Investors Panic: IBIT Faces Heavy Outflows Amid Recession Fears

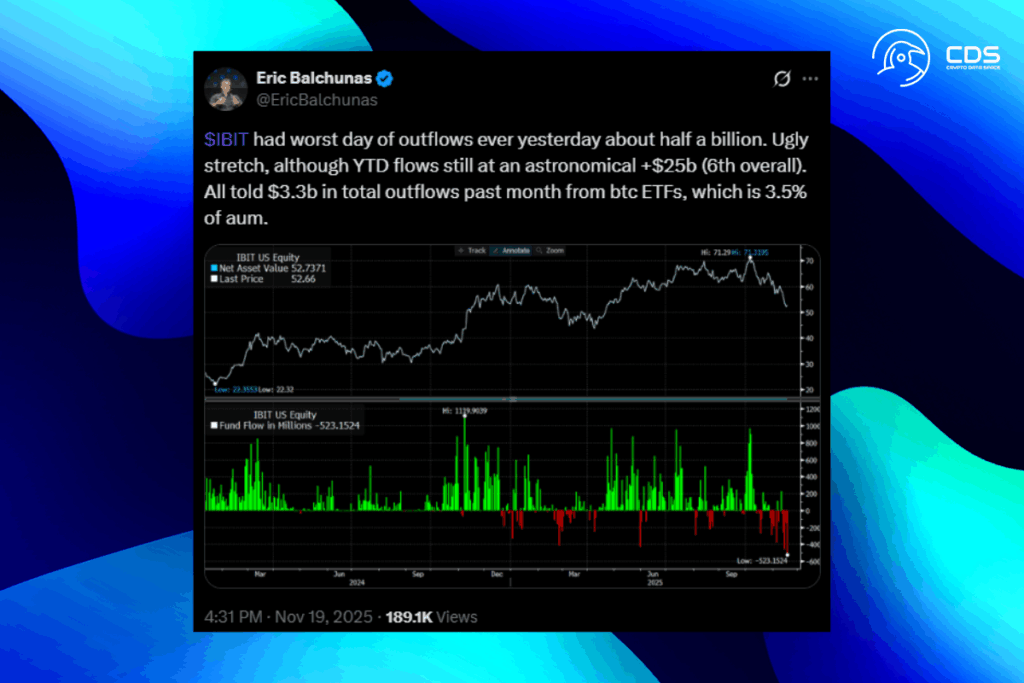

On Tuesday, BlackRock’s iShares Bitcoin Trust (IBIT) lost a record $523 million in investments in a single day. This continued a five-day run of withdrawals that coincided with the underlying asset’s decrease. The exchange-traded fund has lost almost $1.4 billion in assets since last Thursday, according to British asset management firm Farside Investors. In its 22-month history, this is the largest daily total outflow amount.

IBIT had worst day of outflows ever yesterday… ugly stretch,

Bloomberg Senior ETF Analyst Eric Balchunas

The losses have coincided with a six-week market meltdown caused by macroeconomic uncertainties, such as worries about inflation and the longest government shutdown in American history. Additional pressure has come from a continuing trade war, declining employment statistics that suggest a recession, and the effect of AI projects on the balance sheets of large tech companies.

Bitcoin Hits 7-Month Low Amid Market Downturn

Bitcoin hit its lowest level in seven months on Wednesday at $89,037, according to cryptocurrency market data company CoinGecko. It was down more than 4% over the previous day, trading at $89,204. Six weeks after reaching a record high above $126,000, the biggest cryptocurrency by market capitalization is currently down 4% year to date. There is just a 28% probability that Bitcoin will hit $115,000 in its next move, according to users of the Myriad prediction market. Instead, they think it’s more likely to drop to $85,000. Investors’ gloomy perspective is seen in this significant reversal from the trend lines just a week ago.

BlackRock’s Bitcoin ETF Faces Rare Outflow After Historic Inflows

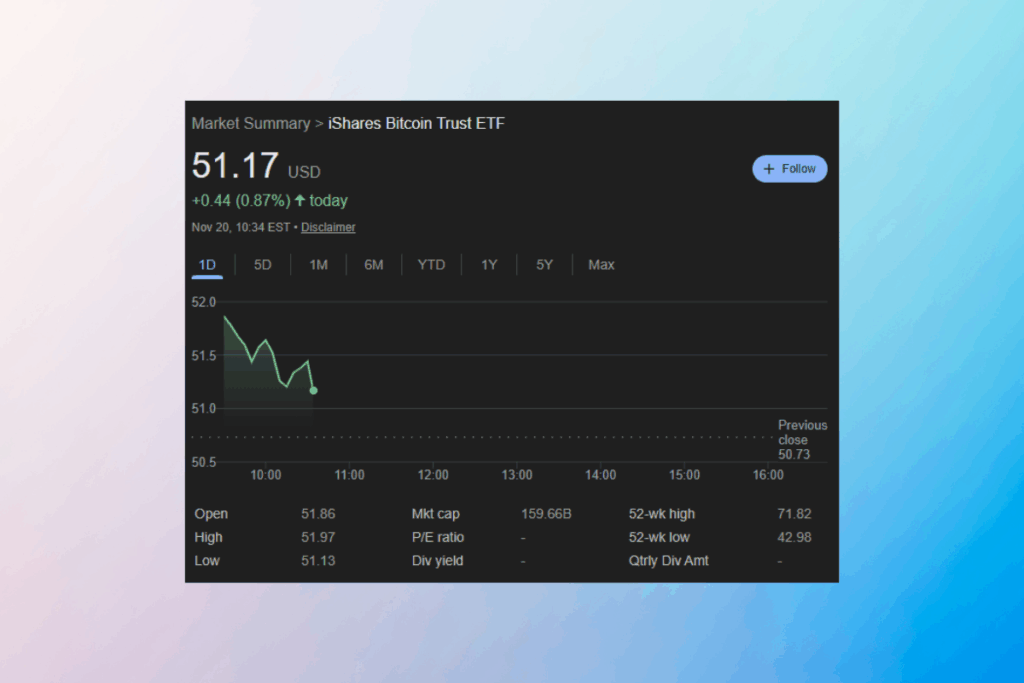

According to Yahoo Finance, IBIT shares have fallen more than 16% in the last month and were down 3.6% yesterday. Last Friday, the ETF saw $463 million in withdrawals, setting a new record. In the past, it had lost about $400 million in two days. For a fund that has made significant progress, this was an uncommon error. IBIT attracted $70 billion in inflows in June more quickly than any ETF in the 32-year history of the sector. At the moment, IBIT oversees assets worth more than $73 billion. This amount exceeds the AUM of its nearest rival by more than three times. Increased institutional interest in Bitcoin coincided with these improvements.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.