Featured News Headlines

Solana Price Falls 45% as Treasury Values Collapse — Opportunity or Capitulation?

Solana’s price has suffered a steep decline despite sustained ETF inflows, with analysts pointing to overwhelming capital outflows and distressed digital asset treasuries (DATs) as the main culprits. While many treasuries are now sitting on heavy losses, some industry leaders argue the downturn represents a rare long-term accumulation opportunity.

SOL Price Plunges 45% Despite Fund Inflows

The Solana (SOL) market has been hit hard by prolonged selling pressure, dropping 45% from $253 to $135 and erasing millions of dollars from treasury holdings. Analysts note that although U.S. spot SOL ETFs recorded $46.3 million in weekly inflows, broader crypto markets saw roughly $3 billion in outflows, greatly exceeding current demand.

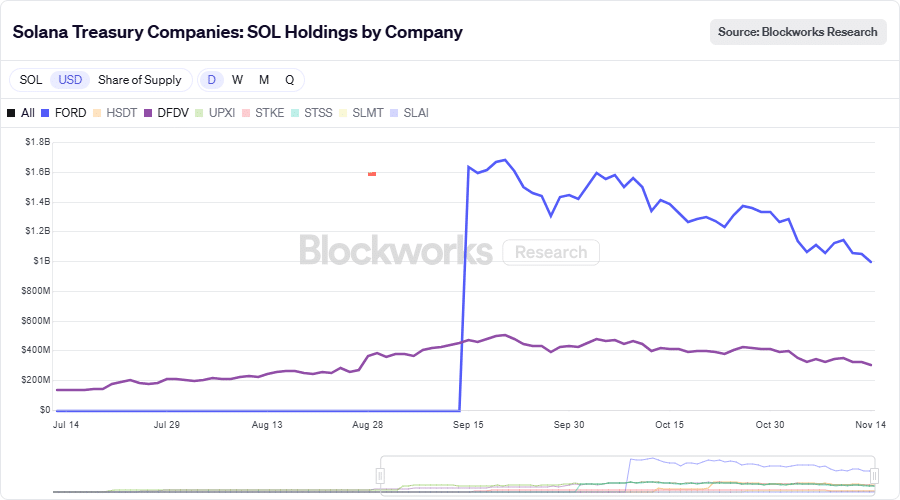

As a result, major Solana-heavy treasuries—including those held by Forward Industries (FORD) and DeFi Development Corporations (DFDV)—have seen their valuations collapse.

DATs Face Major Devaluation Across the Ecosystem

The combined net asset value (NAV) of all Solana treasury firms has plunged from $3.5 billion to $2.1 billion, marking a 40% ecosystem-wide devaluation. The mNAV (market-to-net-asset-value) ratios of many treasury firms now sit at or below parity, which could incentivize more SOL selling to support stock buybacks and stabilize mNAV levels.

DFDV alone saw its holdings fall from $507 million to $310 million, though the firm’s Chief Investment Officer, Parker White, remains aggressively optimistic.

DFDV CIO: “Solana Will Hit $10K by 2030”

Despite the downturn, Parker White considers current prices a “discount” and maintains an extremely bullish long-term outlook. He stated:

“Solana is going to go up bigly over the next decade, at least to $10k, because the world is going more digital… and Solana will capture a huge slice of the global digital value transfer pie.”

White expects maximum volatility through 2028, viewing turbulence as a golden opportunity to grow SPS (SOL per share) and allow long-term believers to accumulate at favorable prices. However, he did not clarify whether boosting mNAV would require selling part of DFDV’s 2.1 million SOL holdings.

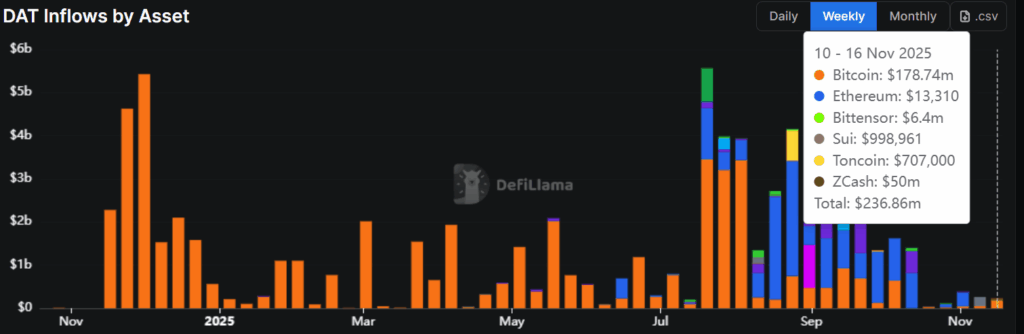

Treasury Inflows Stagnate as Realized Cap Declines

Digital asset treasury inflows for Solana have slowed to a halt, with zero new inflows in mid-November, even as ETF demand remained positive. Meanwhile, the Realized Cap—a key on-chain indicator of market health—has fallen by $3 billion since October 10, signaling significant capital leaving the ecosystem.

A rebound in Realized Cap, analysts say, would be the clearest signal that new money is returning and that SOL may be ready for recovery.

Comments are closed.