Featured News Headlines

Fear and Greed Index Shows Extreme Fear in Crypto

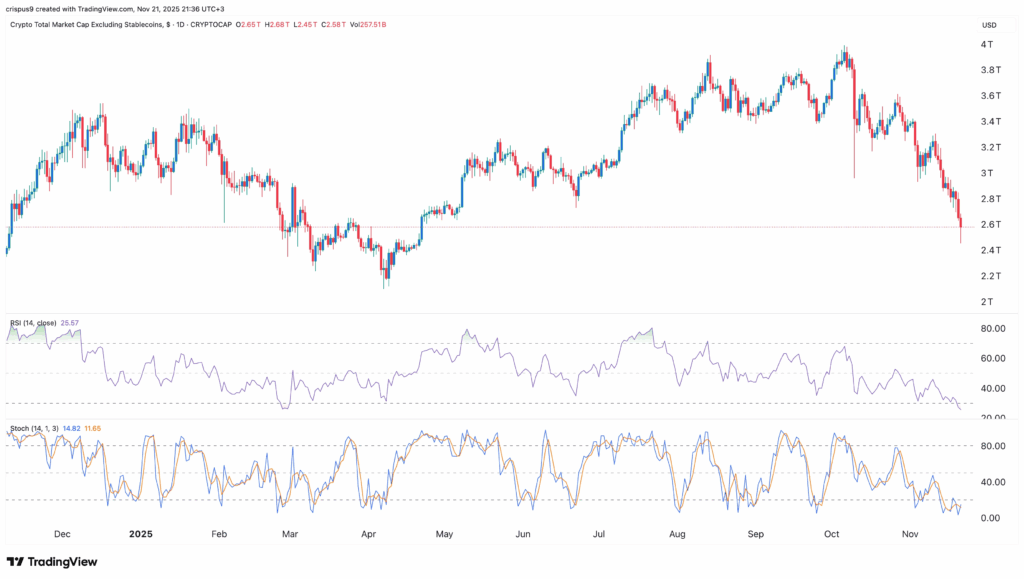

Most altcoins have experienced double-digit declines over the past week, with major cryptocurrencies such as Ethereum, Ripple (XRP), Binance Coin (BNB), and Cardano falling by over 12%. Despite ongoing negative forecasts, several indicators suggest the crypto market downturn may be approaching its conclusion.

Fear and Greed Index Hits Year-to-Date Low

One key metric investors watch is the Fear and Greed Index, which recently dropped to an extreme low of 10. This reflects waning market momentum, heightened volatility, and negative social media sentiment.

Historically, crypto bull markets have often started when the index shows extreme fear. For example, Bitcoin reached a record high in May after the index entered the extreme fear zone. Conversely, bear markets typically begin when the index is in the green or extreme greed zone. With November coming to a close, some analysts view this as a potential precursor to improved market conditions in December, often associated with the so-called “Santa Claus rally.”

Market Cap Shows Oversold Conditions

Another indicator pointing to a potential market shift is the Relative Strength Index (RSI) of the overall crypto market cap, which has fallen to 24 — a level considered oversold. Data suggests that the divergence pattern that has persisted since July may be nearing its end. While a rebound may not be linear, technical patterns such as a double-bottom formation could emerge.

Ongoing Market Cleansing

The crypto market has also been undergoing a significant cleansing process, as reflected in futures trading activity. According to CoinGlass, futures open interest has declined from over $320 billion earlier this year to $123 billion. Total liquidations since October 10 have surpassed $40 billion.

This reduction in leverage and open interest is seen as a sign of a healthier market environment, with less speculative pressure influencing prices.

Additional Market Dynamics

Other factors that could influence market trends include potential shifts in U.S. Federal Reserve interest rate policy, changes in the M2 money supply, and ongoing approvals for altcoin exchange-traded funds (ETFs).

While these signals suggest a potential stabilization or turnaround, the crypto market remains volatile, and patterns observed in past cycles are not guaranteed to repeat.

Comments are closed.