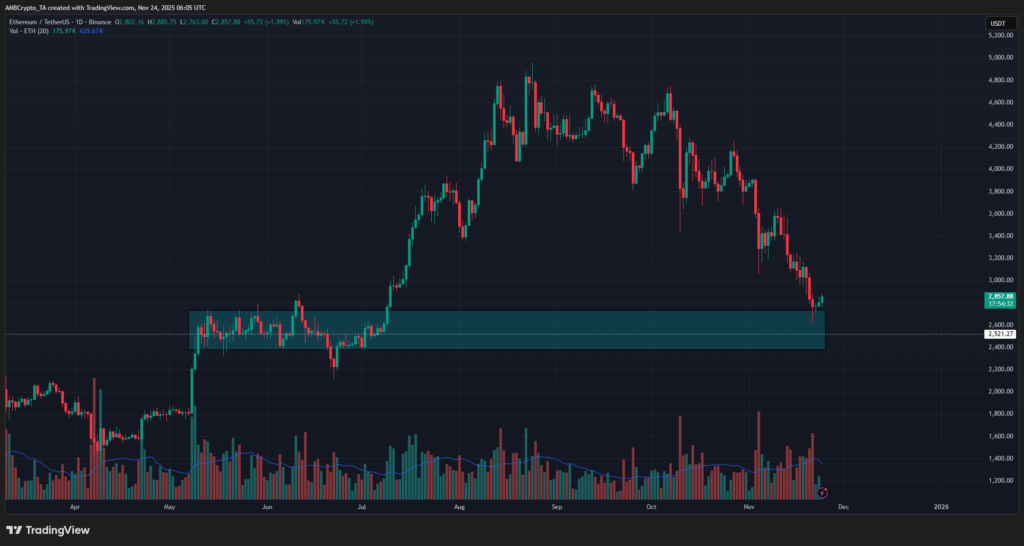

Ethereum lost 10.64% last week, declining from $3,095 to $2,765 by November 21. Following this drop, a modest recovery of 2.88% occurred. Technical analysis shows this bounce originated from a long-term demand zone, though the overall trend continues to signal bearish momentum across the market.

Critical Support Zone in Play

Ethereum’s recovery came from a significant support region between $2,400 and $2,700. This area holds technical importance as it represents a consolidation phase that occurred during May and June. The zone’s relevance extends beyond chart patterns into fundamental on-chain metrics.

Long-term ETH holder cohorts have their realized prices within this range. This situation indicates the zone functions not only as technical support but also as a psychological anchor for established investors. However, current market conditions suggest expecting a rapid trend reversal from this support would be unrealistic.

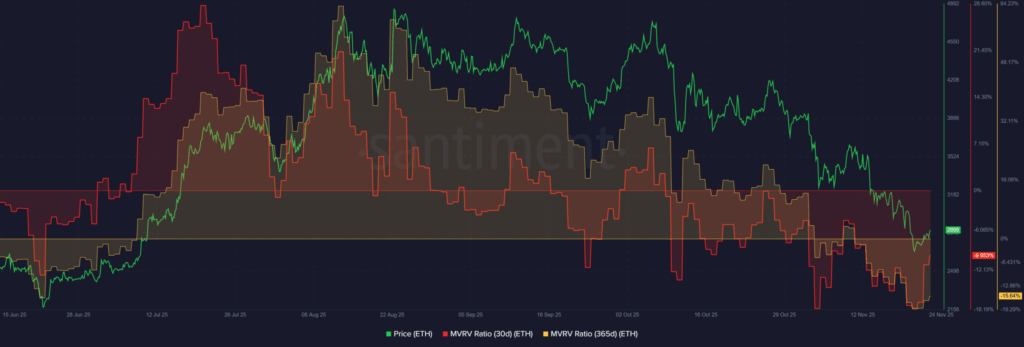

Market sentiment remains overwhelmingly bearish. Insufficient buying demand exists to force a quick reversal back to and beyond the $3,000 mark. MVRV ratios for both short-term and long-term holders sit below zero, meaning average holders are currently at a loss.

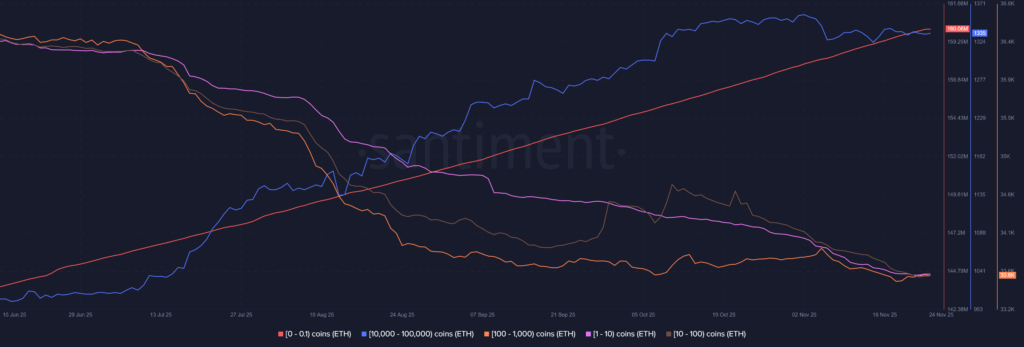

Whales Accumulate While Smaller Holders Exit

Supply distribution data reveals a notable divergence in holder behavior. Wallets holding between 10,000 and 100,000 ETH accumulated during September and October. At the start of November, the number of wallets in this whale cohort declined slightly, though the overall trend favors accumulation.

Meanwhile, wallets holding between 1 and 1,000 ETH have seen their numbers decline steadily since June. Only the smallest ETH holders have increased consistently in number. This data demonstrates whales have been purchasing ETH in recent weeks.

The bulk of selling pressure originates from smaller holder cohorts. A recent AMBCrypto report confirms whale buying activity has been rising. Smart money appears to be betting on a recovery, positioning themselves during the downturn.

Comments are closed.