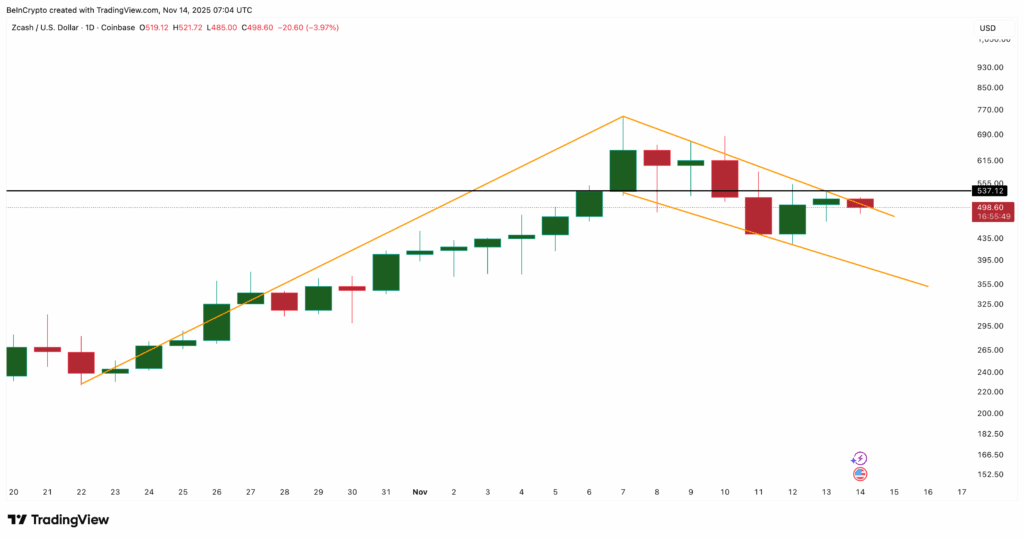

Breakout Needs a Clean Close for Confirmation

Zcash (ZEC) has spent the past week forming a falling flag following its sharp late-October rally. This short corrective pattern typically appears after strong upward moves. The price has now pushed above the flag’s upper boundary, but the breakout remains unconfirmed. For the move to gain momentum, ZEC would need a daily close above $537, where the trendline break and horizontal resistance converge.

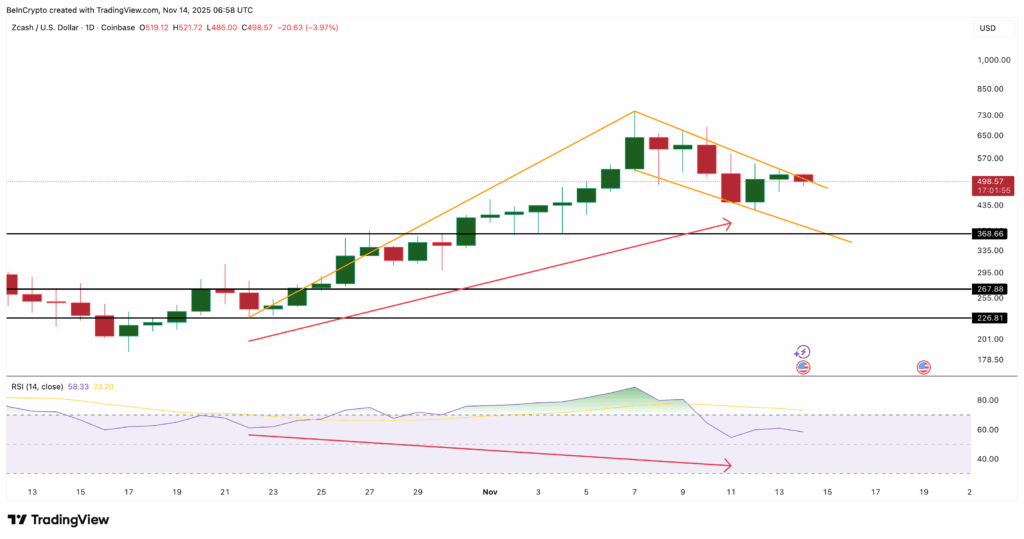

The broader market structure still shows strength because the recent low stayed above the previous major low. Technical momentum indicators echo this. The Relative Strength Index (RSI) has created a hidden bullish divergence: between 22 October and 7 November, ZEC formed a higher low while the RSI printed a lower low.

Hidden bullish divergence often occurs in robust uptrends when momentum cools before potentially resuming.

If ZEC ends a daily session above $537, this would validate the breakout attempt from a structural standpoint.

Selling Pressure Falls as Volume Stabilizes

A significant shift has appeared in selling activity. Exchange spot netflows hit $38.91 million on 12 November, reflecting heavy inflows earlier in the move. Today, inflows have fallen to $5.81 million, marking an 85% decline. This reduction aligns with ZEC’s attempt to break above the flag.

Volume trends also add context. The On-Balance Volume (OBV)—which shows whether trading volume leans more toward up days or down days—has broken above its descending trendline. This indicates a volume-supported breakout attempt. However, OBV has since flattened near 8.16 million. A push above that level would demonstrate a clearer transition from selling to buying pressure. Until then, selling appears weaker but not fully reversed.

From the volume perspective, the message is straightforward: selling has eased significantly, and although buyers are not yet aggressive, the downward pressure on ZEC is far lighter than it was just days ago.

Crucial Zcash Levels That Could Shape the Next Move

ZEC currently trades near $502, positioned between support and resistance. A confirmed daily close above $537–$538would mark the technical trigger for continuation. If momentum reinforces the move, ZEC could navigate toward $612, $688, $749, and potentially higher resistance zones, depending on market participation.

Immediate support lies at $488. A breakdown below this level would weaken the breakout narrative. The next major support is at $368, which previously acted as a protective floor during earlier stages of the rally. Falling through $368 would invalidate the pattern and point to a deeper retracement.

Comments are closed.