Ethereum’s Trend Weakens: Relief Rally or Full Capitulation?

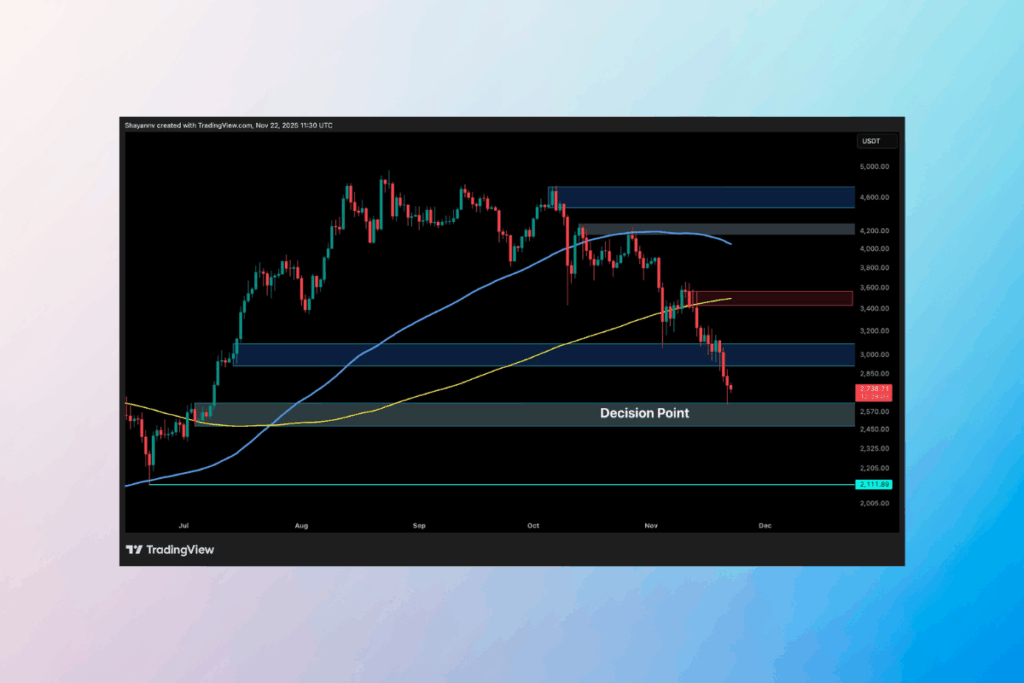

Ethereum’s declining trend has continued over the weekend. The token is now trading within a crucial demand block spanning several months. ETH is getting close to a crucial decision point as liquidity is being aggressively flushed above and below the price. Either a further capitulation into the lower demand zones or a relief bounce could occur at this point.

Ether Weakens Further as Sellers Maintain Full Control

ETH has slipped from the $3.5K–$3.6K supply zone as part of its steep corrective run. It is clearly breaking below the 200-day and 100-day moving averages. According to this analysis, the asset is right in the $2.7K–$2.85K demand range. The July breakout was previously launched from this. With a distinct pattern of lower highs and lower lows, the daily market structure is still very bearish. The declining channel and the 200-day MA’s unsuccessful retest imply that sellers are still in complete control. Prior to the August bounce, the price last gathered in the present area was around $2.7K. The next significant decision level, where long-term bids had previously intervened, would be shown by a clean loss of this area at $2.45K–$2.55K.

ETH Hits Critical Demand Zone: Is a Major Reversal Coming?

The downtrend‘s accuracy is emphasized by the 4-hour timeframe. The asset is still following the downtrend line that was created by the $4,200 drop. Every time this trend line is retested, new selling waves are produced. ETH is currently inside the $2.7K demand block and has reached the lower boundary of the downward channel. There have been short-term liquidity sweeps on both ends of the spectrum. This suggests rising volatility and the possibility of a local bottom forming. The $3.05K–$3.15K imbalance region becomes the first upside objective if buyers hold the current channel bottom. The $3.45K supply area would next be subjected to a more important test.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.