Featured News Headlines

Bitcoin Holds $85K Support: Key Indicators Flash Bullish Signs

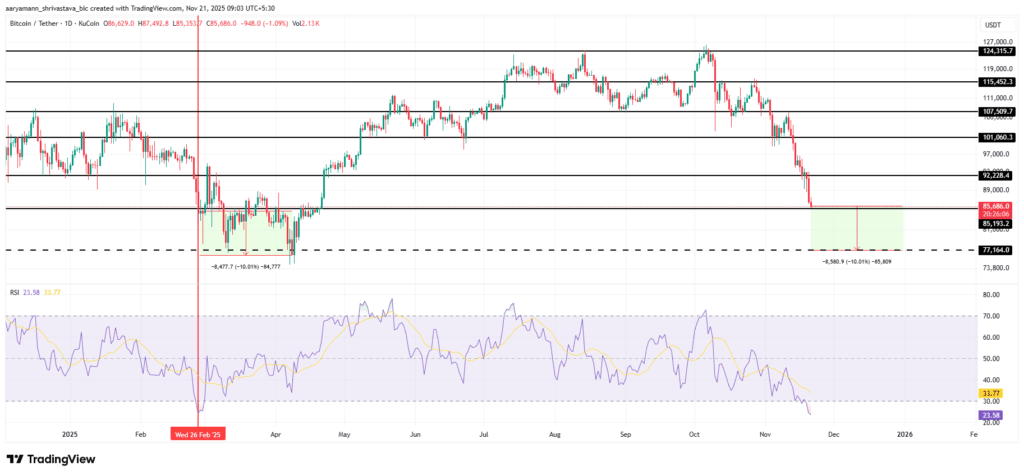

Bitcoin’s pullback to the $85,000 level has sparked concern in the market, but technical indicators suggest a potential opportunity window is emerging. The RSI entering oversold territory for the first time in nine months and the MVRV ratio at its lowest level in three years reflect pre-recovery conditions based on historical data.

RSI Reaches Critical Zone After Nine Months

The Relative Strength Index (RSI) shows Bitcoin has entered oversold territory, a condition last seen in February that preceded a notable recovery. However, historical data suggests caution is warranted before jumping in too quickly.

During the similar February scenario, Bitcoin experienced an additional 10% decline before the rebound began. If the same pattern repeats, BTC could slide toward $77,164 before buyers regain control. If the decline is contained before reaching that level, recovery could begin sooner.

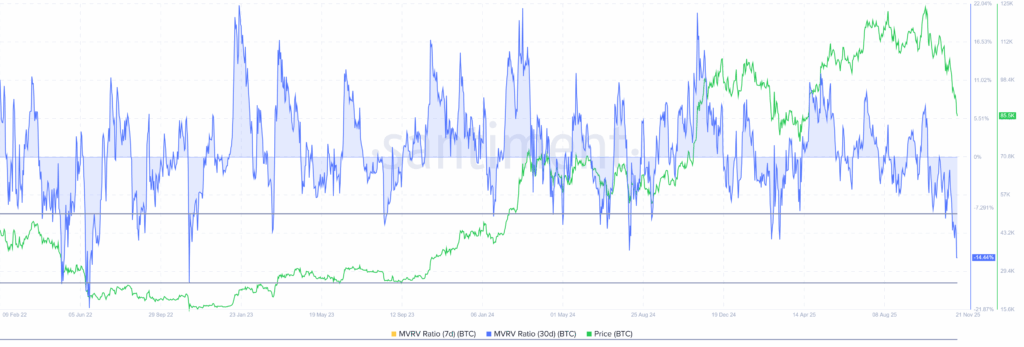

MVRV Ratio Hits Three-Year Low

The Market Value to Realized Value (MVRV) metric for Bitcoin currently sits at -14%, marking the lowest reading in a three-year period. The 30-day MVRV data delivers two critical messages: current holders are at a loss, and Bitcoin is undervalued relative to historical norms.

The zone between -8% and -18% is identified by analysts as the “opportunity zone.” Within this range, selling pressure typically reaches saturation, and exhaustion of sellers gradually gives way to accumulation activity. Such periods often lay the groundwork for price recoveries.

$85,000 Marks Critical Support Level

Bitcoin currently trades at $85,860 and maintains its position above the crucial $85,204 support line. Current indicators suggest that if oversold conditions deepen, a slight additional decline could precede a recovery.

Should the bearish scenario continue, Bitcoin could retreat to $77,164, aligning with the RSI’s historical pattern. In an alternative scenario, loss of the $85,204 support followed by $82,503 could lead to a test of the $80,000 level.

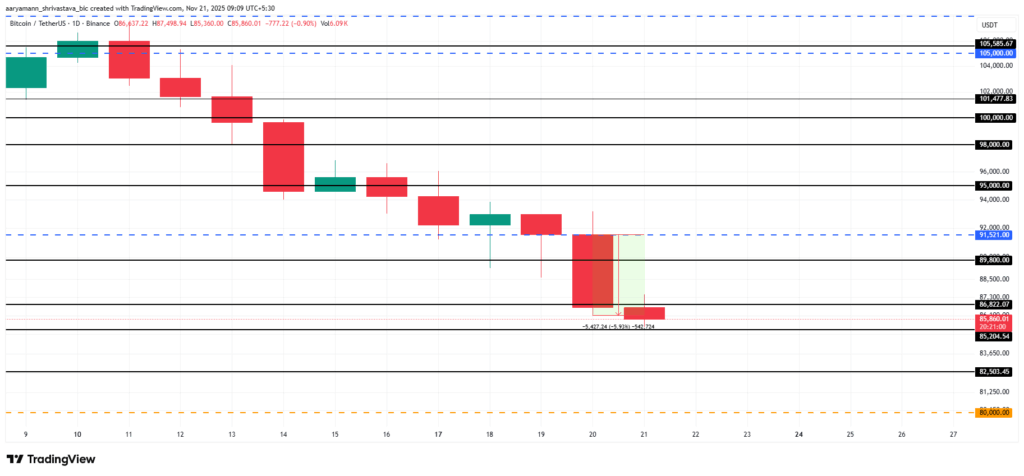

How Would a Bullish Scenario Unfold?

If Bitcoin rebounds from current levels, it could break above $86,822 and retest $89,800. A successful move from that point could establish $91,521 as solid support and enable a push toward $95,000. Such a development would invalidate the bearish outlook and signal a stronger recovery phase.

Market dynamics show that historical data maintains its guiding role, though short-term volatility is expected to persist. Close monitoring of critical support and resistance levels remains essential for market participants.

Comments are closed.