Featured News Headlines

Harvard University Makes Massive 250% Increase in BlackRock Bitcoin ETF

Harvard University has dramatically expanded its exposure to BlackRock’s Bitcoin ETF, ramping up its position by more than 250% in the third quarter despite heightened market volatility and Bitcoin’s recent dip below $100,000. The move marks one of the most notable institutional endorsements of a spot Bitcoin ETF to date.

Harvard’s Bitcoin Bet Grows to $442.8 Million

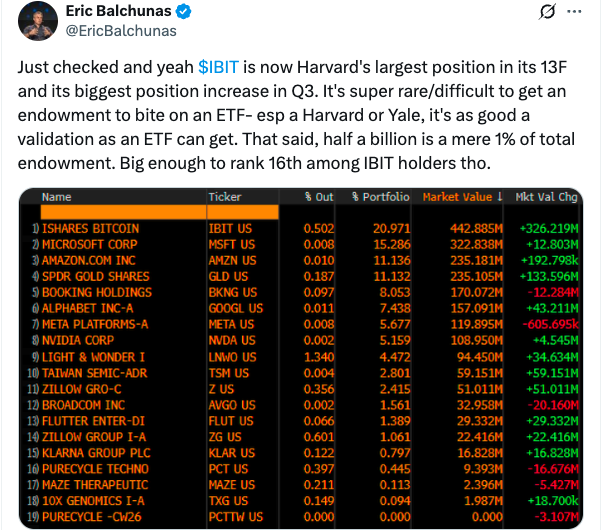

A regulatory filing revealed that Harvard Management Company (HMC) — the group overseeing the university’s $57 billion endowment — now holds more than 6.8 million shares of the iShares Bitcoin Trust ETF (IBIT), valued at $442.8 million as of Sept. 30.

This represents a massive jump from Harvard’s first disclosed IBIT position in August, when the Ivy League institution reported holding 1.9 million shares worth $116.6 million.

“Super Rare” Move From a Major Endowment

According to Bloomberg ETF analyst Eric Balchunas, seeing a major university endowment buy an ETF — especially a Bitcoin ETF — is “super rare” and notably difficult. He described Harvard’s investment as “as good a validation as an ETF can get,” even though the position accounts for just 1% of the school’s total endowment.

Balchunas noted that IBIT was Harvard’s largest investment in its latest filing, marking the university’s biggest position increase in Q3 and making it the 16th-largest holder of the ETF. He previously emphasized that endowments are historically anti-ETF and among the hardest institutions to attract to such products.

Expanding Into Tech, Gold, and Fintech

Beyond Bitcoin, Harvard also strengthened its exposure to major U.S. tech giants, including Amazon, Meta, Microsoft, and Alphabet. The university added a new $16.8 million position in fintech firm Klarna and acquired $59.1 million worth of shares in Taiwan Semiconductor Manufacturing Company.

Harvard nearly doubled its gold exposure as well, increasing its holdings in SPDR Gold Shares (GLD) to 661,391 shares, valued at $235.1 million, up from 333,000 shares in August.

Bitcoin ETF Outflows Surge as BTC Slides Below $95K

Despite Harvard’s aggressive accumulation, data from SoSoValue shows Bitcoin ETFs experienced $1.11 billion in net outflows over the past week as Bitcoin’s price fell below $100,000.

BTC has since slipped under $95,000, touching a 24-hour low of $93,029, briefly erasing its gains for the year.

Comments are closed.