Featured News Headlines

Ethereum HODLers Show Confidence, But Market Momentum Remains Mixed

Ethereum (ETH) has faced a challenging period as it attempts to bounce back from a recent dip. The altcoin king is now striving to regain momentum after slipping below crucial levels, signaling that Ethereum investors are entering a pivotal phase. While the network boasts strong support from long-term holders, renewed growth still hinges on fresh capital inflows.

Ethereum Struggles to Reclaim Key Levels

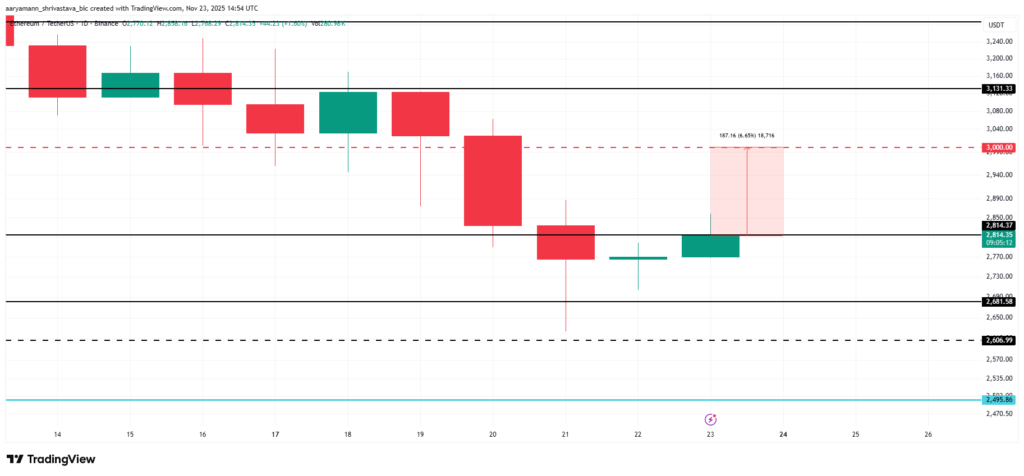

Currently trading at $2,814, Ethereum sits just below a significant resistance point. The cryptocurrency is 6.6% away from the psychologically critical $3,000 level, a milestone that could energize both traders and long-term investors. However, despite the foundation provided by long-term holders, the recovery seems stalled due to limited new investment. Without a meaningful influx of capital, ETH’s path toward $3,000 may face obstacles, leaving it vulnerable to consolidation below this key threshold.

Long-Term Holders Show Steady Confidence

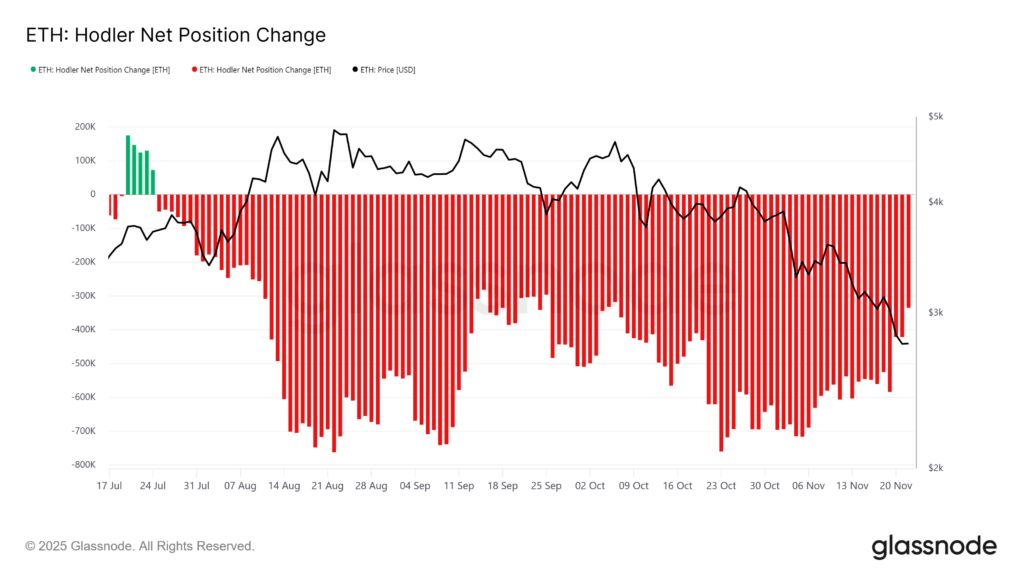

Long-term investors, often referred to as HODLers, continue to play a stabilizing role in Ethereum’s market dynamics. The HODLer Net Position Change indicator highlights a steady upward trend, signaling improved confidence among long-term holders. This metric tracks ETH movements within LTH wallets, and the current rise from negative territory suggests that outflows are slowing.

Historically, such shifts have often preceded renewed accumulation, as long-term holders reduce selling pressure. Their conviction acts as a stabilizing force during volatile periods, providing a foundation for potential upward momentum. If this trend persists, LTHs could transition from simply holding to actively accumulating, offering crucial support for Ethereum’s next rally.

Macro Trends Remain Mixed

While sentiment among long-term holders shows promise, broader market dynamics paint a more uncertain picture. Notably, the number of new Ethereum addresses remains relatively flat, indicating tepid interest from potential new investors. This stagnation is significant because fresh demand is a critical driver of sustained price recovery.

Without increased participation from new market entrants, Ethereum’s growth may rely solely on existing holders. While their support is substantial, it may not be enough to propel ETH past the $3,000 barrier. Analysts note that broader investor engagement is essential for any meaningful breakout, emphasizing the importance of attracting new capital to the network.

$3,000: The Psychological Barrier

The $3,000 level represents more than just a price point—it is a psychological milestone for Ethereum enthusiasts. If ETH can reclaim this zone, it could shift market sentiment from cautious to bullish, potentially paving the way for higher targets such as $3,131 or beyond.

However, reaching this level requires more than just confidence from long-term holders. New inflows of investment are critical, as stagnant participation could limit Ethereum’s ability to sustain a breakout. Should inflows increase and new investors re-enter the market, ETH could mount a credible challenge to $3,000 and possibly transform this resistance into a robust support zone.

The Path Forward for Ethereum

Ethereum’s recovery hinges on a delicate balance between long-term holder conviction and new market engagement. On one hand, the slow but steady accumulation from LTHs strengthens the asset’s foundation, offering stability amid volatility. On the other, a lack of fresh demand poses a risk of consolidation, potentially delaying any meaningful rally.

The coming weeks will be crucial as Ethereum navigates these dynamics. A surge in new investor activity could act as the catalyst needed for ETH to break past $3,000 and restore bullish momentum. Conversely, limited participation may confine the cryptocurrency to a period of sideways trading, leaving the market sentiment cautiously optimistic but uncertain.

Ethereum’s Recovery on a Knife-Edge

In summary, Ethereum remains at a crossroads. Long-term holders provide a stabilizing influence, but without fresh investment, the cryptocurrency’s recovery faces limits. Trading just below $3,000, ETH is poised for either consolidation or a breakout depending on market participation.

The HODLer Net Position Change indicator suggests improving confidence among seasoned investors, signaling that outflows are slowing and accumulation could resume. If this trend is complemented by new capital inflows, Ethereum may reclaim $3,000 and even target higher levels. Until then, market watchers will closely monitor investor engagement, wallet activity, and resistance levels, seeking clues for ETH’s next move.

Comments are closed.