Featured News Headlines

Bitcoin Wipes Out 2025 Gains After Sudden Drop to $93K

Bitcoin kicked off the week with a violent swing, briefly plunging to $93,000 early Monday in Asia before staging a modest rebound. The sudden downturn sparked more than $510 million in liquidations over 24 hours and erased all of the cryptocurrency’s year-to-date gains for 2025, sending shockwaves through global markets.

A Sharp Correction Erases 2025 Progress

BTC’s drop from its early October peak of $126,000 marks a steep 24% correction, breaking through key psychological and technical levels. The dip to $93,000 officially wiped out the asset’s performance for the year, underscoring the intensity of the sell-off.

Weekend trading patterns added to the bearish tone. For the first time in weeks, Bitcoin declined over the weekend rather than climbing—what analyst KillaXBT described as a negative setup heading into Monday. Based on 300 days of price data, this specific pattern suggests a 36% chance that Monday could form a short-term bottom.

Market sentiment tumbled just as quickly. The Crypto Fear and Greed Index slid to 10, registering extreme fear and marking a dramatic reversal from late November 2024, when the indicator hit 93 during peak market enthusiasm.

Derivatives Market Sees Heavy Losses

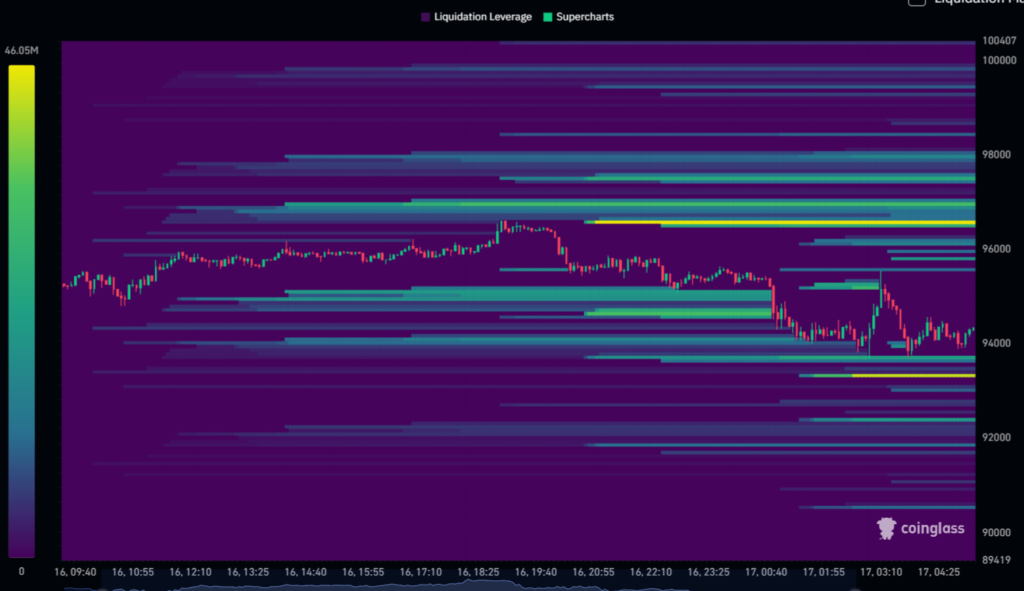

The sharp decline triggered a wave of forced closures, with exchanges liquidating more than 150,000 traders in a single day. Long positions suffered the most, taking hits of $40.37 million within one hour and $77 million across four hours.

Bitcoin led long liquidations at $41.61 million, followed by Ethereum at $13.99 million, while other major cryptocurrencies—including Solana, XRP, and Dogecoin—also saw substantial multi-million-dollar wipeouts.

Key Support Levels Define BTC’s Next Move

According to KillaXBT, Bitcoin’s immediate test lies at $94,100, followed by stronger support at $93,500—the year’s opening price. A deeper support cluster appears in the $89,000–$91,000 region, which historically attracts heavy trading activity.

However, the analyst warns that extreme volatility makes high leverage particularly dangerous, with recent 4–5% price swings putting overexposed traders at elevated risk. A decisive drop below $85,000 would invalidate bullish recovery expectations, while a successful defense of lower supports could pave the way to reclaim $100,000, though resistance at $98,300 stands in the way.

With fear gripping markets and volatility at a peak, Bitcoin now sits at a critical inflection point as traders watch to see whether buyers or sellers seize control heading into year-end.

Comments are closed.