Bitcoin Faces Bearish Warning: Key Indicators Signal Risk

The outlook for Bitcoin is getting worse due to persistent selling pressure. The larger financial markets are in a state of uncertainty. A death cross was set off by the biggest cryptocurrency’s collapse. When the 50-day moving average crosses below the 200-day moving average, this is known as a death cross. According to the widely used bearish signal, short-term momentum is declining more quickly than the long-term trend. Additionally, it was the first time that a weekly candlestick closed below the 50-week moving average. These two technical but crucial indicators suggest that a bear market for Bitcoin may be about to begin.

Selling Pressure Hits Bitcoin: Short-Term Recovery at Risk

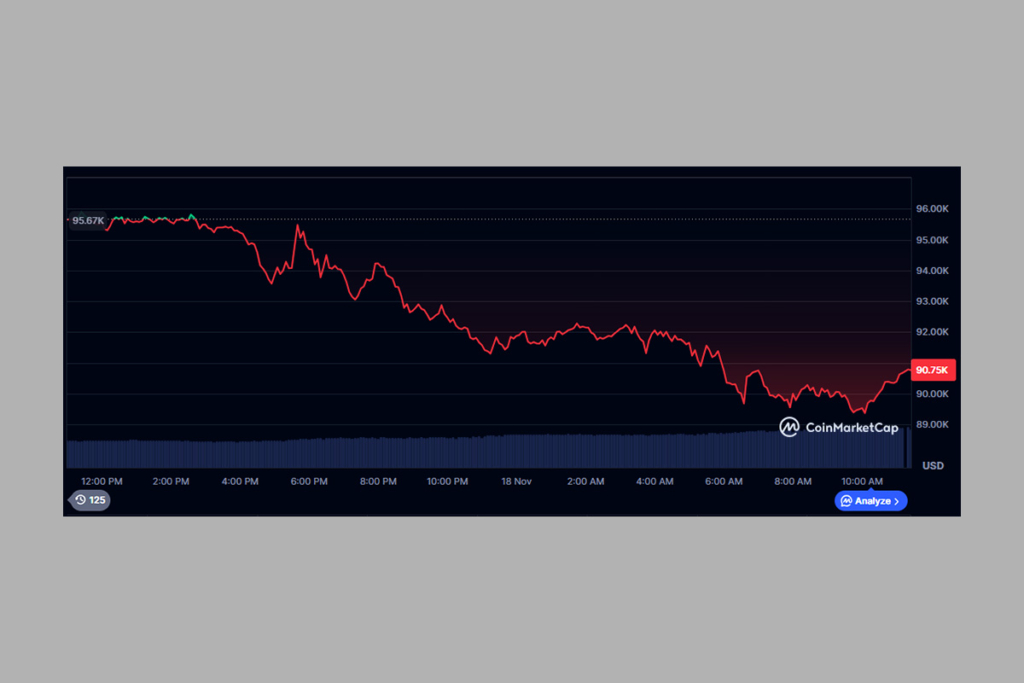

According to CoinMarketCap data, Bitcoin is presently trading for about $91,435, down almost 13.2% over the last week. Selling pressure last week caused it to close slightly above $100,000, below the 50-week moving average. Since the start of the bull market in October 2023, this is the first weekly closure below this level. The beginning of the bull run had previously been indicated by a weekly closure above the 50-week moving average. The possibility of a short-term recovery is now seriously questioned if it closes below that level.

Previous data has prompted analysts to assume that a bear market for cryptocurrency has begun based on price activity over the last three months. CryptoQuant’s Bull Score indicator lends support to this prediction. In the midst of the continuous bleeding in the cryptocurrency market, eight out of ten important on-chain measurements have turned red, indicating a bearish trend.

The main reason for the crypto market decline is growing investor fears in traditional markets,

Farzam Ehsani, CEO of VALR

BTC Futures Show Speculation Rising Despite Bearish Outlook

Open interest has surpassed October 10 levels, according to the futures markets. This suggests that despite a declining market outlook, speculation is still growing. Selling pressure may be increasing if the cumulative volume delta continues to decline. Concurrently, a rise in open interest suggests that investors are opening short positions in anticipation of falling prices.

The recent decline in 25-delta skew into negative territory supports this downward trend. This suggests that options traders continue to use put purchasing as a common strategy for downside protection. A closer examination of the permanent data, however, reveals an increase in the funding rate. Furthermore, the bid-ask delta rise at a depth of 5% to 10% suggests that investors are beginning to purchase the dips. These buyers could have to sell if the price doesn’t stop the hemorrhage. This intensifies the downward trend by creating a long squeeze.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.